The switch to a renewable based grid is complex, rapid and irreversible. And recent events, such as the international geopolitics that has created chaos in Australian and global energy markets – has only strengthened the case for an accelerated green energy transition.

That is the main message from Australia’s Energy Market Operator in releasing the final version of its 2022 Integrated System Plan, its roadmap to a rapid transition to a grid dominated by renewables, featuring two-way energy flows and technologies that will draw on cheap, green power rather than coal, gas and oil.

“Recent international events and Australian market events have further strengthened the case for the shift to renewables,” AEMO chief executive Daniel Westerman says.

“Investment in low-cost renewable energy, firming resources and essential transmission remains the best strategy to deliver affordable and reliable energy, protected against international market shocks.”

And, in a pointed acknowledgment of the new federal Labor government and its $20 billion transmission plan, he notes that “Rewiring the Nation” policy will support the ISP roadmap’s timely and effective delivery.

The scale of the transition foreshadowed by AEMO – a “once in a century” transition in just 10 years is immense.

The country’s main grid is expected to surge from around 30 per cent now to a share of 83 per cent renewables by 2030, which just happens to be consistent with Labor’s new target, before growing to 96 per cent by 2040 and 98 per cent by 2050.

That will require tens of billions of dollars of investment, a reliable supply chain, skilled labour, and social licence, particularly where new infrastructure projects are built. At least now AEMO and the industry has a supportive federal government, rather than one that dismissed the ISP as “lines to nowhere.”

The Step Change scenario shows a five fold increase in rooftop solar PV, which will provide more than twice as much generation than a dramatically diminished coal fleet by 2030.

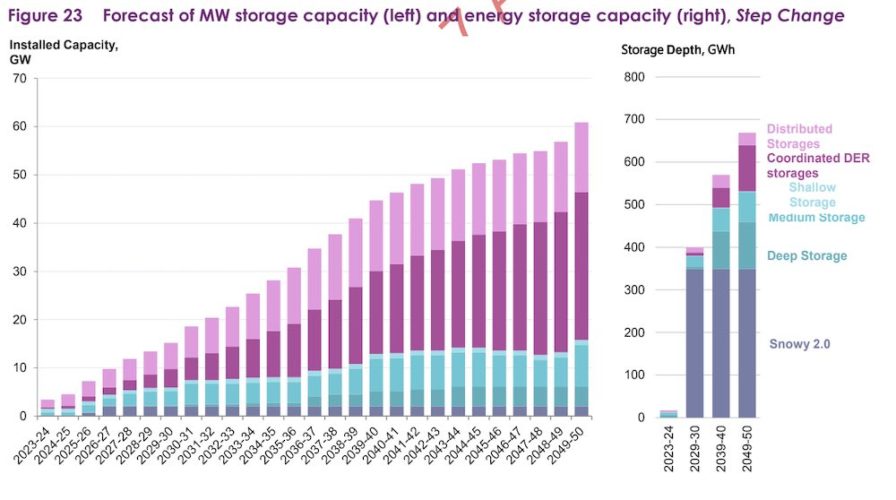

It will require nine times as much large scale renewable capacity installed and three times as much “firming” capacity, largely through storage and much of this will be “distributed” storage i.e. in households and businesses.

But the transition could be even more dramatic than that, because the scenario considered most likely now – Step Change – is likely to be superseded by an even more spectacular transition, hydrogen superpower, in coming years.

The Step Change scenario, curiously, assumes little or no green hydrogen production by 2030, which would be a surprise to the likes of iron ore billionaire Andrew Forrest, and the now BP-led consortium pushing ambitious green hydrogen and ammonia projects in the Pilbara and elsewhere.

Both have grand plans to produce millions of tonnes of green hydrogen by 2030, although their facilities – along with the proposed Sun Cable solar and battery project – will likely be beyond the main grid which is subject to AEMO’s battle plan,

