Note: This is the first of a two part commentary series published today. See also: Origin: Can the gentailer commit to 100% green when the Brookfield bid fails?

Australian Super will always be able to hide behind its view of value in any individual deal. As a fund with $300 billion of assets and $60 billion, give or take, in Australian Equities it’s earned the right to take whatever view it chooses.

However, it’s not obvious to me how reasonable it is to see Origin Energy as being worth significantly more than other analysts, 35% more valuable than the current share price implies and significantly more valuable than the independent expert considers.

I talk about the value later, but here I note that Aussie Super may well value the franking credits that are excluded by MacBank and Grant Samuel.

Nevertheless, the messaging by Aussie Super seems clear. By aligning itself with Frontier Economics, Aussie Super is more or less is signalling that fundamental value is less important than just stopping Brookfield and EIG succeeding by any means. Frontier Economics have made it totally clear they are opposed to the bid succeeding.

At first the front man of Frontier, Danny Price, wrote an article in the AFR complaining that Brookfield’s bid was in his view unacceptable because of Brookfield’s ownership of Ausnet, a Victorian distributor.

As usual, Price made some clever points that look good on paper but, in my view, were pretty much entirely beside the point in the real world.

Somewhat surprisingly, given Frontier Economics’ opposition to the bid, the ACCC then asked Frontier to provide an “Independent Expert” report, essentially asking whether having a retail client base was an advantage to a renewable energy developer.

Unsurprisingly, to me, Frontier’s position was that having a retail client base was not helpful because there was plenty of renewable energy policy and the only thing slowing down the implementation policy was a lack of transmission access.

My own view is quite different. I believe the large gentailers don’t have the balance sheets or the skill sets or the sites to develop the required amount of renewable energy and have been quite happy to see prices rise as they milk cash from the last years out of their coal fired stations.

Or, to put it another way, I believe that management determined to make a difference will make a difference.

Brookfield has committed to building bulk wind and solar and will finance it from what would previously have been the cash flow used for Origin dividends. Or the dividends may be paid for franking credit purposes, if there is any tax, and the money reinvested by the owners into development.

For me, my position is clear: I support entities and management groups that intelligently pursue decarbonisation at all possible pace. That is essentially my sole interest in this transaction. I have a view that a large 100% renewable gentailer will do better than competitors using fossil fuels.

In any event, any large gentailer that commits to large and quick renewable development gets my support.

It makes little difference to my life, but a massive difference to my grand kids and their kids. In a sense, energy decarbonisation is the issue that shaped my entire previous career starting as an idealistic hippy and very junior academic.

Then followed 33 years sharpening my capabilities in the very competitive world of investment banking research, where sorting facts from fiction and working out which facts matter is the essential skill – and since then developing a deeper knowledge of the electricity market and the requisite python skills to analyse large data sets.

When you read the climate science and make all due allowance for future uncertainty and adaptation there just cannot be any reasonable debate that the world needs to decarbonise as quickly as possible.

As such, I was entirely confident that the Frontier Economics expert witness report came to the wrong conclusion.

Fortunately, in my view, this was more or less the view the ACCC adopted.

The Brookfield takeover is, in my opinion, what the Government would prefer to happen. It’s in the country’s best interests. The government wants a big business that will help it achieve its aims, instead of gentailers effectively doing as little as they can get away with.

In my view, Brookfield’s success would lead to Origin getting further ahead of AGL and EnergyAustralia, because Origin will end up with a decarbonised electricity supply which is fundamentally lower cost than coal and gas supply.

Not only lower cost but, once built, its cost base is more or less fixed and not subject to the vagaries of international coal and gas prices.

Origin will also move ahead because it is giving customers what they clearly want. The market recognised this. Grant Samuel noted.

“On the other hand, renewable energy focused gentailers are trading at much higher multiples than peers that have a material exposure to thermal generation.”

Remember that the main reason there is a positive REC price is because customers are buying renewable energy and then giving away the certificates. This is probably something that Frontier and Aussie Super wouldn’t understand.

Aussie Super then formed a view that the consortium bid was too low. Aussie Super was not the only fund to form such a view and the Consortium responded with a higher bid.

