The latest data released by key energy market institutions shows that the near standstill on new large scale renewable energy projects has continued into the new financial year, with no new solar projects registered in the first two months of 2023/24.

The slowdown in new project approvals and financing in the fast half of 2023 has been well documented by the likes of the Clean Energy Council and other bodies, and was confirmed earlier this week by data released by the Clean Energy Regulator.

“The first half of 2023 was quiet for new renewable energy investment commitments,” the CER wrote, noting that just 500MW of new capacity had reached a final investment decision in the first six months of the year, well short of what’s needed to meet the 82 per cent renewables target for 2030.

It blamed “a number of challenges” including higher costs, connection and permitting, and revenue certainty. The one bright spot was the rooftop solar sector, now tipped to match the record 3.2GW of new capacity installed in 2021, and may go higher.

However, new data released by the Australian Energy Market Operator shows that the slow roll-out of new wind, solar and storage capacity has continued into the new financial year.

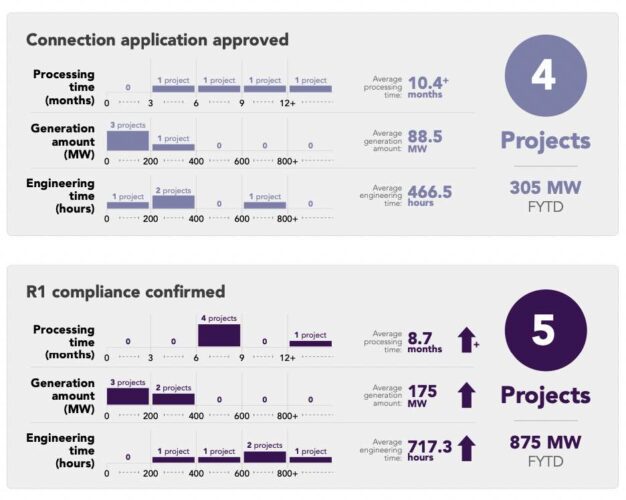

AEMO provided numerous data points, including the observation that just five projects totalling 875 MW of new capacity registered in July and August. Most of this was wind (725MW) and battery storage (150MW), and none for large scale solar.

Registration is allocated to projects which are mechanically complete, and which have satisfied the requirements to begin to move through the commissioning process, which according to AEMO data takes an average of 15.6 months before projects reach full commercial operations.

Of greater concern was the small number of projects – just four, totalling 305MW – that received connection approvals in the first two months of the year – despite extra funding and extra efforts to try and accelerate this process agreed by state and federal energy ministers.

This speaks to the volume of projects that will begin construction in the coming months.

Just two projects, totalling 408MW, had their commissioning approved in the first two months of the year, and CER also confirmed on Thursday that just 22MW of wind and solar projects were approved for LGC generation in August, taking the total for the year to 1,160MW. All the new power stations in August were under 5MW

It’s not that there is a shortage of candidates in large scale wind and solar. According to the AEMO data, there are enquiries from 361 projects totalling more than 123GW of capacity, and connection applications field for 79 project accounting for more than 18.5GW of new capacity.

The connection applications number is promising, because it is a 2.3GW increase over the July number. There are 4.4GW of generation capacity, from 40 different projects, that are going through the commissioning process and have had their registration approved.

In its release the CER said a “large step up in investment” is required to reach the federal government’s target of 82 per cent renewable energy generation by 2030.

It noted that almost 1 GW of new capacity was approved for LGC (large scale generation certificate) creation in the first half of 2023, and that 2.8 GW of new large-scale wind and solar capacity is expected to reach first generation in 2023.

The CER has downgraded its expectations for the 2023 calendar year, and says that new investment may not reach 3 gigawatts, despite wind and solar remain the cheapest options for new energy supply.

“Unfortunately, rising costs for components, engineering and construction combined with strong international demand for these products and services are slowing progress,” it says. “Finding ways to streamline grid connection and fast-tracking new transmission will also be critical for success.”

It expects that the share of renewable energy will grow to about 40 per cent by December, 2023, up from 36.4 per cent for the first half of the calendar year, driven at least in part by the growing uptake of rooftop solar by households.

‘Australia has among the best solar resources in the world and households and businesses continue to install rooftop solar at world leading rates,” CER chief executive and chair David Parker said in a statement, adding that they were doing so to save money and reduce emissions.

In addition, an estimated 60,000 new air source heat pumps have been installed so far this year – up 70% compared to the first half of 2022.