Oh dear, here we go again. It’s that time of the quarter when the summary of electricity trading is released by the Australian Energy Regulator, and the mainstream media can do what it likes to do best: Wring its hands in great angst over the impact of closing coal fired power stations.

“AGL’s closure of Liddell coal fired power station has pushed up power prices,” wept the headline in the AFR, which wants the country to slow down its switch to renewables and, laughably for a financial daily, go nuclear.

The Australian also took a long oar to the AER report, denoting the rise in wholesale electricity prices in the latest quarter as a rise in generation “costs”. But as the report makes clear, that is simply not true.

It’s mostly about market behaviour.

The exit of Liddell simply provided an opportunity for the big energy players – AGL, Origin, EnergyAustralia and Snowy Hydro – to profit from their market power. That much is clear in their own admissions of a doubling in expected profits, as they manage to squeeze more out of the customers they hold so dear to their business.

As the regulator notes, prices were affected in the last quarter because the amount of low-priced coal in the country’s biggest coal states – NSW and Queensland – was reduced.

That’s not because there was less coal generation as a result of the closure of Liddell. As the regulator clearly spells out: “More black coal capacity was offered than a year ago despite Liddell’s exit in April.”

It was simply a reflection that the remaining generators jacked up their prices. Because they could.

Liddell usually bid prices below zero because its kit was so old it couldn’t ramp up and down. By bidding below zero, it got priority in dispatch, and could be confident that the end market price was usually high, unless rooftop solar was eating the coal industry’s lunch, which it often does in the middle of the day.

More low-priced capacity disappeared from the market because there were outages at the Millmerran and Tarong North coal fired power stations in Queensland.

So more gas and hydro got to be dispatched, and they don’t miss when they get the ability to set prices, even if most of the hydro comes from the federal government-owned utility Snowy Hydro.

The regulator noted that the efforts of the energy oligopoly were partially offset by the impact of more renewable capacity on the grid – some 1,100MW of new solar, wind and batteries.

“Wind output reached record levels in June, putting downward pressure on electricity prices and reflecting strong investment in renewable generation and favourable wind conditions,” it noted.

It also said rooftop solar ate into demand, and prices, in the middle of the day. But that left the market exposed to the bidding behaviour when there weren’t enough renewables to bother the cartel.

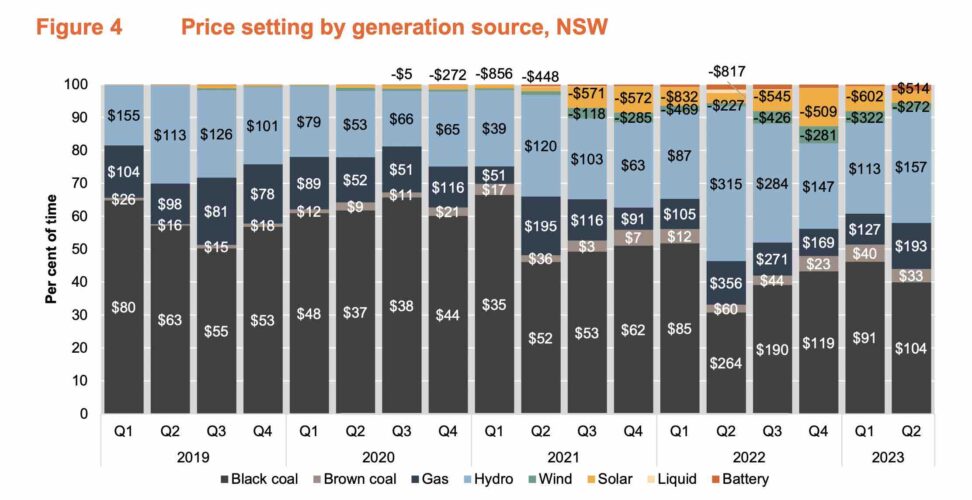

This is the key graph to note:

It shows which generation source bid what during the quarter. Coal-fired power stations jacked up their prices by 15 per cent over the previous quarter to an average $105/MWh.

That is down from their appalling behaviour in their manufactured “energy crisis” from last year, but is still double what they bid two years ago.

And their ability to control the market was enhanced by network outages that reduced the amount of electricity that could be traded between states.

The AER says its investigating one particular outcome, when prices jumped to more than $5,000/MWh, but its latest reports into such pricing events were not flattering for the big market players.

See our story: Energy industry loses plot again as greed trumps strategy and regulator fails consumers

So prices went up. The price set by gas generators jumped by more than 50 per cent, and the price set by hydro generators jumped by one third. When wind and solar got to set the price, it was minus $272/MWh or minus $514/MWh.

It’s important for the mainstream media, and consumers, to understand what’s going on here. It’s complicated, and there are many different things that play on market dynamics and bidding strategies.

But as ITK analyst David Leitch has pointed out numerous times in RenewEconomy’s award winning Energy Insiders podcast, the big utilities have done not much to transition to wind and solar, despite their big words.

There is a reason for that. They are making so much money from their existing fossil fuel fleets, and that is likely to continue for a while, as long as there is not too much new wind and solar capacity to affect their bidding patterns.

Right now, new investment in wind and solar has come to a standstill – again because of many complex factors, but largely as the result of 10-years of policy inaction by the previous Coalition government, at the behest of the legacy power industry.

It’s also why the Vales Point coal generator in NSW is now likely to stay open under its new owners for an extra four years: This is not a community service, far from it. It’s all about money, and greed-flation. And it needs to be called out as such.