The inability of NSW to get the new wind and solar built in a timely fashion is down to the dual issues of inefficient planning approval process and delays in the transmission build out. It is also down to insufficient planning and a lack of leadership that is hurting consumers.

Both these issues are solvable, but it’s really the planning process where NSW has performed most poorly, mishandling regional NSW at nearly every step: The process is not clear enough, not firm enough, and not responsive enough. It’s neither fish nor fowl, but simply stuck in a bog.

It seems to take 5 years to get a wind farm through the planning/EIS process. In my view the NSW Government is inexcusably culpable for this state of affairs. With all due respect to the vast majority of people that are secret NIMBYs, this is a case where the state interest must prevail.

At the same time, renewable developers and state energy institutions like EnergyCo need to learn how to obtain social license in regional NSW. You don’t get there by simply telling land owners what’s happening, you show up with senior people and treat them with respect.

The combination of the lack of new supply and the legislated fixed coal prices means that the coal industry has been able to bury its snouts in the trough of opportunity in NSW.

No-one can blame generator management for the fact that the State Government have indirectly handed them the keys to the Treasury by failing to ensure new supply and by fixing their costs at a level enabling them to laugh all the way to the shareholder meeting.

The single biggest thing the NSW Government can do to improve the lot of anxious consumers in NSW is to improve the planning process.

It’s well within its powers to do that and it just requires not only the political will but the nous to sell it. The legislation more or less already exists. Maybe a few seats need to be moved around in the planning Deparment as well.

Electricity prices are high and coal prices are fixed and low

When Governments interfere in markets, they usually stuff it up. They do so with the best intentions, but typically it’s as if they learned nothing at university, never read any history, and think that being in Government makes you smarter than anyone else. Or perhaps its just that political power goes to the head.

Governments are not the only one to suffer from the affliction that “prices” can be controlled. Farmers are just as bad with cooperatives, sugar cane allocations, wool mountains, or the common agricultural scheme in the EEC. In some cases it takes a long time for the stuff up to show up, in other cases it’s faster.

The only sure way to manipulate a market is to get a monopoly on production or even better an oligopoly like in iron ore. Maybe global oil production qualifies. Preferably an oligopoly where one party is weaker than the others. Even a monopoly sows the seeds of its own destruction but it can take a very long time.

The only way to long lasting success is to give the customer what they want. At least that is what I was taught in the hard, hard competitive school of investment banking.

At the moment we have a short term situation where coal prices for thermal generation in NSW are controlled, but only for 12 months. Victorian coal generators have their own coal where the costs rise steadily but predictably. In Queensland, it’s a mix of market sourced and export linked prices together with some mine mouth coal.

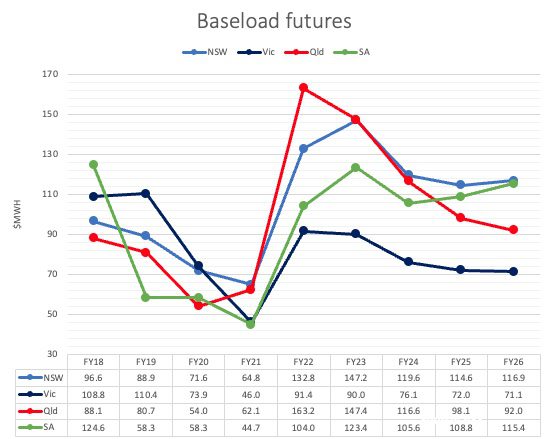

Baseload futures signal a strong outlook for generator profitability

In NSW and South Australia the market expects flatload prices to stay well over $100/MWh as far as December 2026. You can foreget all the do gooder nonsense about “renewable superpower”. Right now, the struggle is to get enough new production to get prices moving back towards underlying costs.

The price history suggests that the market is misjudging something in 2026. I will be surprised if the ex post difference between NSW and QLD prices is as large as the ex ante forecast. I’ll also be surprised if South Australia futures are over $100 in FY26, although the impact of the forthcoming NSW-SA interconnect if any in FY26 is hard to measure.

NSW coal generators are strongly incentivised to stay open

Why would you close a coal generator early if you don’t have to?

When you look at the table below bear in mind: (i) it’s based on spot prices and these only flow into received prices with a 1-3 year lag. (ii) They are likely an under estimate because volumes at Bayswater, Eraring and probably Vales Point/Mt Piper will have increased about 20% following the closure of Earing and (iii) only a couple of years ago these power plants were doing very badly.

Although the decision to close Eraring was announced in 2022, it was likely made in 2021 when electricity prices were low, the NSW Roadmap was announced and new supply of wind and solar was still hitting the market.

Around that time Frank Calabria, CEO of Origin noted that Eraring had significant fixed costs ~$200m (from memory).

As I’ve previously noted, the long term future of NSW’s coal generation was really decided back in the days of the previous ALP State Government when – acting on advice – a decision was made to cancel the Cobbora coal project.

This essentially took away the long term planned coal supply for Vales Point and Eraring. Vales Point found some security by buying out the Chain Valley coal mine ( a mine that has operated since 1960) and has a conveyor to the power station.

In 2022 Delta proposed, and I assume had accepted, an EIS proposal to keep Chain Valley open until 2029 (2 years longer than prior approval) and in the process it increased throughput to 2.8 mtpa of coal from 2.1 mt. Further approval would be required to operate beyond 2029.

In NSW thermal coal generators benefit from an A$125/t (delivered to the power station) for 5500 kcal (23 gj/t) coal. The export price at port of Newcastle in May was around A$142/t and in China the price at port is about A$165/t.

Discussion

NSW coal generators know they are in what is no doubt humorously referred to as “sunset mode”. They are not going to compete that hard for volume as the opportunity to do so is limited by coal access and they are are just going to wait to be forced out of the market by one event or another.

