Billionaire green investors Andrew Forrest and Mike Cannon-Brookes are shaping up for a battle of control over Sun Cable, the world’s largest solar and battery project, with big differences emerging over its design and purpose.

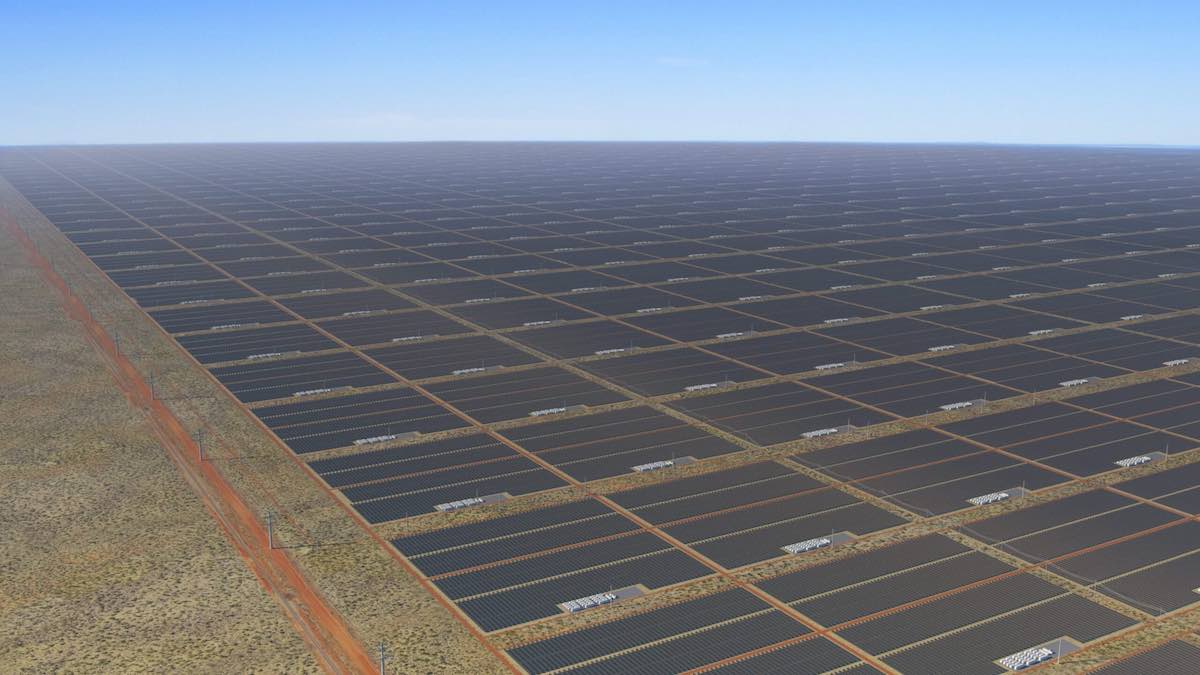

Sun Cable – which is working on a 20GW solar farm and up to 42GWh of battery storage – was put in the hands of administrators last week in a dramatic move that reflected deep division over the project’s direction among its two biggest financial backers, and whether it should go ahead with a 4,200km sub-sea link to Singapore.

Sun Cable has stated in the past that such renewable export projects – focusing on electrons rather than molecules via green hydrogen or ammonia – could be the blueprint for any number of similar plans to allow big energy consumers to take into the wind and solar riches of countries like Australia.

However, Forrest’s privately owned Squadron Energy has made it clear that it still sees merit in the solar and battery component, and the proposed overland high voltage connection to Darwin, but it does not believe the proposed link to Singapore is commercially viable.

“Following a comprehensive technical and financial analysis, that included listening to customer feedback, Squadron Energy has concluded that Sun Cable’s Australia-Asia PowerLink project is not commercially viable,” Squardon chairman John Hartman said in a statement on Monday.

“However, Squadron Energy continues to believe in the vision for a game changing solar and battery project in the North Territory’s Barkly region, including the proposed connection to Darwin.

“As Australia’s largest renewable energy company, Squadron Energy is best placed to help Australia become a green energy exporting superpower by generating renewable energy to produce green hydrogen and green ammonia.”

Squadron has only newly emerged as the biggest renewable energy developer in Australia following its estimated $4 billion purchase of CWP Renewables.

CWP Global, a different entity, is one of the partners in two even bigger projects – the newly renamed Australian Renewable Energy Hub (26GW of wind and solar in the Pilbara), and the Western Green Energy Hub (up to 50GW of wind and solar in the south of Western Australia), that are focused on green hydrogen and ammonia.

The Australia Renewable Energy Hub had initially planned a cable link to Indonesia, and potentially beyond, before rethinking its most likely markets as green hydrogen, domestic manufacturing and – more controversially – green ammonia as a substitute for coal in power plants in Japan and South Korea.

The dispute between Forrest and Cannon-Brookes over the management and purpose of Sun Cable is providing a fascinating clash of riches, egos, and business plans that in many ways speaks to the contest of ideas and technologies in the green energy arena.

Cannon-Brookes is known to be close to, and supportive, of the project’s founders and the focus on electron exports, as well as the creation of a significant green manufacturing industry in the Northern Territory and elsewhere.

A spokesperson fro Grok Ventures, his private investment company, confirmed there has been a difference of opinion between Squadron and all other shareholders over prioritising the Singapore project, even though it has always been the company’s marquee project.

“This was the reason the founders started the company, and the reason investors invested in the company, in the first place,” the spokesperson said.

“Once operating there would be energy generation coming out of Sun Cable to provide renewable energy to both Singapore and various projects in the Northern Territory.

“Grok and every other investor is firmly of the view that the AAPL is the project to back – it continues to hit important milestones and remains on-track to deliver affordable clean energy to Singapore.

“This lighthouse project will likely deliver significant outcomes for the company, attract further investor capital and create a new industry in Australia. Grok’s investment philosophy is to back founders to build real value for investors and to assist the world’s energy transition.”

Forrest, with a series of massive MoUs to announce green hydrogen and ammonia plans at a scale that is barely believable, is hungry for massive arrays of wind and solar farms to provide the power to create the commodities he has promised – 100 million tonnes of green hydrogen and ammonia a year by 2030.

That will require more than 400 gigawatt of new wind and solar capacity, so Sun Cable, at 20GW, would barely scratch the surface of his needs. He newly acquired CWP Renewables boosts his other pipeline to around 20GW in Australia, although there are other big projects mooted for Western Australia.

Sun Cable is an attractive proposition because – at this scale – it is relatively well advanced, having secured land, indigenous support, financial backers, government support and with a huge amount of work done on the complexities of the project.

There are also likely to be competing offers – either individually, in new consortia, or aligning with one of the Australian billionaires.

Among those cited in the media are Australian based investors Macquarie Group and Quinbrook Infrastructure, international energy giant Iberdrola, and global investment funds Brookfield and Temasek.

Grok and Squadron each held 25 per cent of Sun Cable.