However, that was still not enough for Aussie Super, who had received advice from none other than declared bid opponent Frontier Economics that Origin was worth more than the bid. Frontier reportedly said that the assumptions used by Grant Samuel in its expert opinion were too conservative.

My point is that Aussie Super must have picked Frontier knowing that Frontier would support Aussie Super’s opposition to the bid. Aussie Super didn’t want an unbiased opinion, it wanted an opinion to support its pre- determined position.

About the only other thing Aussie Super could have done, in my opinion, to make its opposition look more naked and to point out it was opposed to even a fair bid would have been to ask Brian Fisher of BAE economics to second Frontier Economics’ views.

After saying that I could listen to an argument that Grant Samuel’s long-term oil price is too low or the gas price. However, the gas price assumption is in line with industry and investment bank thinking, in my opinion, and the oil price is only relevant to JCC LNG prices and becoming less so as competition with USA LNG becomes the price setter.

Valuation commentary

There are two issues that Origin Energy investors might consider when deciding whether to accept the Board recommended takeover proposal from EIG and Brookfield.

The first is whether the offer is a good one, and the second is what will happen if the bid fails. I don’t comment here on what will happen if the offer fails. The current share price indicates a likelihood of the bid failing. EIG has said a lower off market offer may transpire.

If it doesn’t Origin will have to take its woeful list of renewable projects and try and learn how to do development. Alternatively it could buy a developer. One might ask for instance why Iberadola is in Australia. It has done next to nothing since it’s been here. In any event, this note focuses on whether the offer is fair.

Shareholders other than Aussie Super value Origin at $8.50 as seen by the share price. That is about 35% less than the reported midpoint of Aussie Super’s $12-$14 range and below the bid. So the first consequence of Aussie Super’s decision is that everyone loses say $1 per share. (bid price – share price)

Is the bid a good one?

In my opinion, few people really have the skills and the information required to form an accurate view of the Origin bid.

I can observe that Grant Samuel, in contrast to Aussie Super and Frontier Economics, had access to internal non-public information and to presentations on that information from Origin management in forming their opinion.

What does Aussie Super know that the Origin Board doesn’t? I’d also observe that the Grant Samuel report was thorough. A considerable amount of comparable transaction evidence and comment was provided.

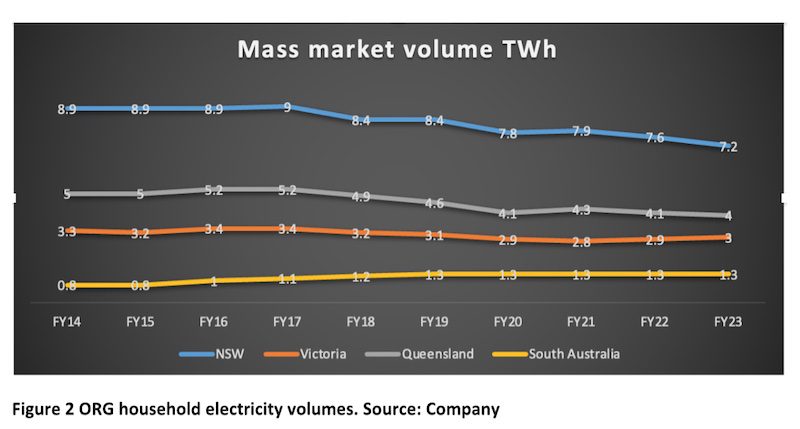

I have already observed that Origin’s traditional household retailing model almost certainly faces volumes that will on average decline over the next 10-20 years.

Electricity volumes will decline because of the ongowing growth of rooftop solar and household gas volumes will decline because (1) Governments are increasingly restricting new residential gas connections, that is happening formally in Victoria and the ACT, and; (2) the economics of replacing gas with electricity in the house are good.

This, then, requires Origin to put together new business models, as previously discussed here at RenewEconomy. The declining household electricity volumes supplied by utilities are an AEMO forecast not even mentioned by Grant Samuel.

