Australia’s rooftop solar market has delivered some early Christmas cheer, charting the biggest month ever for total capacity added in November, 2023, and bringing the year even closer to setting a new all-time high for total annual installations.

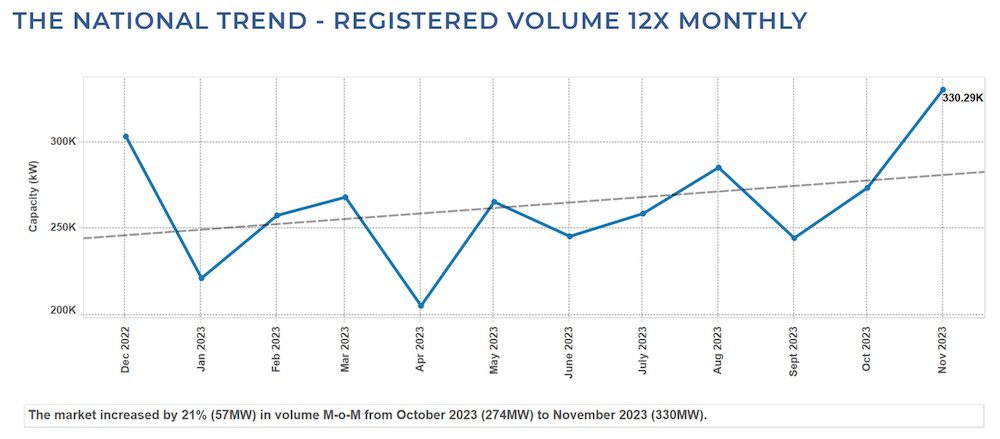

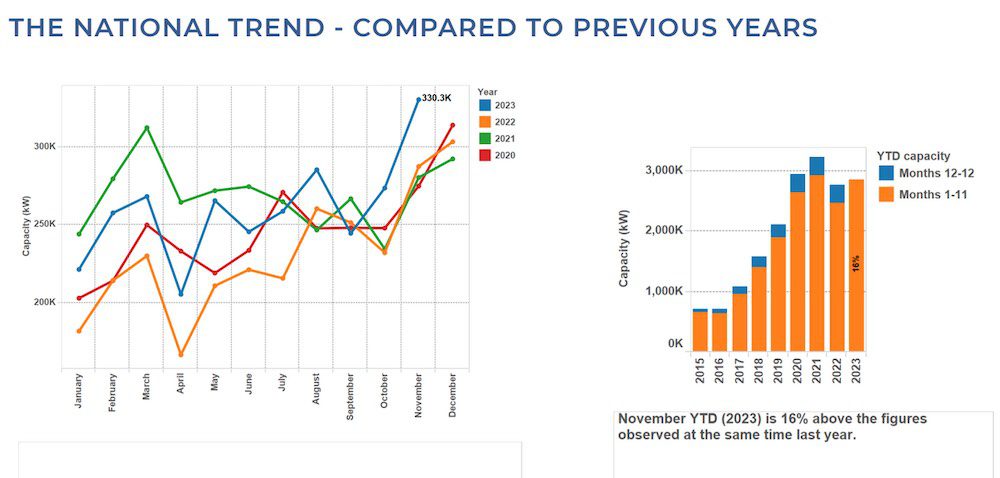

The latest monthly update from market analysts SunWiz shows just over 330MW of new rooftop solar systems (0-100kW) was installed in November 2023, “smashing the previous record” of 314MW set in December 2020.

The average system size jumped to 9.9kW, reflecting a growing push towards electrification, electric vehicles and energy independence, and putting further pressure on the country’s remaining coal generators, and the gas industry.

Already in the past spring, rooftop solar has set numerous output records, eating into the midday market traditionally by coal fired generators, and boosting the case for battery storage and a rethink of energy market rules and regulations.

In South Australia, rooftop solar output has more than equalled all of state demand on some occasions.

The November rooftop solar total was also 57MW (21%) more than was installed in October and 17% ahead of volumes at the same time last year.

The November rooftop solar total was also 57MW (21%) more than was installed in October and 17% ahead of volumes at the same time last year.

The record month puts the year-to-date figures 16 per cent ahead of the same time in 2022, and about 80MW behind the record rate in 2021, when 400,000 new systems totalling 3.3GW of new capacity were added.

SunWiz managing director Warwick Johnston says the uptick at this time of the year is a great sign that rooftop solar growth is back to normal after a disruptive few years, and perhaps even back to its record-setting best.

“This is the kind of record that has me dancing in the hallway,” Johnston told RenewEconomy on Monday.

“For a long time, there… I was reporting records each and every month and it felt a bit boring. Now we’ve got actually our first genuine record since 2020 and …. I’m not bored any more!

“Looking at the data, we are essentially 80MW, now, behind [2021] and so that means that we need to get 80MW more than 2021 did [to set a new record].

“Looking back at 2021, there were actually pretty soft gains in December… So my prediction is that it is going to be tight, but I reckon we’re on track for a record year.”

