The April Liddell closure is a worry for consumers. As Paul Mcardle writes on Wattclarity unit 4 of the 2GW New South Wales coal plant is the first to close, with unit 2 and unit 1 following shortly thereafter.

Again, as McArdle writes, we’ve had seven years to get ready for this and yet there will still be a whiff of worry around, given the struggles to keep supply going in 2022 and, frankly, the fact that not enough new generation has been built in NSW.

On top of that, connections between NSW and Victoria are poor – as evidenced by the persistently materially lower prices in NSW compared to Victoria. Queensland supply has also been limited thanks to the Callide coal plant issues and that means less Queensland exports to NSW and reverse flow at the evening peak.

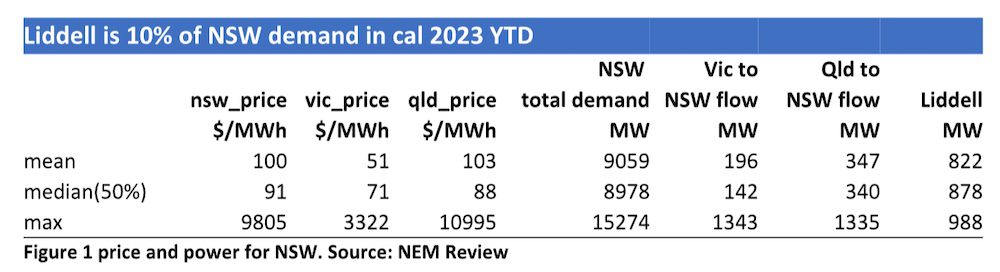

Looking at some data thanks to NEM Review, in the calendar year-to-date Liddell has provided around 10 per cent of NSW demand, including imports.

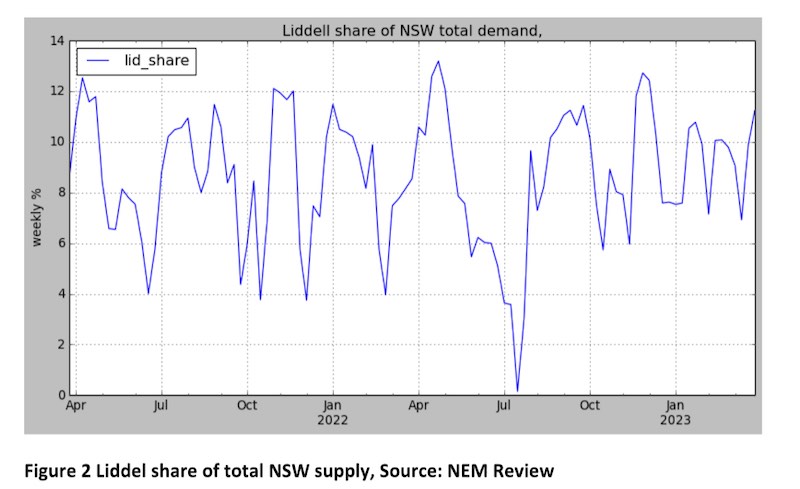

When Liddell’s share of generation rises it tends to be associated with lower NSW prices and, conversely, when Liddell is not running prices are higher.

As mentioned in the introduction, the interstate links between NSW and Victoria and NSW and Queensland are in average shape. In saying that, Queensland is in any event short on supply right now.

Victoria has plenty of surplus supply but can’t get it to NSW in the middle of the day. This is very frustrating for NSW consumers and Victorian suppliers but conversely good for NSW suppliers and Victorian customers.

You can see the implied transmission issue and also the shortage of evening capacity in Queensland by comparing the state spot prices.

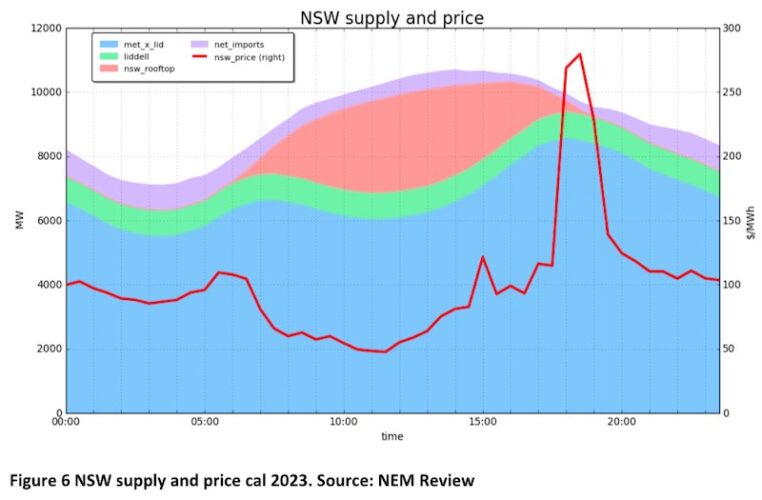

Obviously one big driver of the difference in prices is at around 6:00pm. This is for sure going to get worse in the short term when Liddell closes, because the difference will have to be made up from gas, or hydro, or more coal. All of those will be expensive. Only when NSW builds another, say, 2GW of wind will there be any hope of getting rid of the 6pm peak.

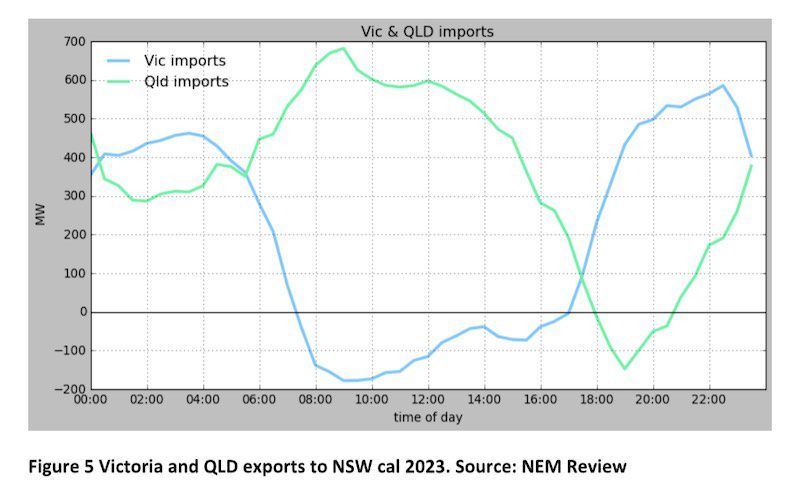

To make this clear we show how imports from Victoria drop off during the middle of the day due, I think, to a constraint on the Vic-NSW interconnect that is invoked when Victoria’s solar generation is high.

More importantly, Queensland runs out of exportable power around 6pm and yet the constraint in Victoria or something prevents power in Victoria heading north while demand and prices are at peak. Indeed, on average NSW generators have been exporting to Queensland between 6pm and 8pm this Summer

The aggregated NSW situation therefore looks as follows:

And remember, this is only Summer. As the solar generation drops off in the south, and to an extent in Queensland, the prices required to replace the Liddell capacity will only increase.

There are lots of plans to fix things: batteries, more supply, more interconnects, etc. However the cavalry may arrive to find some unhappy NSW consumers over the next 12 months.