Note: This is the second of a two part commentary series published today. See also: The super fund giant and advisory firm blocking Australia’s renewable energy transition

There is no reason that Origin Energy couldn’t do what Canadian funds giant Brookfield is proposing to do, and invest heavily in the renewable energy transition in Australia.

I show below that the existing assets could support more than Brookfield proposes, although in the process Origin would take on up to $16 billion of debt and all the APLNG and other dividends would need to be reinvested.

An advantage to Australian investors is that, with care, the franking credit value could be retained and the company stay listed.

In saying that I am conscious the last time investors rejected a bid the bid price was $15 and in rejecting the bid shareholders and management at the time suffered grievously. Careers were ruined, value destroyed. That probably won’t happen this time.

If I thought Origin was actually going to commit to doing the job Brookfield proposes, there would be no need for the consortium bid.

But the difference between Brookfield and Origin, to date, is that Brookfield has staked its reputation in saying it is going to build 12GW of renewables, whereas Origin has half-developed plans, to build 4GW and that 4GW is more of a concept than a commitment.

Based on previous history, not just of Origin but also other gentailers, it’s hard to believe Origin is really committed.

Origin management have shown lots of calculated boldness under the stewardship of the current CEO. The acquisition of 20% of Octopus was a really brave decision, selling down 10% of APLNG and selling the domestic gas production businesses were equally bold. The decision to close Eraring was another strong positive step.

So you have to ask why that same management has been so timid – even hopeless – in regard to building replacement capacity. I’ve written several times how embarrassing it must be to have done so little wind and solar development and to have so few sites to develop, even in the shadows of Eraring closing.

In my position as a spectator, I have long thought that a large gentailer that could proudly and convincingly call itself “100% green” would command a premium with investors and customers alike.

For Origin that is easy enough to achieve, by selling APLNG and converting all its electricity purchases and production to renewables.

In this note I sketch out a scenario and the relative ease of financing it. What I don’t cover is the gas retailing business. But personally I would sell that as well. I know that selling it doesn’t take the gas off the table but it takes it off Origin’s table and would make the customer care system that much simpler.

The gas generation can sit there and, rather than doing more and more as management and the market believes, it will in fact do less and less. But we can wait to see that hypothesis proved. In my view, batteries are going to kill gas generation for the most part.

The current bid will likely fail

The odds are that the current takeover bid for Origin will fail. That’s because of the 75% threshold of success and the opposition of Aussie Super.

EIG have said that it’s likely an off-market offer may be made if the current bid fails.

“Brookfield and EIG have advised that they could come back with an off- market bid for Origin if the agreed deal with the board is voted down.

Mr Thomas said the market was largely misunderstanding the way that both the existing deal and a renewed takeover approach would be structured. He said that it would be EIG – not Brookfield – that would lead the move to buy Origin, but with a pre-sale arrangement in place to sell Origin’s energy markets business to Brookfield. “ Source AFR Nov 6

Origin could do it, but it requires willpower and belief

Be that as it may, I was interested to see how Origin could build enough renewable energy to supply its current total load of 36TWh, noting that Eraring’s output is about 14TWh. That 36TWh will grow but more of it will be to the business market and less to the household sector.

Let’s set a 2035 target of 45TWh.

At the outset I start with the proposition that the customers want decarbonised electricity or, put another way; if Origin didn’t have any coal or gas generation sourced electricity in its supply it would have a differentiated product that customers would have a preference for.

It may be that Origin won’t be able to use the label “100% green” because of its historic investment in gas generation. But if well marketed and well produced, the gas generation can gradually be eliminated.

Typically, also we know that efficient variable renewable energy (VRE) production, given current technology costs, has roughly 70% wind and 30% solar, and that some energy can be bought from the behind the meter market for low cost but equally only on a spot basis.

So we model Origin to require 45TWh of renewables by 2035. Based on the table below I estimate that requires about 10GW of wind and 5GW of utility solar, would produce ebitda of perhaps $2.6 billion, require $25 billion of capital divided between $9 billion of equity and $16 billion of debt.

This kind of task is within Origin’s capabilities. After all, it owned 37.5% of APLNG a well north of $20 billion project and managed the upstream development without any real issues.

If you think about it, CSG production in Queensland is certainly the greatest Australian achievement to date of electrification of an industrial process and one of the best examples in the world.

It went off basically without a hitch and by and large has lived up to its low maintenance promise. Arguably it was in some ways more technically innovated, because CSG hadn’t been done in Australia before, than building onshore wind and solar is today. The latter is now a proven technology more than ready for prime time.

