Around the world, tens of gigawatts of renewable energy generation capacity is being contracted each year by big business as a key plank of corporate decarbonisation strategies, often aiming for the headline-grabbing target of 100% renewables.

But a major report put together by McKinsey and published on Tuesday is proposing a new take on power purchase agreements – the 24/7 Clean PPA – that promises to boost the decarbonisation impact, including for the broader grid, and reduce market risk for corporations.

The report, commissioned by the Long Duration Energy Storage Council, argues that 24/7 Clean PPAs can go well beyond 100% renewables – a goal that, in corporate terms, is increasingly difficult to define.

It proposes to upgrade this to “100% decarbonisation” by creating a closer match between supply and demand. Clearly, they are not headline writers, but there is a reason for the switch.

This package of contracted dispatchable clean power – a “highly desirable commodity,” the report says, for businesses seeking to cut Scope 2 greenhouse gas emissions – would combine a bespoke mix of renewable energy and energy storage.

But not necessarily storage from big, lithium-ion batteries. For 24/7 Clean PPAs, the focus – and not entirely surprisingly, considering the organisation behind the report – is on long duration energy storage, or LDES.

That’s partly because LDES offers much more flexibility of supply; and partly because, at the moment, li-ion batteries cost too much. The report cites the levelised cost of electricity from a wind, solar and lithium-ion battery hybrid system as more than $US200/MWh “in most regions.”

By contrast, it argues that solutions based on “novel” energy storage technologies like LDES are expected to reduce the cost of 24/7 renewable power to less than $US100/MWh in the near future – if deployment accelerates.

“Li-ion batteries have a limited ability to provide long-duration flexibility economically as their energy storage capex increases in a linear relationship to duration,” the report says.

“This contrasts with LDES technologies, which generally have higher power capacity capex but can increase energy storage capacity at a low cost, allowing for scalable duration.”

Ultimately, however, the report goes well beyond making a long and detailed pitch for more investment in LDES, to propose what is almost certainly a much-needed makeover of corporate renewable energy procurement.

McKinsey says current PPA structures fall under one of four categories: pay-as-produced; shaped; baseload; as-consumed. In pay-as-produced PPAs – the so-called “gold standard” of renewable energy procurement – the off-taker buys the gross generation from the assets, thereby bearing the price risk.

Because of this price risk, however, the remaining three PPA structures have become increasingly popular. In these cases the seller has to settle the difference between the power produced and the load and, as the report notes, transparency on the source of that “filler” power is quite limited. It may be from fossil-based generators.

A sub-category includes so-called sleeved PPAs – popular here in Australia – and certificate-only PPAs, which serve essentially as carbon offsetting measures for companies and do very little to truly green up broader electricity network power supplies.

Already, these sort of renewables-lite corporate offtake deals are not generally recognised by organisations like RE100, to which companies serious about decarbonisation sign up and are held to account.

But it’s arguable that a new approach, entirely, could be needed.

“Today’s standard renewables PPAs enable new clean generation capacity but do not support full system decarbonisation due to a temporal mismatch between generation and demand,” the report says.

“24/7 clean PPAs are an essential non-regulatory tool to support this acceleration by enabling investments in clean, dispatchable capacity that will drive down costs,” the report adds.

“In addition to decarbonisation solutions, off-takers need solutions that reduce their exposure to increased power price volatility, resulting in part from increased renewables penetration.

“Current 100% renewable PPAs do not fully hedge price volatility risk, which is accentuated by high penetration of variable RES and volatility of commodity prices.”

