The gas-led recovery? Maybe it’s now time to lay this fossil-fuel marketing ploy to rest. The latest data from the Australian Energy Market Operator shows that electricity production from fossil gas plunged by more than half in June. And the long term outlook is not good.

The fossil gas industry has been the noisiest fossil fuel lobby group in the country these past few years, enabled by the Coalition’s brain-dead response to the Covid epidemic and now screaming blue murder at being banned from new homes in the ACT, and now Victoria.

The fossil gas industry had a brief moment in the spotlight last year, in the entirely confected “energy crisis” that sent prices soaring to the market cap and caused the wholesale electricity market to be suspended.

Australian consumers are still paying the cost of that market abuse through their soaring electricity bills, and in higher inflation across the economy.

Sanity, and more reasonable market forces, are now starting to prevail. The growth of rooftop solar in particular, and large scale wind and solar in general, are reducing the number of times that the fossil gas industry can abuse the market, and prices have fallen accordingly.

According to AEMO’s latest quarterly report, the month of June saw the lowest gas fired-generation since 2005 at an average of 1,347MW, a 1,440 MW reduction from June, 2022.

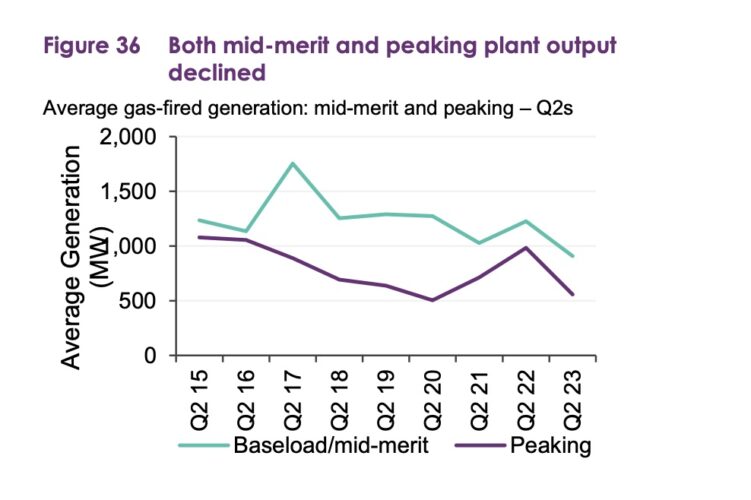

Over the whole quarter, gas-fired generation in the National Electricity Market averaged 1,469MW – a fall of 34 per cent compared to the same quarter last year, and the lowest average Q2 output since 2006.

According to AEMO, this is unequivocally good news. The high gas generation of the June quarter last year, it says, was the reason that wholesale prices were so high. Now that it has been sidelined – much less gas was offered for dispatch because it cannot compete with other cleaner fuels – prices have fallen.

Still, when given the opportunity, the gas generators do squeeze as much as they can from consumers: In just three hours of trading on one April morning, when network problems prevented imports and competition from Victoria, the gas generators pushed the price to the market cap.

One fifth of the increased wholesale prices in the state for that quarter came from that single three hour period when the fossil gas industry was able to run rampant.

The AEMO report notes that the amount of gas generation was down significantly for both peaking and “mid-merit” gas generators.

This comes as the share of renewables increases significantly, and the share of coal generation also falls. It was once assumed that gas would play a greater role in such scenarios, but South Australia proves this wrong.

As this graph below illustrates, the amount of gas generation in the South Australia grid has fallen significantly, even after the closure of the last coal fired generator in that state in 2016, and as the share of renewables has jumped to more than 70 per cent.

The share of gas generation is expected to decline further as the market rolls out more batteries with “grid forming inverters”, and completes a new connection to NSW – which will nearly eliminate the number of times that the market operator has to call on gas for “synchronous” services to the grid.

Over the much longer term, the outlook for fossil gas is similarly dim. Another important AEMO document released late last week, the Inputs, Assumptions and Scenarios report for the next iteration of its 30-year planning blueprint, suggests that the use of fossil gas will decline significantly.

“To achieve the emissions reductions targets outlined in the scenario narratives, fuel-switching away from fossil fuels is required over time in all sectors,” it notes.

“Natural gas can be substituted by electricity, as well as low or zero emissions molecular fuels such as hydrogen, biomethane or renewable LPG.” AEMO’s report is based on reaching 82 per cent renewables by 2030. A new scenario, Green Energy Exports, assumes a zero carbon grid as early as 2032.