Corporate Power Purchase Agreements signed between renewable energy projects and electricity buyers (directly or indirectly via a retailer) have become an important part of Australia’s renewable energy market.

After the 2020 Renewable Energy Target (RET) was achieved, most of the PPAs underwriting investment in new renewable energy projects were either via a corporate PPA or the state-owned utilities in Queensland as the major retailers stopped signing PPAs.

2023 was a record year for corporate PPA deal volumes, but it was also a challenging market in which there were few deals with new projects and most PPAs were negotiated by larger, experienced deal makers.

Major new policy frameworks are being established – the Capacity Investment Scheme (CIS) and the Renewable Energy Guarantee of Origin scheme – which will reshape the corporate PPA sector.

The Business Renewables Centre – Australia (BRC-A) looks back at the key corporate PPA trends in 2023 and ahead to consider some of the implications of the CIS for corporate PPAs.

2023 a record year for corporate PPAs

For the second year running, the deal volume hit a new record year – just over 1700MW after reaching around 1500MW last year. For the past four years, the volume of capacity negotiated through corporate PPAs has been 1GW and above.

Experienced corporate buyers and public sector led the way

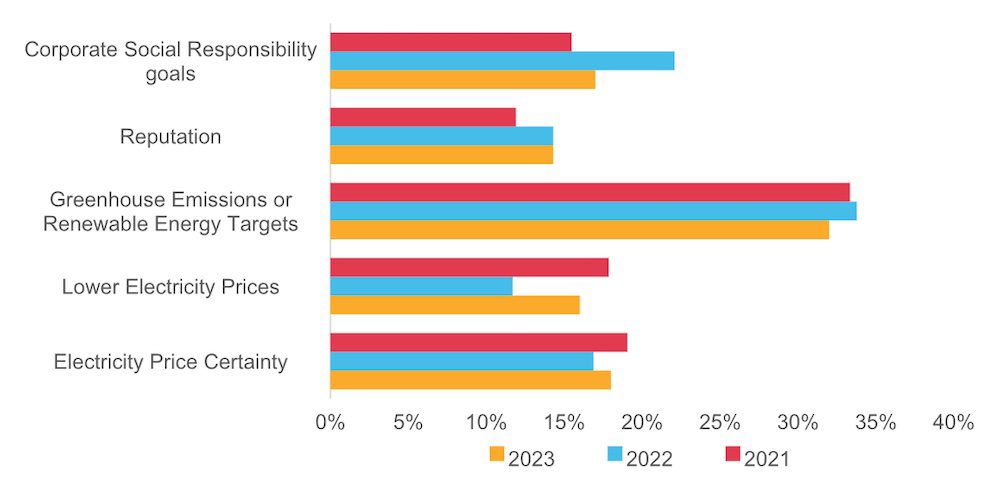

BRC-A’s annual buyer survey has consistently found net zero and sustainability targets, are the key drivers for PPA demand.

Financial considerations are the major factor once buyers are evaluating PPAs, but climate targets are the key driver for interest in PPAs which has maintained demand across the ups and downs in wholesale electricity markets.

Due to a slowdown in supply of new renewable energy projects, many participants noted an excess of demand for PPAs relative to supply – creating a ‘sellers market’.

Within this challenging market, there was a notable shift towards larger deals (>100 MW) and fewer small deals (<20 MW).

Two-thirds of the deal volumes were signed by corporates that had already signed PPAs such as BHP (6th PPA), Telstra (5th PPA) and Woolworths (3rd PPA). As with past years, public sector organisations were also prominent, notably regional local government buyer groups.

The first ‘hydrogen PPA’ was signed by Fortescue Metals with Bulli solar farm in Queensland and BRC-A’s survey found growing activity by advisers on PPAs which include battery storage.

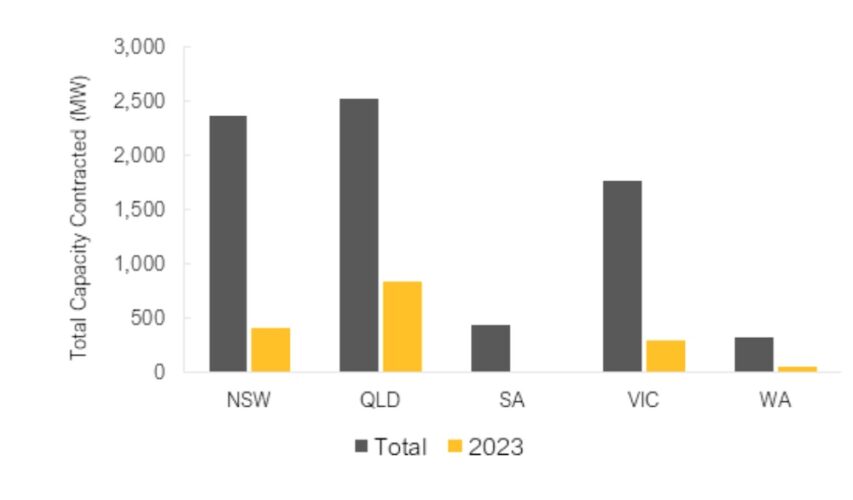

Queensland is now the leading state for corporate PPAs

Queensland has led the pack in both 2022 and 2023 – and has overtaken NSW as the leading state for corporate PPAs.

