An “innovative and ground-breaking” deal between Tesla and the ASX-listed Genex for a new big battery project in Queensland could provide a blue-print for future financing of battery storage projects in Australia, and help overcome a major hurdle for such investments.

Genex last December announced it had locked in a unique revenue sharing deal with battery supplier Tesla for the 50MW/100MWh Bouldercombe big battery in Queensland, with Tesla agreeing to operate the battery and deliver a guaranteed return to Genex.

More details of that deal were revealed this week in the latest quarterly update from Genex, and at a webinar on Tuesday.

Battery storage projects have been difficult to finance because – without a defined contract with a state government or the Australian Energy Market Operator or a major retailer – revenues are difficult to predict.

That uncertainty makes getting finance from bankers more difficult, and more expensive. Which is why the Genex deal with Tesla has created so much interest, particularly from rival battery suppliers who suspect they may have to copy such deals, and from aspiring battery storage investors.

Some big battery storage projects are likely to get funding from programs like that of the Australian Renewable Energy Agency, particularly for trialling “grid forming” inverter capabilities, but most developers of Australia battery storage projects face considerable uncertainty over their revenue sources.

That underlines the significance of the Genex deal, and its revelation that it now expects a payback from the $55-60 million investment within a few years.

That prediction is underpinned by the structure of a revenue sharing agreement with Tesla, which will build the battery, using its Megapack technology, and operate it using its Autobidder bidding system.

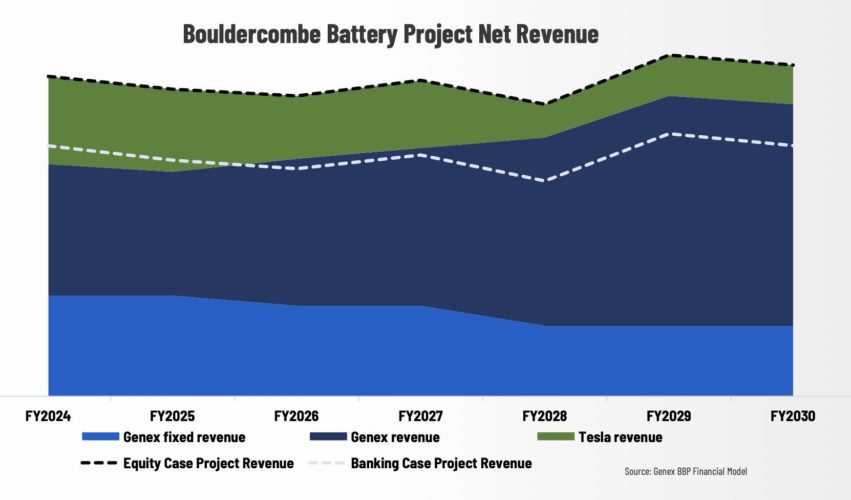

As this chart below shows, Tesla has guaranteed a minimum amount of revenue got Genex, declining over the eight year term of the contract (in light blue).

Any upside from merchant revenues will be shared but Genex (dark blue) and Tesla (green). The numbers from the graph have been removed, due to the confidential nature of the deal, but Genex revealed that it expects somewhere between $11 million and $15 million of revenue per year.

Chief financial officer Craig Francis noted that the original Tesla big battery at the Hornsdale Power Reserve in South Australia has assumed a payback of around 8-10 years, but delivered that within three to four years. “We’re looking to do the same thing,” he said.

The “base case” revenue (white dotted line in graph above) that is being presented to bankers assumes $11 million from “system normal” operations without unplanned outages or major price spikes. But Genex says the potential revenue of $15 million is based around the possibility of such contingency events.

“So we see quite a bit of upside of this project in excess of the bank locations,” Harding said.

“We know those events they do happen. They’re unpredictable as to when that will happen and the magnitude of those events, but what we’ve seen with the other batteries in the NEM is is that presents a really good opportunity to really enhance the payback for this type of technology.”

The black dotted line represents what Francis described as the “equity base” project revenue. “”What we see here is that both Genex and Tesla are really incentivized to maximise and get the most out of this … to deliver maximum profit to both.”

CEO James harding revealed that the Bouldercombe battery could easily be doubled in capacity – either through doubling the peak capacity from 50MW or, more likely, doubling the depth of storage from two hours to four hours, or to 200MWh.

Harding said Genex was already looking at a “number” of other big battery storage projects in Queensland, and in NSW.

“We know the market pretty well in Queensland and we see the potential there. So we are looking at a couple of other battery opportunities in Queensland and elsewhere around the NEM, and NSW hopefully.

“Within five years I’d expect another two or three batteries in our portfolio.”

Genex is also building its flagship pumped hydro project at Kidston in north Queensland, where it has begun construction of the 250MW/2000MWh facility.

It is also looking at a wind farm nearby of up to 200MW, and expects to make a final investment decision by the middle of the next year, and continuing feasibility studies into a 250MW solar addition at the same site.

It already operates the 50MW Kidston solar farm near the abandoned mine now being repurposed for pumped hydro storage, along with the 50MW Jemalong solar farm in NSW. See: Solar farms cash in on high prices, despite clouds sent in by La Nina