As previously seen on Skytop Strategies and published with permission.

Over the past fourteen years, we have ingested data from 800 expert ESG sources. We've freely shared the rankings we've derived from the 400 million data points we've ingested with hundreds of thousands of site visitors around the world. However, we keep hearing a misperception that big companies automatically get better ratings than little ones.

Big Companies Don’t Have Systematically Better ESG Ratings

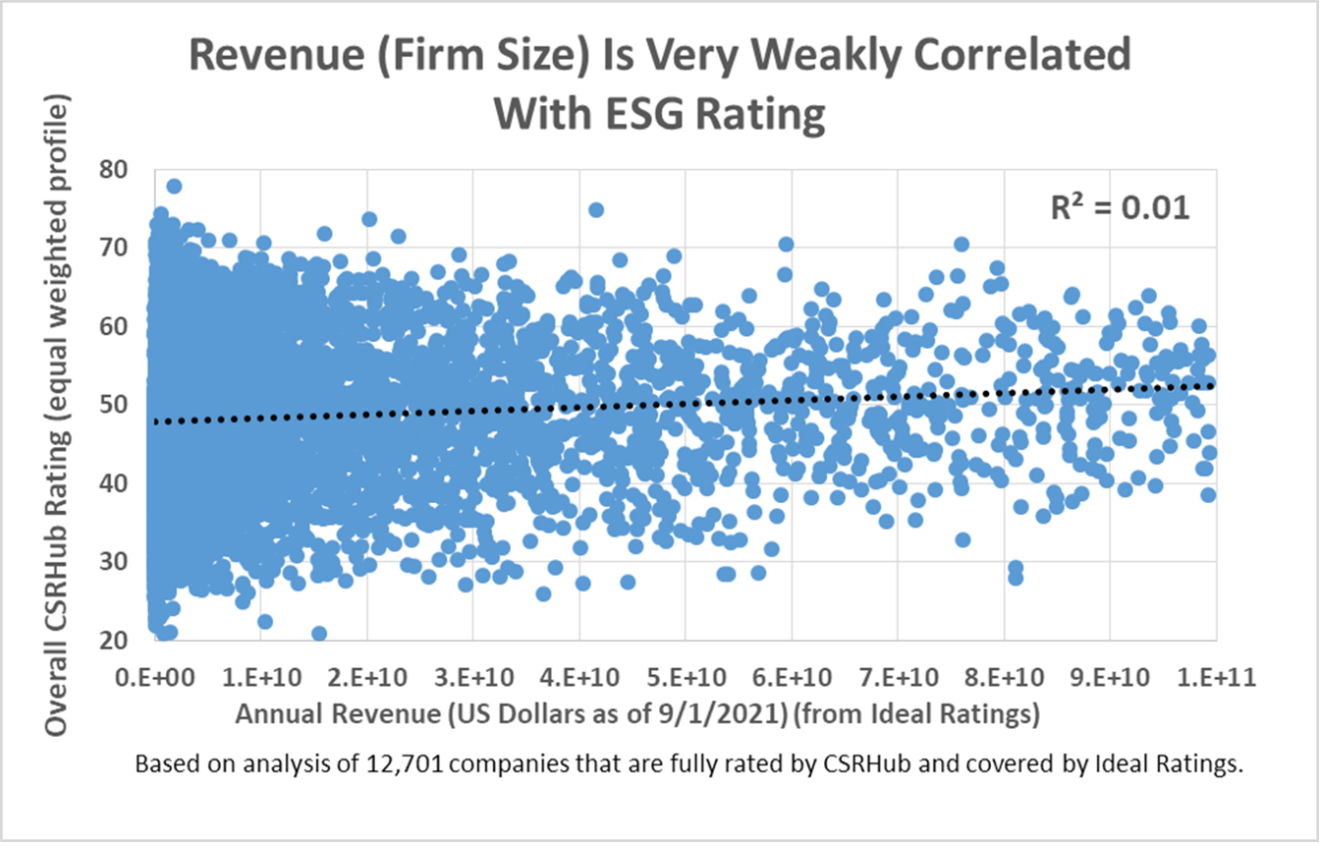

As the chart below shows, there is almost no correlation between a company’s revenue and a consensus view of ESG performance (the kind of score that my firm, CSRHub, generates).