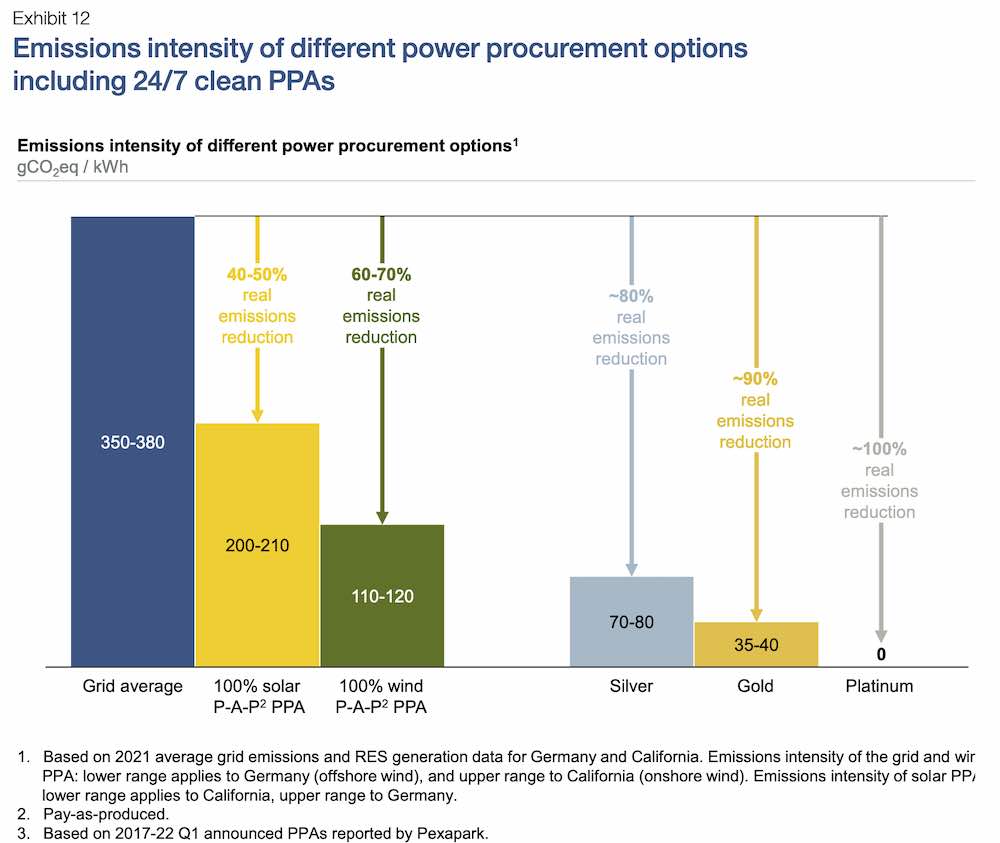

McKinsey proposes 24/7 Clean PPAs could be adopted through a standardised assessment mechanism, allowing for different levels of ambition and establishing a pathway to 100% decarbonisation with increasing levels of clean supply-demand matching.

“Entry Level” 24/7 clean PPAs would have low entry barriers and cost in the range of today’s average power market prices in many regions, to help accelerate adoption.

While “Platinum” PPAs would represent the highest ambition level (approaching 100% clean supply-demand matching) and target companies looking to accelerate decarbonisation and technology deployment.

And while these top level PPAs would come at a price premium, McKinsey says the costs of Platinum 24/7 clean PPAs are expected to decline by 30-40% over the coming decade, as technology matures and scale increases, closing the gap to market prices.

Of course, tailoring 24/7 Clean PPAs for different businesses with vastly differing power needs won’t be an easy task – regular renewable energy offtake PPAs are already renowned for being enormously complex.

To that end, the report has identified some of the key economic and technical issues that need to be resolved, including the establishment of a standardised assessment framework; official certification by independent organisations; optimisation of technology mixes; and the lowering of barriers to entry for corporates to drive economies of scale.

“In a world where rapid decarbonisation of the power grid is an increasingly important priority, there is an urgent need to manage the fluctuations of supply and demand and price risks associated with renewable power generation,” the report concludes.

“While there are many obstacles to overcome, the key message of this report is that this is an entirely feasible task, that LDES is a key enabler, and that the prize of effective power decarbonisation is well worth the effort.”

Two upcoming webinars will discuss the report’s findings:

– For the APAC/EMEA-friendly session, 10:30-11:30 CET, Thu 12th May, listen here.

– For the Americas/EMEA-friendly session, 15:30-16:30 CET, Thu 12th May, listen here.