Owning a four-hour duration battery over the past 12 months would have been very profitable. More batteries would be built if Australia had an investment tax credit similar to the US. Such a credit would encourage more batteries in the same way the LRET scheme has incentivised wind and solar.

Surely we want to encourage more storage/firming, so we why don’t we have a NEM wide storage policy like the LRET? The same could be said for behind the meter storage.

The so far poorly explained and obscure Capacity Investment Scheme seems like it will be accessible only as a backstop to state government programs. It’s hard to see how this can be as effective as a NEM-wide competitive scheme open to all participants.

(See also: South Australia and Victoria to host first auctions under Capacity Investment Scheme

It’s very clear that the open to all USA investment tax credit is producing much more storage than in Australia, even though the USA on average has less renewable energy share and more gas.

The four phases of storage and the zero phases of Australia storage policy

A battery spread, as I use the term, refers to the difference between the buy and the sell price for energy consumed and delivered by a battery.

There are no doubt lots of clever ways to use a battery and most of these have been discussed on RenewEconomy over time. Batteries can be used to provide system services (primarily frequency management), for “diurnal” = daily trading via time shifting power delivery, to defend a “cap” and to provide transmission support.

Other services are also possible. Batteries deliver other services to the grid and to consumers but many are harder to monetise and certainly require many modelling assumptions.

Last year, or was it the year before, in every other note I wrote I referenced the NREL Storage Futures Study. Back in November 2021 we interviewed Paul Denholm, the lead author of the study, on Energyinsders. If there is still anyone that hasn’t read that study and has even the vaguest interest in batteries, put down the coffee mug and head over there now.

In that set of studies, the four stages in the evolution of storage were defined and discussed:

As everyone who follows the sector in Australia knows, we are moving through those stages steadily. There are now plenty of batteries, I’m losing count, of 1-2 hour duration aimed primarily at providing ancillary services. We also have 2-3 batteries either developed or being developed that are aimed at transmission support.

Now we are moving into phase 3 – Diurnal storage. That is typically buying in the middle of the day and selling at night. In the USA, because of solar in California and the way the capacity market is defined, it’s always been the four-hour battery that is the modelling target.

Equally in the USA batteries have generally always been able to qualify for the investment tax credit. In Australia we have made storage really difficult because we never give any support to batteries. Solar and wind get the REC, utility scale batteries get nothing. Then we complain about a lack of firming power.

To be crystal clear, the firming power has to be built before the coal stations close down. Relying on the market to provide the pricing signals for that is risky. In fact, it’s definitional that if the replacement power is built before the old power closes, as it must be, then there must be some losses in the system when both the new and the old are still operating.

It’s the same in the distributed sector. Behind the meter solar gets the SREC, behind the meter batteries get a big fat donut. Then distribution companies unreasonably complain about excess exports straining their systems.

Often though, we don’t get the price signal from the market to build storage because the existing coal provides lots of firming.

Instead of a simple NEM-wide policy, we are lumbered with monolithic, empire building pumped hydro projects that inevitably have poor social license, are over budget, and late. Nothing wrong with pumped hydro, particularly, despite the adjectives. It’s just that it’s only one technology and even its biggest supporters would likely agree that deploying it takes time.

If Australia had an investment tax credit like the USA we’d have a lot more four-hour batteries and consumers, particularly in Queensland and NSW would be a lot happier.

Why doesn’t the SREC scheme or a more direct subsidy apply to the household battery sector? How is it that even the USA can do better than Australia regarding these policies? Back to the market signals.