Also worth noting is that Origin does not have control other than perhaps negative control (that is a veto of sorts) either at APLNG or at Octopus. In my opinion this reduces the value of those investments at least relative to the case where a control premium is applicable. In mitigation it is a large investor in both assets

Equally there is clearly a willing buyer for Origin’s stake in APLNG in the form of EIG, but maybe not many others, and it’s likely there are willing buyers in Octopus, but getting confidence in a future cash flow valuation of Octopus – given the lack of history, the rapid growth, the heavy reliance on future forecasts – is quite problematic.

A textbook valuation is based on the estimated discounted cash flows (DCF). Variations on this include a dividend discount model or an Internal Rate of Return.

In a conglomerate (multi-business company) another approach is “sum of the parts” – a methodology I have often employed myself and broadly appropriate to Origin.

In regard to the “parts” Grant Samuel made the following summary comments:

Energy Markets (44% of Origin’s proportionate business operations value) is a mature business that requires significant investment to transition its generation assets (primarily Eraring) to a future-facing portfolio of battery, renewable and flexible generation projects;

Octopus Energy (12% of Origin’s proportionate business operations value) has a fundamentally different growth outlook from the rest of Origin’s business operations that is complemented by the scalable nature of its Kraken technology platform; and

APLNG (44% of Origin’s proportionate business operations value) is a mature producing asset witha finite operating life (i.e. no terminal value) but has a track record of stable production output albeit with a large exposure to volatile LNG prices.

I agree with all of those comments. Particularly in regard to APLNG. APLNG’s reserves are declining and hence its value is declining.

Sure it will run for another 20 years, perhaps 25, and that is a long time. Eventually APLNG will have a negative value because of its abandonment costs. That is the costs of cleaning up Curtis Island and remediation all the coal seam gas wells.

Despite the fact that closure is 20 years down the track APLNG already carries over $1.5 billion of remediation provisions on its balance sheet. The implied undiscounted value of remediation for 100% of APLNG is over $4 billion.

On the more positive side for APLNG, and subject to trade practices concerns, it’s easy to imagine that in the fullness of time only two of the three plants on Curtis Island will operate and that APLNG’s business could merge either with GLNG or QCLNG. Such a merger would save a bunch of costs.

Origin’s energy markets business is both mature and at risk

Overall Origin’s household electricity volumes have declined by 13% since 2014, with losses every year in the largest market NSW and most years in the second largest market Queensland, partly offset by small gains in Victoria.

I don’t show volumes per customer, but it’s likely these would show larger declines. There are lots of factors besides behind-the-meter solar driving these household volumes, but its a perpetual headwind.

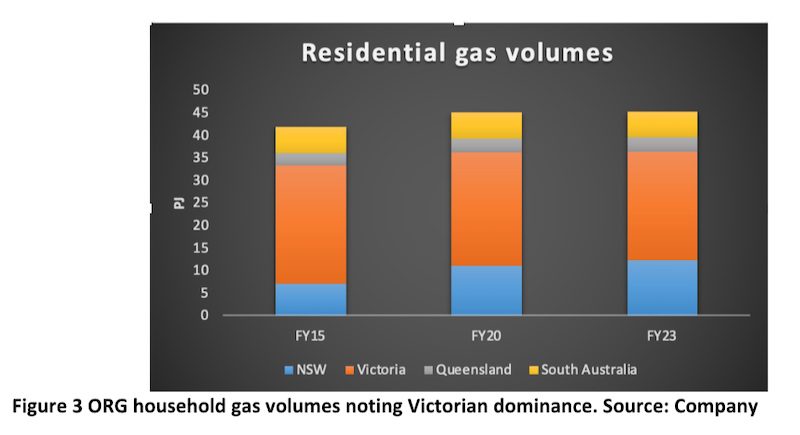

Origin’s household gas volumes have grown since 2015, but that growth stopped around 2020. What would worry me is that over 50% of ORG’s household gas volumes are in Victoria, a state where household use of gas is now being discouraged quite strongly.

Leaving aside volumes, and also, for the moment putting to one side any value associated with keeping Eraring open, the main assumptions driving value perceptions of Origin’s energy markets business are:

- Whether a forecast reduction of $200 million (40%) of energy markets costs can be achieved.