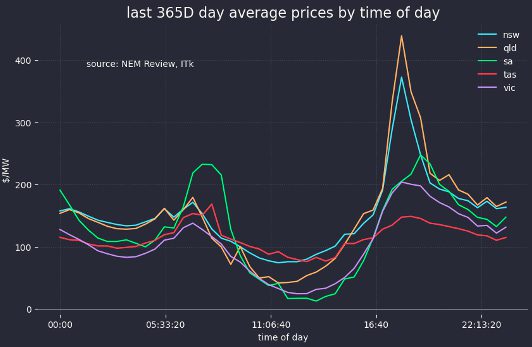

Right now, it’s like perpetual Xmas. Prices are high as far as the eye can see. Transmission access from Queensland and Victoria is limited at peak pricing times, indeed QLD can be short on power at dinner time.

Solar competition in the middle of the day is an issue but NSW coal generators are some of the best in the world at ramping up and down.

Looking a bit further forward, eventually CS Energy – despite a recent poor track record – will get Callide C going again.

There will be significant new wind projects coming on line in QLD and this may enable QLD to export more to NSW at peak pricing times, possibly requiring NSW coal generators to sharpen their evening pricing pencil.

There will continue to be growth in NSW rooftop solar and there will be some new batteries that may impact peak pricing.

More transmission to Victoria and South Australia will also assist but against that Yallourn’s closure gets ever closer. You can see the ability of battery competition, and it has to be competition to be effective, to cut peak and average prices from the following graph.

Midday prices would rise due to storage charging but the reduction in evening peak prices will be a much stronger impact.

Equally, the storage could take advantage of cheap solar driving imports from qld in the middle of the which currently are effectively re exported to Victoria and then there would be less need for imports when QLD is short at evening peak.

What there won’t be is much new utility wind and solar.

NSW has missed a big opportunity

NSW energy minister Penny Sharpe has an easy opportunity to make a mark in her critical portfolio and put one up on Matt Kean by declaring NSW REZs as critical state significant infrastructure.

With a bit of care, appropriate flora and fauna studies and the appropriate visual and noise studies in regard to wind and solar projects could be managed in a far more efficient manner.

Pumped hydro would need to be carved out or handled by exception but the bulk energy, including arguably the transmission within an REZ, could be approved in a more timely fashion.

To my way of thinking this would be a far more forward way of thinking than paying Eraring still more money to stay open. Money as I’ve shown above the coal generators most definitely don’t need. In fact they need more sticks not carrots.

Most wind and solar projects are State Significant Developments [SSD] and have normal EIS standards. The alternative is State Significant Infrastructure [SSI].

In a nutshell SSD projects are subject to third party merit appeals. By contrast SSI are projects that primarily involve the delivery of infrastructure that is permitted without development consent under Part 4 of the Environmental Assessment Act.

There are no merits appeals against SSI decisions although there is still a judicial review opportunity. My very limited understanding is that the standard in a judicial review is simply put a lot higher. If an entire REZ was declared SSI then potential planning approvals for individual projects could be done in say 12 months.

In deciding whether infrastructure is State significant the Minister may consider whether:

“the infrastructure delivers major public benefits such as large-scale essential transport, utility infrastructure or social services to the community …..

….. the infrastructure would assist in implementation of State plans, strategies and policy frameworks (e.g. State Infrastructure Strategy; Future Transport Strategy 2056, NSW Renewable Energy Action Plan; NSW Climate Change Policy Framework ….“

It seems to a humble analyst like me that replacing NSW coal generation with new supply, keeping the lights on etc is about as clear a case of State Significant Infrastructure as there has ever been.

The more I read about this, the stranger it seems that the original legislation around the NSW Roadmap didn’t include specific mention that the REZs would be SSI. But it’s not too late.

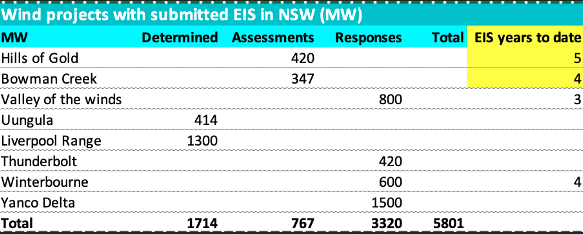

Environmental approval for a wind farm likely to take 5 years in NSW!

The years in environmental/EIS process shown below include the project scoping as well as the full EIS approval.

5 years! How incredibly poor is that!

This contrasts with the situation at the moment where despite plenty of Departmental experience at approving wind and solar farms the planning process in NSW is regarded as poor by developers when compared with the experience in Qld or incredibly Victoria.

In my entire 40 year career its always been the case that the worst place (from a time and cost overrun perspective) to develop infrastructure is Victoria and the best place is Queensland. To find that Victoria is presently regarded as a better prospect than NSW for wind and solar development is astonishing.

Repeating from June that only 2 NSW wind farm projects have been “determined” under the NSW planning process. 2 projects! And one of those has been approved since 2018 but is now going through a revision.

Looking at those projects, Bowmans Creek did two years of studies prior to submitting its EIS in early 2021. Now in mid 2023 Ark Energy is still responding to submissions. So the EIS process is on track for 4 years. How absurd is that?

The Hills of Gold wind farm started its form preliminary Environmental Assessment to the Department in November, 2018. The actual EIS was submitted in November 2020. Here we are in mid 2023 and the EIS is still not approved. How absurd is that?

The Valley of the Winds project submitted its scoping report in May 2020 and the EIS has now reached the public consultation stage. Based on other wind farm progress what seems to me like a project that could make a big difference at 800 MW will be stuck in the EIS process for another 2 years.

It is absurd.