A new report has found that the often-touted financial losses from climate action would mostly affect the very wealthy, with minimal impacts on the average person’s retirement or savings – challenging the commonly-held view that the world’s poorest people will pay a hefty cost for the climate transition.

The report, published today in Joule, found that in high-income countries, most financial losses associated with climate mitigation and the energy transition would be borne by the most affluent individuals, for whom the loss would make up a small percentage of their overall wealth.

Lead author Lucas Chancel, a professor in economics at Sciences Po in Paris, first began the research after reading a paper that estimated the total amount of “stranded” assets if ambitious climate policy drove a rapid decline in fossil fuel use.

Chancel partnered with the author of that paper, University of Massachusetts Amherst economics professor Gregor Semieniuk, to estimate the wealth distribution of the people who owned those assets.

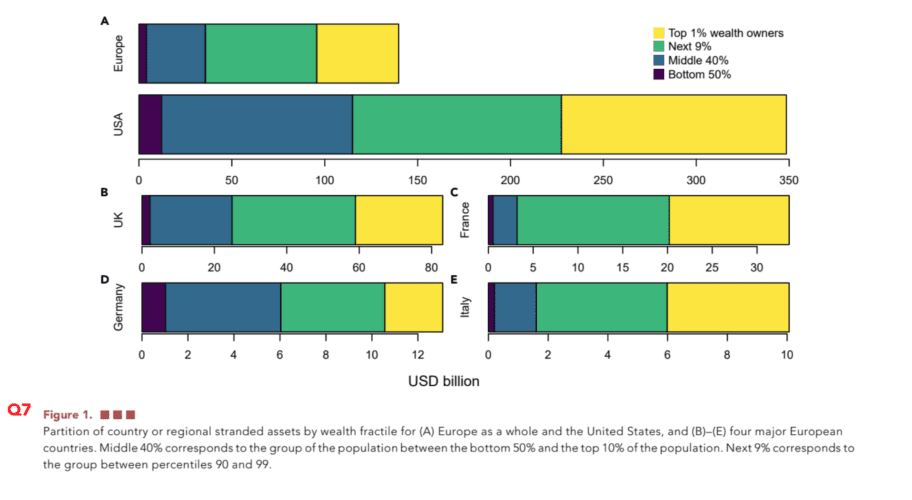

Their results found that, in the United States, two-thirds of the financial losses from stranded fossil fuel assets would affect the top 10 per cent of wealth holders, with half of that affecting the top 1 per cent.

Because the 1 per cent tends to have a diverse portfolio of investments, any losses from fossil fuel assets would make up less than 1 per cent of that group’s net wealth.

When the researchers repeated this analysis for the United Kingdom and continental European countries, they found similar results.

“There’s this big question of who’s winning and who is losing from the transition and from climate change in general,” says Chancel.

“Even though our results are simple, they were not present in research or public debates before.

“This work is one step forward in understanding the winners and losers from the point of view of the assets that might be at risk in this transition.”

In contrast, 3.5% of the estimated financial losses would affect the poorest half of Americans. While asset losses make up a larger proportion of wealth for this group, poorer people overall have significantly lower net wealth: the researchers estimate those losses could be compensated for an estimated $9 billion in Europe and $12 billion in the US.

The authors detail three different avenues for drumming up those funds, including a carbon emissions tax, renegotiating liabilities to energy companies, and a tax on the wealthiest individuals.

“There’s this idea that it’s the general populace that should be opposed to climate policy that creates stranded assets because their pensions are at risk or their retirement savings or just their savings,” says Semieniuk.

“It’s not untrue that some wealth is at risk, but in affluent countries, it’s not a reason for government inaction because it would be so cheap for governments to compensate that.”