- The finite value of a very favourable legacy gas purchase contract Origin has with APLNG. Macquarie Bank Equity Research valued this contract at over $1 billIon. This contract runs until 2034. On the supply side Origin has very large sales contracts to Rio’s alumina refineries in Queensland. I have written previously about electrifying those refineries and how wonderful it could be.

- The underlying electricity gross margin that Origin will achieve, post Eraring closure.

- The extent to which gas profits can be undercut by batteries. It’s this last point where I am most likely to differ from other analysts because I say that, once built, batteries can easily undercut gas. Many other analysts, and indeed consensus, has gas generation setting the price more or less into perpetuity.

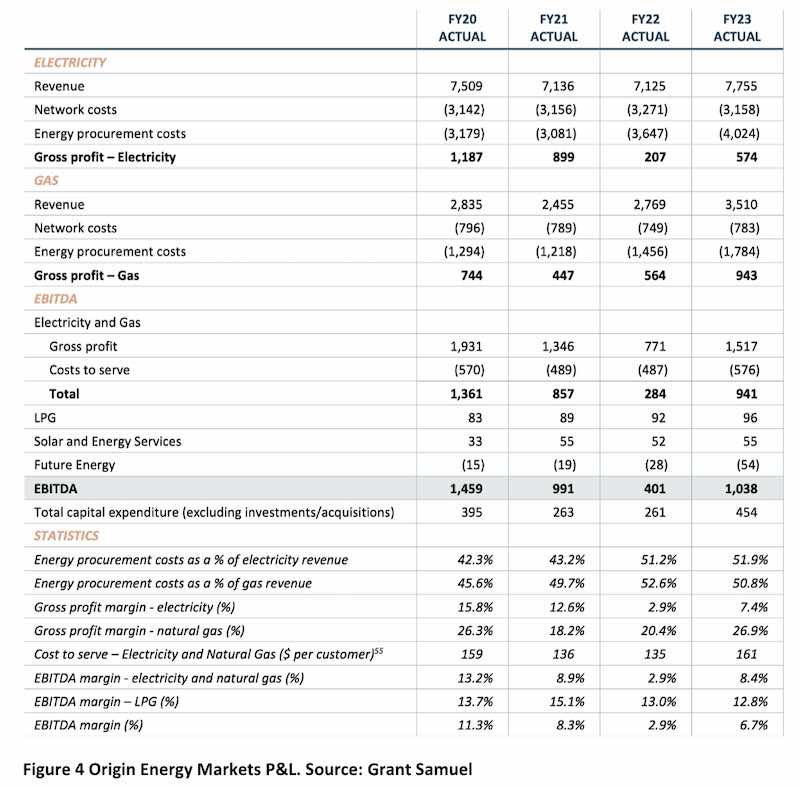

These points can be considered in the context of the Energy Markets profit and loss account:

Note the size of the gas profits. These depend on the aforementioned “back book” gas contract and will very likely decline significantly post 2034.

The table shows that Origin’s total cost to serve was $576 million in 2023 with a low number of $487 million in FY22. Bad debts are part of the cost increase. Grant Samuel assumes in its valuation, following company management advice no doubt, that cost savings of over $200 million will be achieved by FY25.

The majority of the EBITDA margin improvement is achieved by FY25 due to the successful execution of the cash cost saving initiatives ($200-250 million in total cost outs by FY25).

In my experience, it’s very unusual and very, very aggressive for a company to forecast a cost saving of $200 million or more on a cost base of $500 million. They may achieve that and likely will have the Octopus cost to serve in the UK as the example and yet it still seems at this distance to be a stretch.

Eraring staying open is an admission of defeat

In my opinion, while there is some near term value in Eraring staying open for a year or two, all it does is dig a deeper hole for Origin, just as it has for AGL and EnergyAustralia.

The value depends on being able to charge a flat load price of say $100/MWh even though the pressure on spring coal generation spot prices grows every year.

Queensland will be pushing much more energy into NSW in about 12 months time. Some forecasters have Eraring running to 2032 and earning $400 million a year (over $1 per share of value).