Basically, what is required and has so far been utterly missing is will power. It was will power that made CSG development in Queensland happen. The consortia doing the Curtis Island developments all believed in it, they believed they were racing against one another and wanted to be the best.

They overcame all the social license obstacles including the overreach of environmental claims and got the job done.

Has there been a massive water table contamination? I say no. I am sure some folk will say yes, it’s just being covered up, but I am not aware of much evidence.

This does not mean I support gas, because the burning of gas and fugitive emissions are massive issues, but the wells themselves are not. Or at least that is my view.

Execution

So for Origin to achieve 41TWh of utility VRE production by 2035 it has to manage the following hurdles:

– Getting the sites.

– Financing the capex.

– Getting the people skills.

Sites

Again, looking at CSG, Origin was once quite good at getting resources. It developed easily the best CSG reserves and at relatively attractive prices. Even Stockyard Hill has eventually turned out to be a reasonable asset.

But if there is one thing we learned from the Grant Samuel report it’s that Origin has made a truly lamentable effort at finding sites. I could not believe how poorly management has prepared for the company’s future. I’d be firing senior management responsible for that lack of achievement. Such a letdown given the company’s history.

Given there is actually a race on and assuming that the belated “me too” offshore wind thing is the wrong path, the easiest way to get some sites is to buy or partner with a company that does have some.

An immediate list is Neoen’s Australian business, Iberdrola which seems entirely uncommitted to its Australian investment, or if you want to partner with a junior burger in the space, Andrew Forrest. But there are probably others, after all in the background there is a fair bit of site development going on.

Finance

There are three basic finances I can think of that can be used either individually or in combination to find $9 billion of equity:

- Cash flow from or sale of interest in APLNG (or even Octopus)

- Cutting the dividnend

- An external partner a la AGL and Tilt.

We already know from the bid that Origin’s stake in APLNG is worth about $7.5 billion. We also know there is a willing buyer in EIG. Job done.

However in the alternative to a sale, and the sale is by far the best solution because it sets ORG’s course firmly down decarbonisation route 1.

In the alternative APLNG cash flow to Origin can be used. I personally don’t like Origin hanging onto APLNG, not just because it leaves Origin as a gas company but also because, as APLNG uses up its reserves, equity investors will become less and less enamoured of the company that owns it.

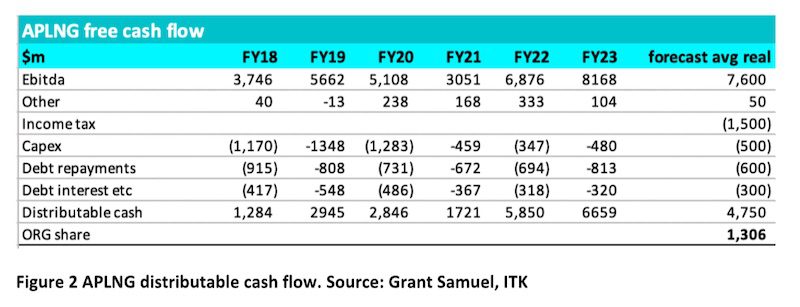

Nevertheless the following table adapted from Grant Samuel shows the historic free cash flow. Looking forward, the first thing is that the tax losses incurred in the first couple of years will soon be used up and APLNG will move into tax paying mode.

APLNG reports an income tax expense of say $1500 million per year and in future that will be paid most years and result in more franking credits.

Secondly APLNG has around $6 billion of debt that is being paid down at about $0.6-$0.8 billion per year, let’s call it $0.7 billion and so repaid in about nine years. I’d expect a refinancing of APLNG such that it continued to carry some debt for say 20 years.

Grant Samuel models APLNG production continuing until 2064 but annual production only stays at the current 600-700 PJ per year rate until 2032, less than 10 years away, and then moves down into run off mode.

Grant Samuel does not model capex or opex to increase on a per unit of production basis, but they observe – and I completely concur – that there is every chance that as the lower quality resources are produced costs will rise.

That is the fate of nearly all mines, they eventually become uneconomic even though some resource remains. Modern approaches may mix in lower quality with higher quality resource over the life of the project but personally I still prefer the early years.

Boiling all that down Origin could expect to be getting between $1 billion and $1.5 billion of after tax dividends per year for the next 10 years from APLNG. That’s enough to finance the equity component of a large renewable build.

People skills

Personally I don’t think any of the gentailers presently have the people to do large-scale wind and solar development. It’s not necessarily the skill set, although there is no recent experience of development. Rather, it’s the culture and mind set. The world is built by committed people. But I’ve said enough about that already.