Rooftop solar has taken another significant bite out of electricity demand, and the customer volumes of leading utility Origin Energy, as the pace of change in Australia’s main grid continues to accelerate.

Rooftop solar on Friday trumped all fossil fuels, contributing to 34 per cent of total generation in the middle of the day – beating the combined output of brown coal, black coal and fossil gas, and helping establish a new record renewables share of 68.7 per cent.

The increased uptake of rooftop solar is expected to push these numbers towards 100 per cent renewables by 2025, challenging the operating dynamics and economics of the remaining coal fleet, and the business models of legacy utilities.

Origin Energy, having decided to stop its fight against solar and battery storage in 2015, has again revealed how this impacts its business, reporting another two per cent volumes in the September quarter as a result of rooftop solar and more energy efficient appliances.

In recent years, Origin has been able to use the flexibility of Eraring to ramp up and down in response to the growing impact of rooftop PV, but its recent coal supply issues – due to the floods earlier this year – appears to have caused a change to its strategy.

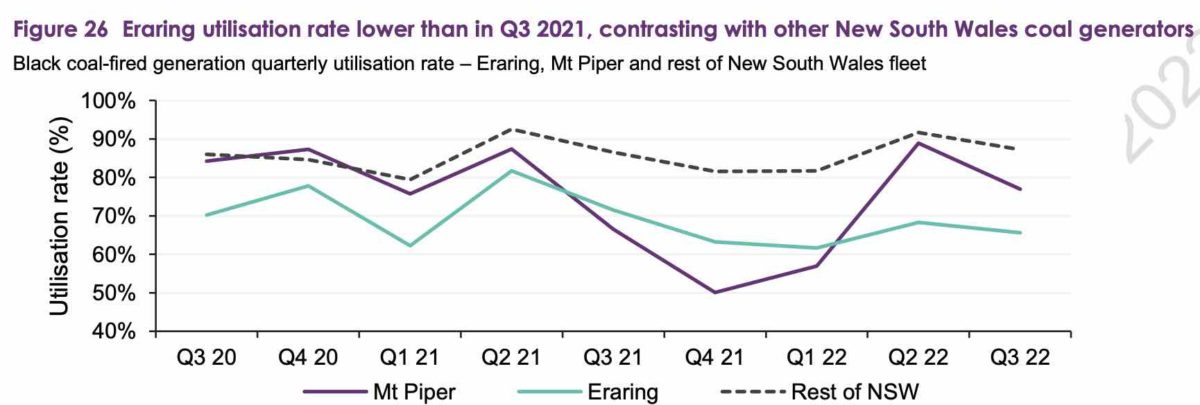

AEMO’s recent Quarterly Energy Dynamics report notes that Eraring’s output was considerably lower than the NSW coal fleet average, and its lowest since 2013, but largely because of the higher price bands for its output. The capacity it offered at prices below $100/MWh fell by 850MW on average. AEMO said.

The big bite out of Origin’s retail business was more than offset by significant wins in the business market, where new customer gains resulted in an eight per cent overall increase in volumes.

“Net new business customer wins drove electricity sales volume growth, offsetting weaker retail sales volumes due to improvements in energy efficiency and an increase in solar uptake,” CEO Frank Calabria said in the company’s quarterly production report.

Origin also expanded its renewables portfolio, including a $163 million investment to maintain its 20 per cent stake in the leading UK energy and technology company, Octopus Energy, and another $6 million for the acquisition of the 60MW Yanco solar project in the Riverina region of NSW.

Most of Origin’s money comes from fossil gas, with surging prices driving a 64 per cent jump in LNG revenues – compared to the same quarter a year earlier – to a “very solid” $2.77 billion.

This was despite wet weather that prevented access to some wells, and led to a two per cent fall in production, and interrupted planned downstream maintenance.

“The outlook for the LNG trading business has improved,” Calabria said.

“For FY2025, we have hedged around 70 per cent of volumes and we expect EBITDA in the range of $350-$550 million. This outlook remains subject to market prices on unhedged volumes, operational performance and delivery risk of physical cargoes, and shipping and regasification costs.”