The biggest battery in the South Australia market was operating at full tilt on Wednesday night, and battery output overall hit a new peak as wholesale electricity prices swung between the market floor in the morning to the market peak in the late afternoon.

The wholesale market price hit the market floor of minus $1,000 in the morning (around 9.30am grid time) before surging in the late afternoon to the market cap of $16,600 as solar and wind output dried up as the sun went down on a hot Adelaide day.

South Australia averages 71 per cent wind and solar – world-leading for a grid of this size – and 82 per cent over the last quarter, and while that has proved reliable it does come with increased volatility in the market.

The state has the largest amounts of negative pricing events, due to surplus renewables which are either stored, exported or curtailed, but its fleet of peaking gas generators demand top dollar when called upon to fill the evening peaks, particularly when the diesel generators are brought on line, as they were on Wednesday.

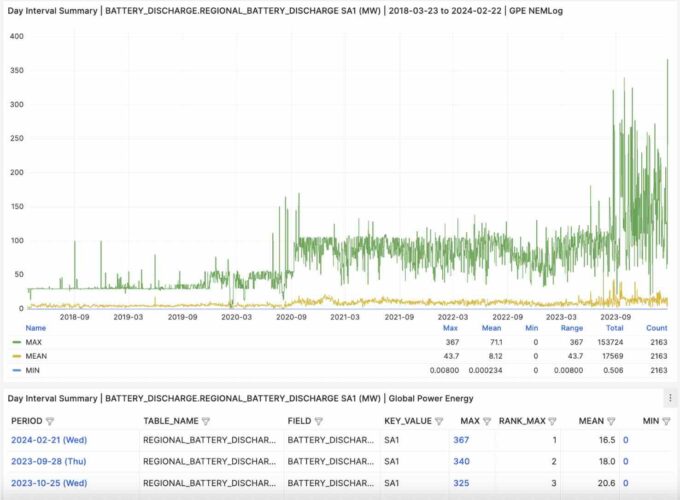

The big batteries joined in too – and the discharge of the state’s growing fleet of big battery storage units hit a peak output of 367 MW, beating the previous record of 340 MW set in September last year, according to the data providers GPE NEMLog.

What was interesting was that – according to the GPE NEMLog data, the newly commissioned 250 MW, one hour Torrens Island battery was discharging at just above its nominal capacity, 251 MW, with the 150 MW (193 MWh) Hornsdale Power Reserve at 80 MW, and the 25 MW, two hour Lake Bonney battery also near its capacity at 24 MW.

Other batteries to participate included smaller installations from the network of SA Water installations. All told, the share of battery output was 14 per cent of all supply at one stage.

The chart above, from OpenNEM, shows the growing role that battery storage (in blue) is playing in the daily electricity market. It’s interesting because it is completely new, and not even foreseen before Musk decided he could build the Tesla big battery in less than 100 days in 2017.

That first big battery – officially known as the Hornsdale Power Reserve – came on line in late 2017 but largely confined itself to the frequency and network services market.

But as more batteries come on line, and as Hornsdale itself has grown, the batteries are playing an increasing role in the storage of excess wind and solar and feeding that power back into the grid in the evening peaks, and any other demand or price opportunities. Those patches of blue will grow and grow.

See also RenewEconomy’s Big Battery Map of Australia.