If it wasn’t already (it was), the writing is now on the wall for coal-fired electricity generation in Australia.

Queensland last month and then Victoria just this week have all but assured that both of those states will end their reliance on coal power by the mid 2030s. NSW is planning for the exit of all its coal generators and W.A. will shut down the last state owned coal plant by 2028.

The Australian Energy Market Operator’s latest Integrated System Plan assumes brown coal will leave the national grid by 2032. If it adopts the so-called hydrogen superpower scenario next time round, as many expect, that will confirm that all coal could be gone in little more than a decade.

And a series of announcements on big new renewble energy plans and accelerated coal plant closures by Australia’s major gen-tailers has shown it’s not just policy setting the tone.

But for those who did not see the writing on the wall, a good chart can speak a thousand words.

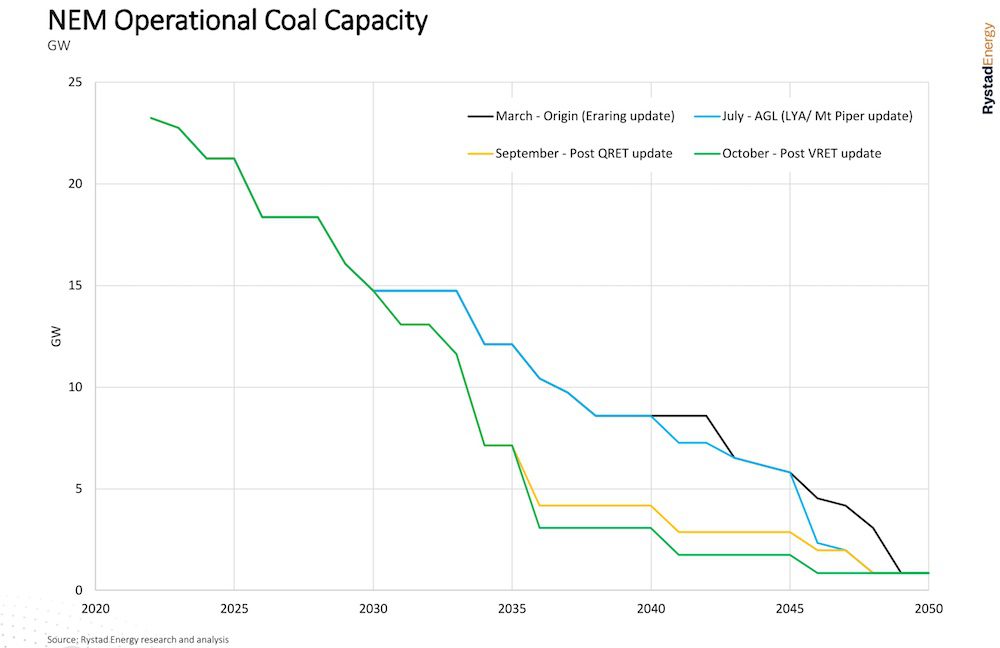

The above chart comes from Rystad Energy lead renewable energy market analyst, David Dixon.

“One of the big themes for 2022 is the accelerated exit of coal power from the National Electricity market,” says Dixon in a LinkedIn post accompanying the chart.

“By 2036 only 13% (3.1GW) of the NEM’s operational coal capacity will remain, this is down from 45% (10.4GW) at the start of 2022, prior to state government, AGL and Origin Energy announcements.”

“These include (but are not limited to) AGL’s 2.2 GW Loy Yang A coal plant exit being brought forward to 2035, the update to the QRET (80% by 2035), the update to the VRET (95% by 2035), funding for Marinus Link and the award of the VRET2 winners,” he says.