New financing commitments and construction starts for wind and solar projects may have slowed to a trickle in the first half of 2023, but the queue for connection agreements continues to grow.

The Australian Energy Market Operator says it has received 16 new connection applications from projects totalling 3.9GW of capacity in the June quarter, taking the total capacity of projects working their way from connection applications to commissioning to 30GW.

This number includes wind, solar and battery projects, although there is no breakdown for particularly technology.

Connection agreements have been notoriously hard to obtain for many wind and solar projects, with problems emerging at various stages of the process.

But AEMO says construction timelines are also being affected by the need to refinance – presumably because of high interest rates – long wait times for equipment and also the need to change suppliers.

“At the end of Q2 2023 there were 10.3 GW of plant at various stages of construction (pre-registration), compared to 6.5 GW at the end of Q2 2022,” AEMO says in its latest Quarterly Energy Dynamics report, which includes the data for the first time.

“The number of connections progressing through registration and commissioning remains relatively similar across both quarters, with 1.2 GW and 3.9 GW of plant progressing through registration and commissioning respectively in Q2 2023, compared with 1.5 GW and 5.0 GW in Q2 2022.

“Common issues currently reported to be impacting construction timelines include the need to refinance projects, long lead times for equipment, and the need to change original equipment manufacturers.”

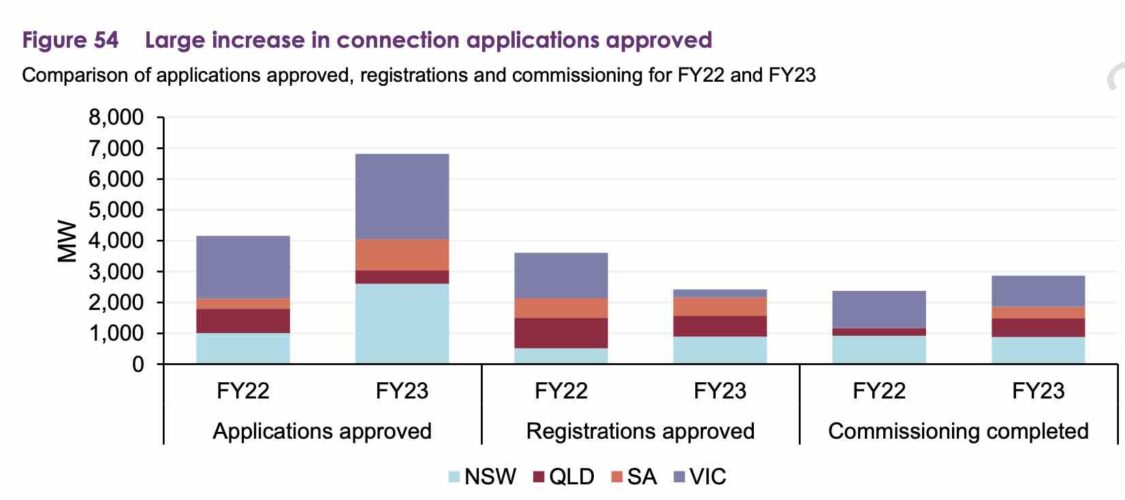

AEMO says there was a 63 per cent increase in new connection approvals in the last financial year, up from 4.2GW to 6.8GW.

The amount of plant approved for registration so that the projects can commence commissioning – i.e. the projects were mechanically built but yet to start generation – fell by 32 per cent to 2.4GW.

However, the amount of plant that completed the commissioning process over the year, and were approved for full operation, jumped 21 per cent to 2.9GW.

Both numbers are well below what is needed to meet Australia’s renewable target of 82 per cent by 2030, and AEMO recently received more funds to help speed up the connection process, and is working with the industry on key connection reforms.

The QED report shows that the output of grid-scale variable renewable energy (VRE) reach a record Q2 average of 4,599 MW, which was a rise 19 per cent, or 745MW, from on last year.

The largest growth in grid solar output was in Queensland (which rose by 241 MW, or 69 per cent) and in New South Wales (74MW, +18%).

Victoria posted the largest increase in wind output (up 27 per cent or an a average of 289MW) due to a big increase in available capacity from new and recently connected facilities, and also stronger output from previously poor performing facilities such as the Macarthur wind farm.