This misperception probably arises out due to the fact that large companies have big ESG staffs and budgets. They issue a lot of fancy reports and talk at ESG conferences. However, there are many smaller companies that are known and valued for their work on environment, social, and governance factors. ESG experts—the folks who generate the ratings we use—value and respect these small and medium-sized firms.

Big Companies Don’t Get More Attention

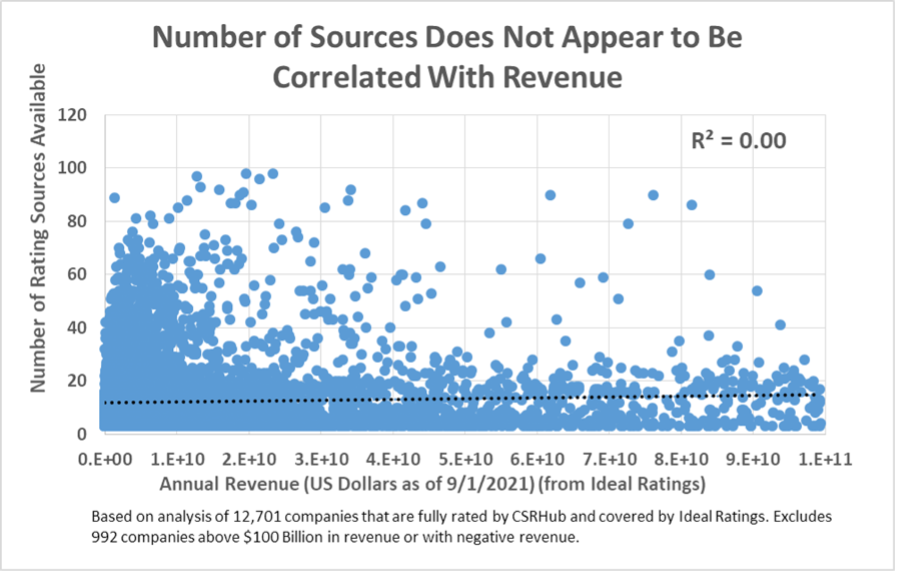

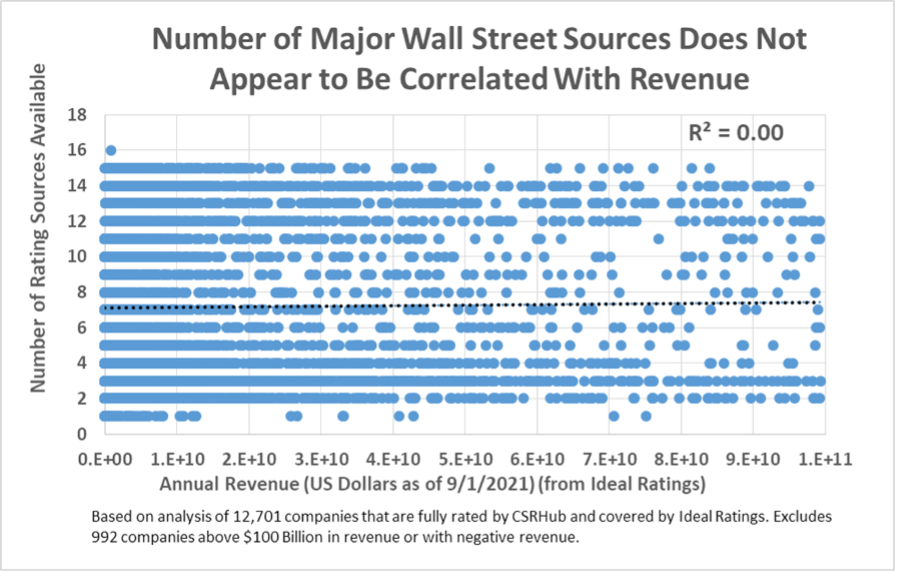

Again, if one uses a broad enough data set (the chart below relies on ratings for more than 12,000 entities in 150+ countries), there is only a weak relationship between firm size and the number of ratings they receive.