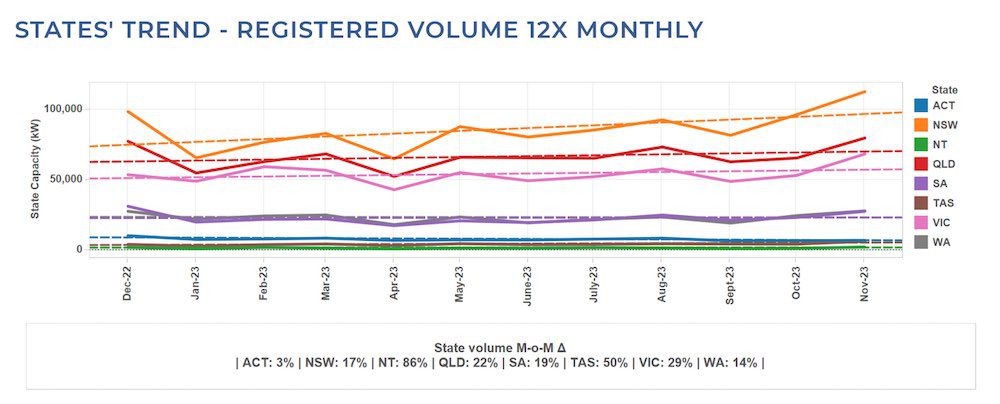

At the state level, the data shows strong growth up and down Australia’s eastern seaboard, with November highs recorded by SunWiz in New South Wales, Queensland, Victoria and Tasmania.

But all states trended upwards for the month, with the Northern Territory and Tasmania charting “exceptional growth rates” of 86% and 50% respectively, SunWiz says. NSW still leads the country on total volume.

For households, the biggest growth in installs for the month was in the 10-15kW segment, as the average home rooftop solar system size jumped, again, to 9.9kW – almost crossing the 10kW threshold. The strongest commercial segments were 15-30kW and a “long-awaited surge” from 75-100kW.

Johnston says the record month doesn’t necessarily come down to anything drastically different happening in the policy environment or in consumer thinking, but rather represents a “return to normal” after a couple of years shaped by challenges in the supply chain.

“What was interesting… was last year we had front page news from the war in Ukraine flowing through to energy price shocks. And we saw in our lead volumes, you know, real spikes,” he says.

“Whereas now, those lead volumes are consistently elevated. So, to me what we’re seeing here is people looking at this as a cost of living concern, and moving on that reason.”

Another big driver of growth going forward, Johnston says, will be the increasing uptake of electric vehicles.

“As the market goes from 100,000 EVs sold this year, to, let’s say 200,000 next year – and when you consider PV [system sales] are 300,000 a year, then you can say, ok, people will be buying or upgrading their PV system,” to help fuel those EVs.

So, with the market seemingly back on track, and back into record territory, do we really need an extension of the federal government’s rooftop solar subsidy, the Small-scale Renewable Energy Scheme?

The Climate Change Authority last week added its voice to a growing chorus calling for the federal government to extend the SRES beyond its current end-date of 2030, and to add home battery storage to the scheme as well as home electric vehicle chargers.

As things stand, however, the subsidy winds up in 2030 and in its remaining years, when rooftop solar uptake is expected to increase exponentially, the discount provided is being ratcheted down under the rules of the scheme.

“I think we definitely need some expansion of SRES,” Johnston says.

“We need cheap bulk renewable energy from grid-scale, but it’s not going to come for at least another three years in the quantum that we need it.

“The only thing that’s actually delivering abatement at the moment is the small stuff, and so it’s absurd that we should be reducing subsidies, as is currently baked in.”

Johnston not only wants the SRES kept open for longer, but would like to see it adjusted to take in bigger rooftop solar systems, well beyond the current 100kW.

“My position is that we should be expanding the SRES to one megawatt systems because we should be cutting the red tape for green business,” he tells RenewEconomy.

“That artificial threshold of 100kW – [that size system is] just routine, these days. When we started the program, it was an anomaly.

“And you see people exploiting loopholes to get a 100kW system and then coming back and putting another amount on later. Or you see people artificially capping their system at 100kW when they might have installed 150kW or 180kW otherwise.”

Add in the federal government’s announcement a couple of weeks ago on the introduction of a Capacity Investment Scheme to drive the roll-out of large-scale solar, and the commercial and industrial sector risk falling through the cracks, Johnston says.

“[All of this] implies that LGC prices will fall, because it doesn’t appear there’s going to be an extension to the LRET, and that means that for businesses that want to do the right thing… they’re going to lose.

“So, for administrative reasons, we should already have been upping the [SRES capacity] threshold. Now, for financial reasons, to keep this thing ticking over, this powerhouse of the green transition, we should be cutting red tape,” he says.

Should the SRES be expanded to take in behind-the-meter battery storage and bi-directional EV charging equipment?

“I think so, yes,” says Johnston.

“We are in the situation where, perversely, there are constraints on how much green energy can be generated and injected from people’s roofs, where we should be trying to get every green electron into the network that we possibly can.

“Now there are a few ways of doing that, including actually … lowering the network voltages to what they should be. There’s coordinating hot water services, etc, so that we can soak up that excess solar.

“But batteries are certainly something that can facilitate the deployment of more solar – both from the market perspective and the network perspective.”