Support for policy to expand electricity storage seems to be growing. The Smart Energy Council and Clean Energy Council have both thrown their weight behind such plans. Increasingly, attention is turning to the details of such a policy, and of its costs. This note looks at the economics of “grid-oriented” behind-the-meter batteries.

Context

In November 2021 Green Energy Markets suggested an extension of the small scale solar subsidy scheme to home batteries. In February this year, Senator Helen Haines introduced to the Parliament a bill that was built on their analysis and ideas.

In May, Peter Harris, Peter Sheehan, Ted Woodley and I released a report suggesting that electricity storage policy should be at the centre of the Australian government’s energy policy. We suggested a broad-based scheme for storage, big and small behind and in front of the meter and including EVs, modelled broadly on the Renewable Energy Target.

The electricity storage market in Australia is growing quickly. Technology and commercial development in this part of the market is rapid. There is a great deal to be done to understand this better for the purposes of policy-level assessment, so that customers can get value from storage and so that industry profits from it. This note responds to that need.

This study

We report here on preliminary studies that are seeking to understand how much income a behind-the-meter (BTM) battery would earn if it was oriented purely towards the 5 minute wholesale market and sought to maximise its profits in that market.

We further ask how this would change if such a BTM battery was operated so as to make the most of the arbitrage opportunities in wholesale markets as well as in the retail market (i.e. the arbitraging the prices in the customer’s retail supply and assuming also that they have BTM solar.)

A BTM battery oriented so fully to the grid is not the norm. There are increasing instances of “virtual power plant” batteries that can be centrally dispatched, but not in the regular (daily) way that we are assuming here.

The commercial construct we are using, for the purpose of this assessment, is where a household (or a utility) invests in a BTM battery as a device for high frequency trading. Would this be profitable? If it is, this sort of commercial arrangement could well find a market.

We assume a 5kW/10 kWh battery (typical of residential behind-the-meter batteries) and we also assume that the household has solar panels and that the battery is operated so as to fully charge during the period from 8am to 5pm and fully discharge in the period from 5.30pm to 9pm, every day.

For the wholesale market prices we took these 5 minute prices over the period 1 October 2021 (when 5 minute prices were introduced in the NEM) up until 31 August 2022.

For Case A (the BTM battery that is oriented purely to the wholesale market) we assume the battery is charged, at 5kW, for the 24 cheapest five minute intervals (i.e. 2 hours) in the charging period and then discharged at 5kW for the 24 most expensive five minute intervals in the discharging period.

For Case B (the BTM battery that makes the best of wholesale trading opportunities and behind-the-meter trading opportunities) we put a ceiling on the charging price of 5 cents per kWh (this being the assumed feed-in rate for surplus rooftop solar). And we put a floor price of 40 cents per kWh on the discharge (this being the assumed retail price of grid-supplied electricity in the peak period).

This means that we are assuming that the customer always has 5kW of solar available to charge the battery (if needed) during the charging period, and that the customer has sufficient demand to consume 5kW at each instance that it is drawing from the battery during the discharging period.

For most households this is optimistic (there will be many instances when 5kW will not be available and households rarely have demands of 5kW at any one time).

A more realistic analysis would use a sample of actual data of 5 minute demand and rooftop solar generation. Case B should therefore be thought of as an upper bound of the income that a 5kW/10kWh battery might get if it was programmed to make the most of wholesale and BTM retail trading opportunities.

