Federal Labor has announced the biggest new capital allocation to the Clean Energy Finance Corporation since the launch of the green bank more than a decade ago, including $19 billion to help fund the new transmission and storage capacity so urgently needed to replace coal.

It is the first increase in the CEFC’s capital allocation since it was established in 2012 with $10 billion. In total, another $20.5 billion has been added to its coffers – divided between Rewiring the Nation investments, the Household Energy Upgrades Fund, and the Powering Australia Technology Fund.

The vast bulk of the new funding – $19 billion – will help underwrite transformation Australia’s energy grid infrastructure, including through huge and costly new electricity transmissions projects, long duration energy storage and distribution network infrastructure.

It comes amid yet more reports that the country is falling behind the 82 per cent renewable target for 2030 modelled by the Australian Energy Market Operator in its Integrated System Plan, and adopted by the federal government.

CEFC chief Ian Learmonth says the green bank expects to make “substantial grid-related investment decisions” within the coming year.

Learmonth told RenewEconomy projects identified as priorities in AEMO’s ISP would be a key focus for the green bank with the new funding.

“We have been in discussions with governments and investors on a range of [Rewiring the Nation] related projects for some time and hope to bring these to financial close drawing on this additional capital.

“While these transactions are often large and complex, we must move quickly to invest in the expansion and augmentation of our grid and related infrastructure to deliver on Australia’s net zero objectives,” Learmonth said.

The allocation of the new funds – cleared through an amendment to Treasury laws – comes as concern grows that Australia’s renewable energy transition is not moving fast enough to meet federal targets, despite a massive pipeline of projects waiting in the wings.

AEMO boss Daniel Westerman said on Tuesday that while the market is responding to the anticipated closure of coal fired power stations with investment in renewable energy, firming generation and storage, “this investment is not happening fast enough.”

“Bringing these new projects to market and connecting them into the grid urgently is critical to ensure consumers continue to have reliable power when they need it,” he told the Australian Energy Week conference in Melbourne.

The need for much more speed was also reflected in the latest EY Renewable Energy Country Attractiveness Index, published last week, which showed Australia losing ground in the global contest for green investment.

EY says – as do many other observers – that deployment rates of new wind and solar need to at least double for Australia to achieve its 2030 renewable energy target.

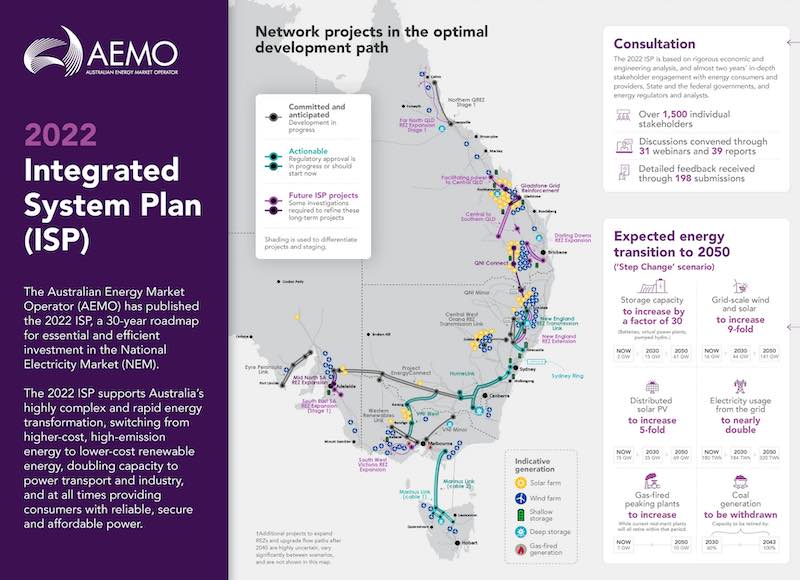

The enormity of Australia’s task is laid out in AEMO’s ISP, which forecasts the need for 10,000km of new transmission lines and nine times the large-scale renewable generation. Energy storage capacity is expected to need to increase by a factor of 30 by 2050 – and from 2GW today to 15GW by 2030.

On transmission, the ISP’s Optimal Development Pathway identifies five major projects as “immediately actionable” and which should progress as urgently as possible: HumeLink, VNI West, Marinus Link, Sydney Ring and New England REZ Transmission Link.

The cost of these five transmission projects alone was last year estimated by AEMO at $12.7 billion, which – as the market operator points out – represents just 7% of the total generation, storage and network investment in the NEM.

“We do not underestimate the scale of the challenge or the pace at which this transformation must occur, especially in light of the economic and supply chain headwinds impacting many sectors of our economy, including energy,” Learmonth said on Thursday.

“Our role is to help develop new and tailored investment models that will lift market momentum toward sustainable green investment opportunities, to deliver on the ISP.

“This considerable additional capital allocation will help accelerate these investments, alongside our ongoing work to drive down emissions across the economy.”

CEFC chair Steven Skala says the “most significant” new support from the federal government recognises the success of the green bank’s model in investing to lead the market and prove up investment opportunities.

“New large-scale investments in priority grid infrastructure projects complement our existing work in transforming our energy system and bringing the benefits of decarbonisation to key sectors of our economy,” Skala said.

The CEFC says it will provide further information on the investment approach for each of the three new investment priorities in due course.