Personally and professionally I can’t see it at all. Maybe three years of those earnings, but after that there will be heaps of renewables eating away at volumes and revenue. Any fund manager betting on Eraring getting good profits right out to 2032 just doesn’t know what’s actually happening.

Every year the company fails to commit to replacing its coal generation with wind and solar is another year of living with an illusion. Origin appears to have done next to nothing since its Eraring closure announcemen to develop a replacement portfolio.

PPAs are equivalent to leases and might be capitalised as debt

Should the bid not succeed there will be heaps of attention paid to the capital requirements Origin will need to make to replace Eraring.

The standard answer, and you will get it from AGL and EnergyAustralia as well, is that there is no need for capital, no need to build or own assets, simply buy the energy from some other developer.

However, in my view ,signing a long term PPA, speaking as an accountant, is pretty much the same as putting debt on your balance sheet.

For a say 400MW wind farm, signing a 15 year PPA at say $70/MWh is equivalent to committing to buy say $85 million of electricity per year, or $1,287 million in total over 15 years.

The Present Value (PV) of that commitment at 8% is about $730 million. That is, you have taken on $730 million of debt in committing to buy that electricity. Origin needs about 10 of those projects to replace Eraring. That’s if there were 10 wind PPAs of 400 MW each available in NSW.

Valuing Octopus as a retailing business with a 4-5% margins is reasonable

Profit margins of 4% to 5% (ebitda) for a utility with a large retail customer base is entirely reasonable and is the sort of assumption that has been made by regulators when electricity tariffs are regulated.

On that basis all you have to know to do a valuation is the forecast sales and then you multiply by the ebita margin and divide by the WACC to get the valuation.

If you are feeling fancy you can express that as a value per customer, although the reality as I have previously said is it’s not a per customer valuation. You can only get that margin if you have enough customers to achieve scale, typically in my opinion, in Australia, that’s at least 250,000 with an ability to supply gas as well as electricity. Really I’d prefer 1 million customers to have valuation confidence.

In Australia, for instance, if a household has a bill of $2000 per year, 5% is $100 and WACC is say 8% to give a value per customer of $1250. What I personally don’t think you can do is take that customer valuation and then add on extra bits for trading capabilities, etc, although that is what Macquarie bank equity research did.

Origin’s non-household electricity business is as large in volume terms as its household business. As I previously wrote there are few comparatives and I have mostly resorted to looking at ERM’s results before it was taken over. These suggest historic margins of $4/MWh.

An example of a recent sum of the parts for Origin was by Macquarie Bank Equity Research where I have a lot of respect for the utilities analyst, a former competitor. This valuation was reported in AFR on September 13.

Declaration of interest

I have provided some minor paid advice to Allens regarding a response to Matt Harris of Frontier Economics witness statement provided to the ACCC. Other than that my interest is unpaid and solely in supporting whichever parties I think will make a good fist of decarbonising the electricity grid. Presently, that’s a fairly short list but it doesn’t include Aussie Super.

My own credentials to comment on ORG valuation and business model

My qualifications, such as they are, to comment on Origin’s valuation assumption are that I covered Origin professionally as an analyst at JP Morgan and UBS from the time when its original business unit (SAGASCO) was part of Boral, through to early 2016. This included numerous visits to Origin facilities, including APLNG and many management, at the time, presentations.

Since at least 2012 I wrote several articles or provided commentary to fund managers stating that a utility and an LNG business would be better separated as they were assets of a different risk class and investors who want a utility.

In a somewhat similar vein I wrote a report commissioned by Lock the Gate observing that Origin would likely be better placed by getting out of Northern Territory gas exploration and selling its LNG business. Within the next 12 months, as if by chance, Origin ceased its Beetaloo investment and sold down part of its interest in APLNG.

Origin has changed its asset profile significantly since I ceased formal coverage – and on top of that, I do not have the benefit of competing with other investment banking analysts in the Origin “buy or sell” space. That competition, as in other activities keeps you match fit and provides opportunities to see how equity and debt market participants are pricing Origin at the margin.

Perhaps the main point from all that experience is knowing how likely it is that there will be an error either accidental or of bias in the valuation and, consequently, how likely it is that wrong conclusions will be drawn.