Results

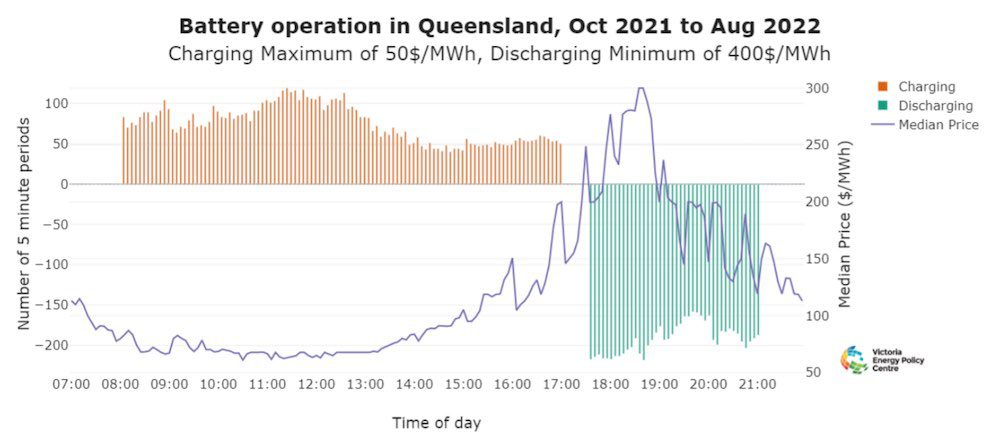

The first chart below shows the number of 5 minute instances over our study period in which the battery charges and the number that it discharges for Case A (BTM battery oriented to the wholesale market) in Queensland.

From the chart you can see that it is most likely to be charging from 10.30am to 1.30pm when rooftop solar peaks and so wholesale prices in Queensland are their lowest.

Conversely we can see that the battery is very likely to discharge from 5.30pm to 7.30pm when prices are most often their highest (the blue line in the chart is the median spot price in Queensland in each interval).

The second chart (below) shows the results for Case B. You can see now that putting a ceiling of $50/MWh on the charging price and a ceiling of $400/MWh on the discharging price results in a much more even spread of charging and discharging.

How do these operating results translate into income for our two cases? The chart below shows the annual income our 5kW/10 kWh battery wholesale market arbitrage battery would earn in each of the five NEM regions (we assumed income in the 12th month equal to the average of the 11 modelled months).

As we see in this chart, the income is lowest in Tasmania where its hydro storage caps prices in peak periods and raises them in off-peak periods relative to other NEM regions.

In South Australia and Queensland, we see the highest incomes. This follows the observation that their plentiful solar drives prices down in the charging periods; and with very expensive gas generation typically setting wholesale market prices during the discharging hours, the combination of the high prices in those hours and the low prices in the charging hours leads to handsome arbitrage revenues.

The table below shows, in the first column, the annual income for the wholesale-market-focused battery (Case A). The second column shows the annual income for the wholesale-and-retail-market-focused battery (Case B).

| Case A: Annual income (wholesale oriented) | Case B: Annual income (wholesale + retail oriented) | |

|---|---|---|

| VIC | $719 | $1,628 |

| NSW | $777 | $1,659 |

| TAS | $444 | $1,472 |

| SA | $1,085 | $1,916 |

| QLD | $1,875 | $2,559 |

The first (data) column shows healthy income for a wholesale-only oriented battery, particularly in Queensland. Tasmania, as expected, shows the lowest income and not enough to justify installing a wholesale market BTM battery there.

The second column (Case B) shows healthy income in all NEM regions and that also being able to charge/discharge to the house is most/least valuable in those states with the least/most attractive wholesale market arbitrage opportunities, i.e. Tasmania / Queensland.

Assuming installed costs of circa $10k for our assumed battery, these numbers suggest attractive net returns, particularly for batteries that can arbitrage wholesale and retail markets, in all regions.

Our analysis hints that growing storage in the NEM is unlikely to require a great deal of subsidy. It reveals quite substantial wholesale market arbitrage income and potentially lucrative retail market arbitrage income.

While NEM prices have been quite extreme over our study period, it might be that this becomes a new normal – gas is now extremely expensive and ongoing solar expansion will provide plentiful cheap supply in the middle of the day.

Nectr pioneered VPP-enabled solar-battery bundles and Energy Australia has now brought this model into their main retail business (having started it in their retail venture business) and compensation for “virtual power plant” participation is now common amongst those retailers offering VPP battery plans.

What can be learned about how these are working in the real world?

Considering the many factors that affect the economics of storage, this analysis suggests that it is important to not try to pick winners. The real market is much too complex and dynamic for any of us to fully grasp.

The best we can hope to do is encourage smart risk-takers to have a go and then analyse who is succeeding and who is not. Singling out behind-the-meter instead of front-of-meter batteries or big batteries versus small batteries as more worthy than the other for policy support, would be a bad idea.

Bruce Mountain and Ben Willey, Victoria Energy Policy Centre