Two of Australia’s biggest battery projects will be built in NSW – including at the site of the shuttered Liddell coal fired power generator – after the winners of the country’s biggest tender for firm capacity were announced on Wednesday.

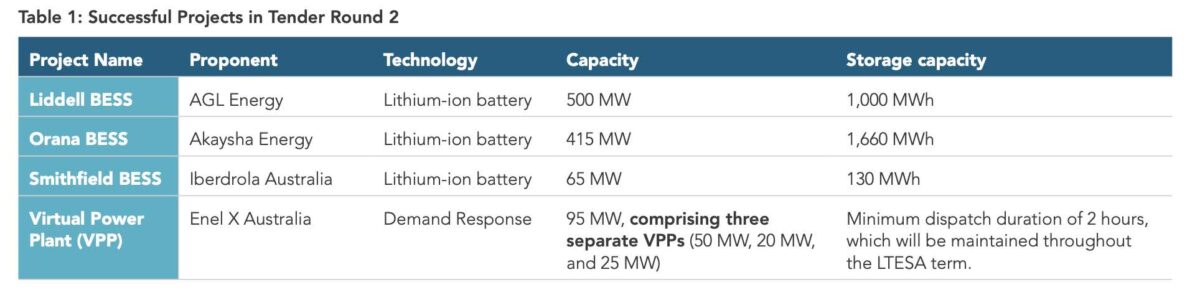

The two biggest winners of the tender – jointly funded by the NSW and federal Labor governments – are a 500 MW, two hour battery proposed for the Liddell site by AGL Energy, and a 415MW, four hour battery (1660 MWh) proposed by BlackRock’s Akaysha Energy at Orana in the state’s central west.

The other winners of the capacity auction are a 65 MW, two hour battery at Smithfield in Sydney to be built by Spanish energy giant Iberdrola, and 90 MW of demand response capacity – including three separate virtual power plants – put together by Enel X.

The capacity tender was held to fill a potential supply gap from the planned closure of the country’s biggest coal fired power generator, the 2.88 GW Eraring facility, on the central coast, currently scheduled for August, 2025.

All the projects must be built by December, 2025, so the developers will have to get their skates on to meet that deadline. All must be available to deliver at least half their capacity to any LOR3 events (a signal of potential supply shortfalls) that are declared by the Australian Energy Market Operator.

NSW had originally planned a tender for 380 MW of two hour capacity, but this was expanded to 930 MW after being combined with the first rollout of the new Capacity Investment Scheme, and after AEMO identified a potentially bigger supply gap after the Eraring closure.

In the end, 1,075 MW of capacity with nearly 3,000 MWh of storage was awarded, representing new projects worth $1.8 billion. More than 3,000 MW of capacity was bid into the auction, including one peaking gas generator that was not successful.

NSW energy minister Penny Sharpe said the winning projects are equal to 8 per cent of the total 2022/23 NSW summer peak demand and are critical for energy security in NSW.

“We have no time to waste as coal-fired power stations retire,” Sharpe said in a statement issued ahead of a media conference in Sydney. “We must get more renewable energy into the grid – backed by storage and flexible demand – to keep the lights on and meet our net zero targets.”

Asked at a press conference about whether the winning projects would fill the gap, Sharpe said they “go someway to that. We still think that there is going to be a reliability gap that we’re going to have to deal with, but this puts a big, big – really fills the big hole there. ”

AEMO’s own data suggests, however, that the reliability gap – identified as 786 MW in 2025/26 in its most recent update – would be filled by these new projects.

Federal energy minister Chris Bowen said the governments were getting on with the job of delivering a cleaner cheaper grid for NSW after little had been done over the past decade.

“Firming infrastructure is the key to enabling the rollout of more renewable generation, the cheapest, cleanest form of energy available,” Bowen said.

It is the second major coup for Akaysha Energy, which is also building the 850 MW, 1680 MWh Waratah Super battery at the site of the shuttered Munmorah coal fired power station, which will act as a kind of giant “shock absorber” for the grid by increasing capacity on key transmission lines.

AGL has already built big batteries at Torrens Island in South Australia (250 MW, one hour) and the soon to operating Broken Hill (50 MW, one hour), and has contracts to operate third party batteries at Wandoan in Queensland.

The Liddell battery, which has been in the pipeline since the decision to close Liddell was made several years ago, will be the latest of a number of big batteries planned for a site of a coal fired power station, including the already built Hazelwood battery, and Eraring, Munmorah, Collie, Tarong, Stanwell and Kogan Creek.

AGL says it has yet to reach a final investment decision on the Liddell battery, but that is expected before the end of the year.

These sites are attractive to developers because they already host key infrastructure, such as switching stations and transmission lines.

For Iberdrola, it will be its second big battery following the 25MW, two hour facility at its Lake Bonney wind farm, although it also has operating rights over the 50 MW, 75 MWh Wallgrove battery in western Sydney.

The winning projects made bids for long term energy supply agreements (LTESAs), and annual annuity payments. According to AEMO Services, the average price bid for the LTESAs was $32,000 a MW a year ($11,000 per MWh), while the annual annuity was capped at $40,000/MW (but not all bid).

The exact details of the winning bids were not announced, but the average LTESA price suggests an annual cost of around $34 million, which is significantly lower than the recent WA battery contracts, although that state was seeking a more complex and detailed response from new big batteries to manage the solar duck.

But the reality is that the batteries may not exercise those floor price contracts, because they will make more money on the open market. Certainly, they will need to to make a return to investors.

AEMO Services executive general manager Paul Verschuer said all projects were also appraised on social licence commitments, deliverability and the organisational capability and capacity.

“As one of the world’s fastest decarbonisation initiatives, the NSW energy transition has inevitable challenges, however these tenders demonstrate strong momentum and interest from the private sector to deliver this new generation of cleaner, more affordable and reliable energy infrastructure at rapid pace,” he said.

The results of a separate tender seeking around 1GW of new wind and solar capacity, and up to 600MW of long duration storage (at least eight hours), are expected before the end of the year, while another tender will be launched in coming weeks.

However, that new tender will not include anticipated “access rights” to new renewable energy zones – essentially reserving unencumbered spots on the grid – and will now be held in the first half of 2024, adding to concerns about the pace of the rollout in NSW.

See also RenewEconomy’s updated Big Battery Storage Map of Australia

And: The eye-watering payments being made to big batteries to squash huge solar duck