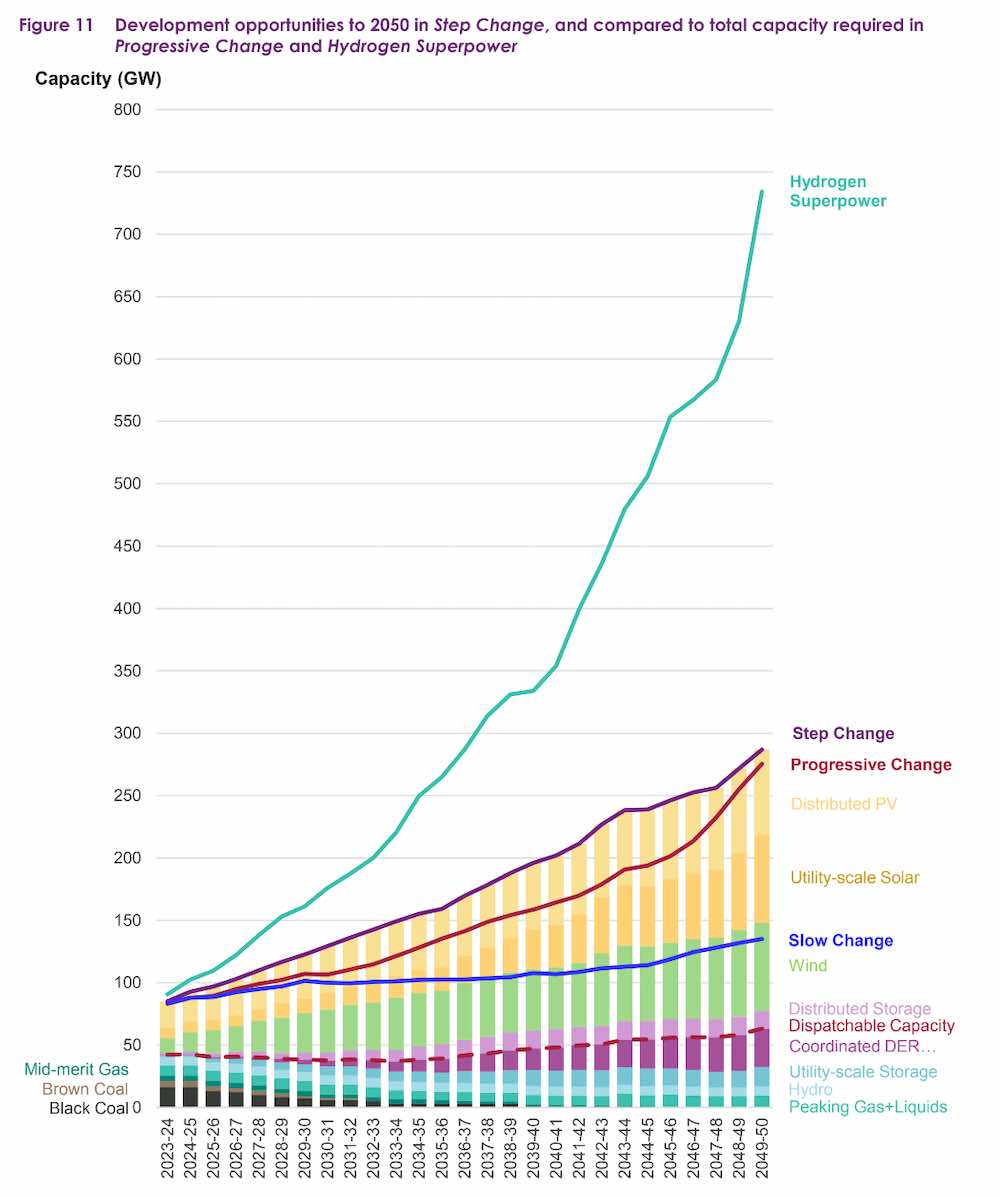

Significant production of green hydrogen connected to Australia’s main grid is included only in the hydrogen superpower scenario, and this would require an even bigger increase in the amount of wind and solar capacity. (See top graph)

This boost in wind and solar capacity in turn will flow through to the grid, with excess production helping to kick out more coal much earlier, and reaching a renewable share in the high 90% within a decade.

But even in the Step Change scenario that is now considered most likely, and which forms the current basis for AEMO’s roadmap, things will happen quickly enough, and AEMO is keen for the country to get cracking on building the infrastructure required.

“This transformation of the NEM’s generation fleet is fast in both historical and global terms, making it very challenging to achieve from each of a technical, economic and social perspective,” AEMO says.

“However, Australia is uniquely rich in renewable resources relative to global peers, with the financial and institutional capacity to exploit them, offering the opportunity to export renewable energy in large quantities, including in the form of hydrogen.

“To reach Australia’s full storage and export potential (the Hydrogen Superpower scenario), the NEM would be called on to deliver eight times its current energy delivery, compared to double in Step Change (without the export of energy)”

It notes that even in the Step Change scenario, electricity supply is expected to be generated almost exclusively from renewable resources by the mid 2040s, with energy storage helping to manage their seasonality and intermittency, and peaking gas-fired generation providing firming support.

It’s also worth noting that the share of gas will fall significantly, even with the exit of coal fired generation. Gas peaking plants will still be required, but there will be less gas capacity than exists now – 10GW versus more than 11GW currently.

And the gas that is there but hardly ever switched on, apart from helping to fill in for wind and solar droughts, or surges in peak demand, and most of the “gas plants” may actually turn out to be using biogas or hydrogen. So much for the gas led recovery.

“The level of urgency for action and investment against each of those three has increased markedly between the draft and this final version,” Westerman says.

And AEMO has not backed down from its prediction of a rapid exist of coal, and the closure of all brown coal generators within a decade, despite the howls of protest from fossil fuel boosters.

Indeed, Westerman points to the amount of declared closures increasing from 5GW to 8GW just in the last few months (most of this is the fast-tracked closure of Eraring which AEMO may have suspected at the time of the draft).

“I would come back again to the level of consultation with industry …. it has been extremely strong and this is what we asked a wide swathe of stakeholders and they are telling us this is the most likely scenario.”

The final version of the ISP considers various changes since the draft was released in December, including the push for offshore wind, the surge in coal and gas prices, simply chain issues, and the potential delay of Snowy 2.0 and the likely two year delay of the sub-sea Marinus Link from Tasmania to Victoria.

Despite these variables, it largely holds true to the draft.

AEMO does, however, outline what it calls its “optimum development path” (ODP), the centrepiece of which is the fast-tracking of the HumeLink transmission line, linking western Sydney to Snowy and Wagga Wagga.

It suggests that this could make up for the delay of Snowy 2.0 by linking in already existing Snowy hydro assets, and deliver handsome returns.

It will also provide a connection to other priority transmission links, the new ProjectConnect linking South Australia and NSW that has already begun construction, and the proposed VNI and VNI West links between Victoria and NSW.

“If it is delivered earlier than is needed for Snowy 2.0, it will still be delivering its market benefits, and its timely delivery will still provide greater resilience to the risks schedule slippage in other generation, storage and transmission investments,” AEMO notes.

“If it is then available when coal exits, it would provide access to Snowy 2.0 to New South Wales consumers to cover potential generation shortfalls.

“If it is not, additional storage and/or peaking gas development would be required, even more than the significant investments being made under the NSW Electricity Infrastructure Roadmap.”

As an example, it says that if HumeLink is not available when the Bayswater coal generator in the Hunter Valley closes, an additional 1.3 GW of firming capacity would be required.