Diurnal signals

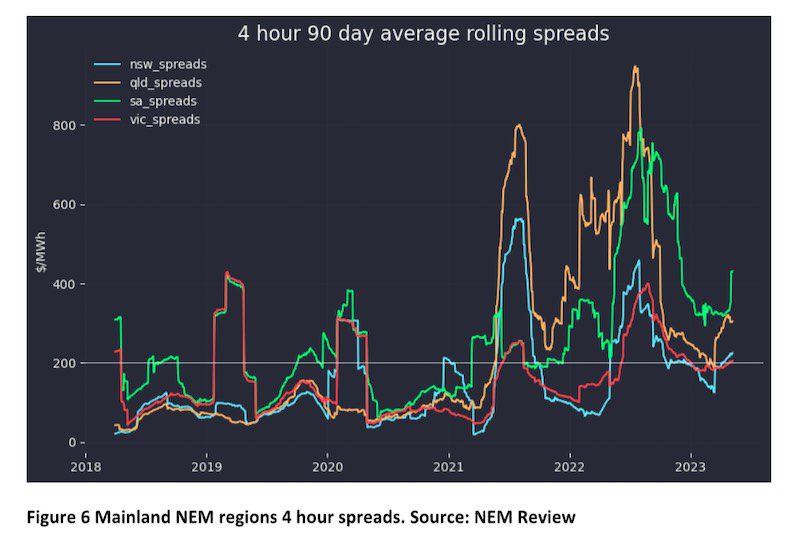

Lots of sophisticated battery models exist. You wont find them in this note. Instead what we show is very simple. We show two-hour, four-hour and eight-hour moving average diurnal spreads. The method was to downloand from NEM review half hourly price data going back about five years up to the present.

Each discreet day of the 1900 days in the sample consists of 48 half-hourly prices which were sorted from low to high. An efficiency factor of 85% was used. So for a two-hour spread for a day consisted of the average price of the four highest priced half-hours – the average price of the four lowest half-hours/efficiency factor.

The results for that day were then averaged over a rolling window. Results shown here are most for 90 day windows.

Previous work shows that when utility batteries cost roughly about $A600-$650/kWh of capacity that a spread of $200/MWh every day is required to earn WACC. So the graphs have a $200 line drawn on them.

Of course, eight-hour batteries have lower unit capital costs than two-hour batteries. Why? Well less overheads per kWh, less connection costs per kWh, less inverters (a 1MW inverter can go for 1 hour or 10 hours, if it’s 10 hours the cost per kWh of capacity of the inverter is only 10% of the 1 hour battery). On the other hand there may be some additional costs of longer duration like more internal safety equipment. Nevertheless, in these simple graphs those cost differentials are ignored.

And yes, Freddie, bigger spreads would be obtained by aggregating five minute rather than half hourly data. At the same time, these graphs implicitly assume perfect foreseight. That is, the battery is charged at the low prices and sold at the high. Because the shape of daily prices is fairly predictable – i.e. prices will mostly be lower in the middle of the day particularly in summer and higher pre breakfast and in the evening peak – because of that predictability, perfect foresight is on average not a bad assumption.

Anyhow without further ado.

Not the seasonal peaks. These will be much more obvious in the southern states.

We all could have made money in Queensland last year. A four-hour battery probably could have paid it for itself in 12 months. This illustrates the point made by Brad Hopkins; installed capacity has an option value not fully captured in models otherwise known as “you’ve got to be in it to win it”.

Victorian prices are lower and mostly that means spreads are lower as well. Equally you can see the strong seasonal impacts in Victoria. Basically Victorian batteries used for diurnal trading have historically been less profitable than in other states, except Tasmania. This may well change when the coal stations close and Victoria may become the best state to have a battery. We shall see.

High solar penetration in South Australia and a winter drop-off produces both good average spreads and clear seasonality.

I don’t show Tasmania, but if I did it would show that batteries don’t earn their required return. No surprise there.

Looking at the four-hour spreads across the mainland NEM regions provokes a question:

Spreads have gone up and basically justify investing in a four-hour battery if the conditions of the past continue. Yet it’s not clear if the increased spread is due to the higher penentration of solar or the obvious difficulties caused by high priced thermal generation in the past 18 months. Or, indeed, if it’s some combination of the above.

My own view is that markets are likely to be volatile. Every closure of a coal station requires an increase from other sources equal to about 5% or more of NEM-wide annual energy delivered (say an extra 10TWh) only some of which comes from rooftop.

A rough rule of thumb is that you need 1MW of firming for every 3-4MW of VRE. Equally, although batteries can connect anywhere on the grid and will typically make the grid stronger where they are connected, they nevertheless have to compete for transmission access with other demand when charging and other supply when delivering power. So they still need plenty of planning studies, etc.

What the federal government said about the Capacity Investment Scheme