New projects remain uncommon

The volume of corporate PPAs with new projects has notably declined in recent years, reflecting lower supply and market risks.

In 2022, there were virtually no PPAs with new projects and last year the deal volumes were evenly split between PPAs with new projects (28 per cent), committed projects that had secured finance (33 per cent) and operational projects (39 per cent).

What is the future of corporate PPAs?

In the first phase (2016-20), corporate PPAs were primarily developed by large corporates to leverage greater value and environmental impact through wholesale PPAs negotiated directly with new projects.

In the second phase (2020-23), Corporate PPAs (partly) filled the investment void after the achievement of the RET and the market expanded to a wider diversity of buyers via de-risked PPAs with operational projects brokered by retailers. Corporate PPAs may be entering a third-phase now as the post-RET policy architecture is established.

Late 2023, the federal government announced an expansion of the Capacity Investment Scheme (CIS) to contract 23GW of renewable energy and 9GW of despatchable resources (e.g. battery storage) until 2027.

Although the scheme design is not yet established, it appears the CIS will be a variation on the NSW Long-Term Energy Supply Agreement (LTESA) model, with minimum revenue certainty designed to enable projects to secure debt finance rather than a traditional contract-for-difference.

What are the implications for corporate PPAs?

One scenario is that corporate PPAs are crowded out as projects focus on bidding for contracts under the CIS and the big three retailers ramp up contracting with renewable energy and storage projects again. However, in our view, it is unlikely that corporate PPAs will fade out: buyer demand is underpinned by emissions reduction, ESG and reputational drivers that will continue.

A second scenario is that most corporate PPAs are signed after projects secure a contract via the CIS. In Queensland, state-owned utilities with mandates to sign PPAs have emerged as the dominant entities for contracting with new projects.

Most (but not all) corporate PPAs have been retail PPAs signed with solar and wind farms after one of the state-owned utilities have signed a PPA to underwrite construction. A similar dynamic could emerge as the CIS scales up.

A third scenario is that corporate PPAs become part of bids for the CIS. Under the NSW LTESA model, tender criteria reward bidders with retailer or corporate PPAs because the aim is not to displace conventional market contracting. Brad Hopkins (AEMO Services) noted after the announcement of the second round of LTESAs (November 2023):

“Previously, people needed a 15 year PPA with a credit worthy utility in order to get a project built. They’re showing up to our tenders, and they’re saying, we need enough financial support from the LTESAs to pay our debt … we’ve got a five year contract with a medium sized company or a large corporate or a new entrant retailer and our equity investors are happy to take the risk that we get another contract in another five years’2

Scheme design is not finalised and outcomes will depend on the strategies of market participants, but it may be the role and type of corporate PPAs change more than the volumes.

Corporate PPAs with new projects via CIS auctions could remain the minority as in recent years because only larger parties would be attractive to enhance CIS bids – and the role of PPAs could increasingly focus on revenue certainty through commissioning and operational phases, especially if the big retailers become active in CIS auctions.

What does it mean if corporate PPAs with new projects become less common? Legally, additionality is achieved if LGCs are retired but, for many, ‘true’ additionality is a PPA that enables a new solar or wind farm.

PPAs with new projects remain the ‘gold standard’ and it’s important larger buyers continue to use their procurement power to underwrite new projects – AEMO estimates 6 GW of projects need to be built annually to meet the 2030 target so it’s a vital time for investment in new projects.

However, a vibrant corporate PPA market for projects after financial close still adds to demand and enables projects to proceed with greater confidence knowing there is offtake demand once in construction or operational.

A healthy corporate PPA market should exhibit a mix of buyer sizes, stretching from PPAs with larger buyers underwriting new projects to medium-sized buyers contracting via retailers. But as the CIS scales up, if PPAs become primarily a secondary market for projects after they have secured finance, debates around additionality will intensify.

———

Chris Briggs & Alex Nasser, Business Renewables Centre-Australia & University of Technology, Sydney.

The BRC-A is currently facilitating a PPA buyers group for the City of Sydney – if interested email [email protected].