For this chart, we have defined a source to include “Wall Street” ESG analyst firms, crowd sources, university groups, industry associations, and government databases. Interestingly, nothing changes if we use only the Wall Street firms (we work with 16 Wall Street sources). There is still little connection between attention (as measured by number of sources) and revenue.

Market Capitalization Does Matter—But Only a Bit

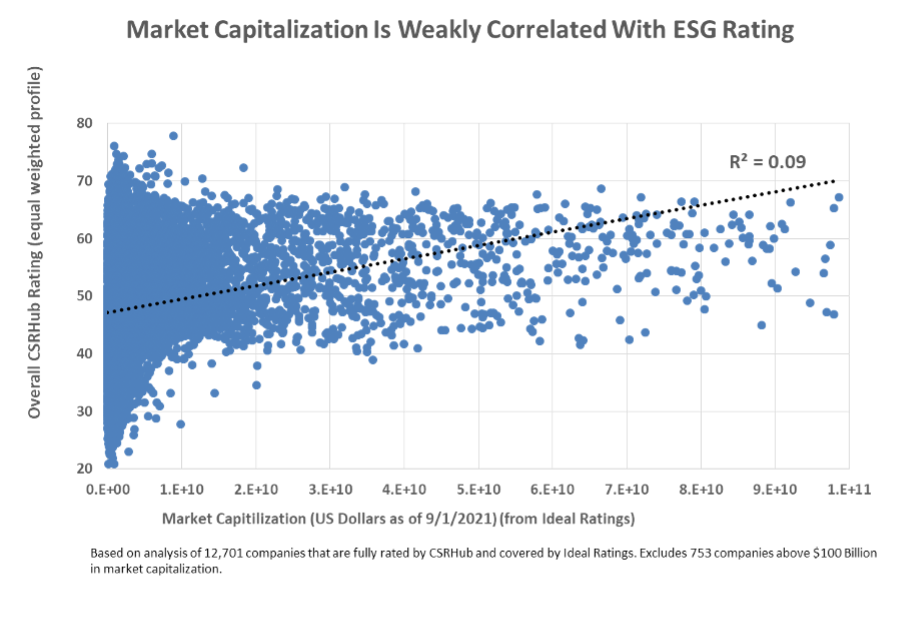

Some of the big, high revenue entities we track are private or semi-private. What if we look the relationship between only publicly traded entities and their market capitalization? Here there is some connection with ratings—a slight upward trend (a slim 9% correlation).

Why Do These Misperceptions Continue to Exist?

We don’t know for sure why so many people in the ESG area do not know that bigger doesn’t automatically mean better. We suspect:

- Many users of ESG data see only information on large, well-followed entities. They never see the hundreds of very good smaller firms.

- Many entities have disparate ratings (see our previous post on this). Data users may remember the high scores for a major company from one system and aggregate them with the high scores for another entity from another source.

- Companies emphasize, broadcast, and draw attention to their good scores and not their bad ones.

There are many myths and misperceptions in ESG Data. We believe it is important to pop these bubbles if we are going to use ESG data to make material decisions.

Bahar Gidwani is CTO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

Bahar Gidwani is CTO and Co-founder of CSRHub. He has built and run large technology-based businesses for many years. Bahar holds a CFA, worked on Wall Street with Kidder, Peabody, and with McKinsey & Co. Bahar has consulted to a number of major companies and currently serves on the board of several software and Web companies. He has an MBA from Harvard Business School and an undergraduate degree in physics and astronomy. He plays bridge, races sailboats, and is based in New York City.

About CSRHub

CSRHub offers one of the world’s broadest and most consistent set of Environment, Social, and Governance (ESG) ratings, covering 50,000 companies. Its Big Data algorithm combines millions of data points on ESG performance from hundreds of sources, including leading ESG analyst raters, to produce consensus scores on all aspects of corporate social responsibility and sustainability. CSRHub ratings can be used to drive corporate, investor and consumer decisions. For more information, visit www.CSRHub.com. CSRHub is a B Corporation.