A group of the biggest clean energy investors in Australia has released a groundbreaking new plan, which they say provides an ambitious and credible pathway to take fossil fuels out of Australia’s electricity grid in line with the 1.5°C target.

The Clean Energy Investors Group say this is the first plan that provides such a credible pathway, and involves closing all coal plants by 2033, instead of 2038, and fast tracking Victoria’s 95 per cent renewables target to 2030 from 2035.

It even targets a 94 per cent renewables share by 2035 in the country’s most coal dependent state, Queensland.

CEIG chief executive Simon Corbell, the former ACT climate minister who masterminded the territory’s rapid transition to “net” 100 per cent renewables by 2030, says the plan – prepared by advisors Baringa – is needed because no one has produced one to date.

The Australian Energy Market Operator has got close, but its central “step change” modelling is still based on a near 2°C climate scenario, and its 1.5°C calculations are based on some unrealistic assumptions.

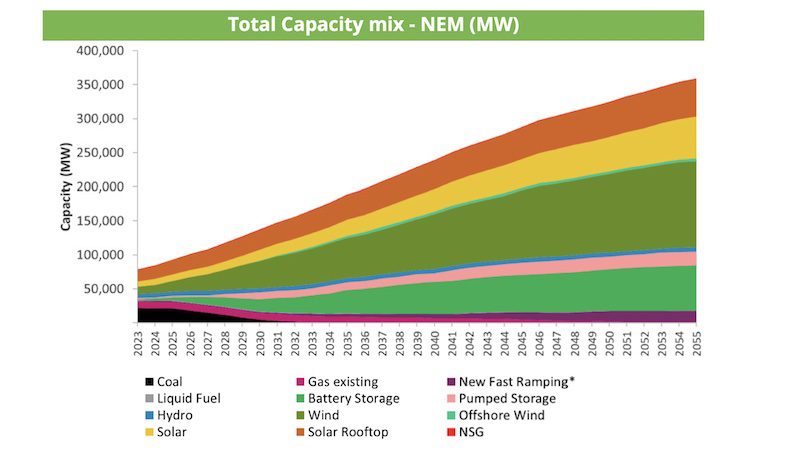

Corbell says the Baringa plan involves a lot of new expenditure – $116 billion above current forecasts – but is eminently doable because it assumes an average of 5.5GW of new wind and solar per annum, and 22GW of deep storage, of which half has already been committed.

“This is a credible scenario,” Corbell tells RenewEconomy. “We are actually really well place, but we need a clear signal from government that we are aiming for 1.5°C.” If that is forthcoming, he says, then investors can do the rest.

CEIG is a significant group because it includes some of the biggest players in the market, including France’s Neoen, Macquarie Group, Andrew Forrest’s Squadron Energy and Windlab, and Tilt Renewables. The only major legacy utility represented is the federal government owned Snowy Hydro.

The headline figures for the Baringa plan involve some big numbers. Total investment required is about $421` billion, with Queensland and NSW needing around $140 billion each, and Victoria about $93 billion.

That represents an “investment gap” over and above current government and market investment plans of $116 billion, with the biggest gap being in Victoria ($39 billion), Queensland ($35 billion) and NSW ($33 billion) attracting most new investment.

The plan assumes that Australia will need to fast track the closure of its entire coal generation fleet to 2033, which is turn requires Victoria – which hosts the three remaining big brown coal generators, to fast track its 95 per cent renewable target to 2030, and to reach 98 per cent by 2035.

Queensland will need to fast track its 80 per cent renewable target from 2035 to 2031, and reach 94 per cent renewables by 2035. The state barely sources more than 20 per cent from renewables now.

The Baringa report estimates that onshore wind accounts for almost half of the total investment with more than $200 billion, with significant investment also required in utility-scale solar ($53 billion), rooftop solar ($31 billion), and offshore wind ($9 billion).

The Baringa report estimates that onshore wind accounts for almost half of the total investment with more than $200 billion, with significant investment also required in utility-scale solar ($53 billion), rooftop solar ($31 billion), and offshore wind ($9 billion).

It says that despite government incentives – and ambitious targets from the Victoria government – it does not expect offshore wind to be cost competitive until the 2040s.

Big investment is also required in storage, but the biggest will be in behind-the-meter storage ($42 billion), followed by pumped storage ($41 billion), utility-scale battery storage ($23 billion) and new fast ramping capacity ($15 billion) to provide system security.

A further $41 billion of public investment will also be needed for transmission, but this is only $2 billion above current estimates.

Possibly the most eye catching of the assumptions is the need to accelerate the closure of the country’s remaining coal fired power stations, coming in a week when AGL is due to begin the closure of the last of its three units at the Liddell power station in NSW.

(The first of these three remaining units will be closed on Saturday, April 22, followed by another on Monday, April 24 and then the final one on Friday, April 28.

“The coal closure schedules will define the carbon trajectory of the electricity sector,” the report says.

“For the 1.5°C Investor Credible scenario we have developed an independent view on these coal closures, which is as ambitious as possible while retaining credible timing and staging.”

The emphasis is on the dirty brown coal generators in Victoria, because of their carbon intensity – and leads to the accelerated targets for Victoria, and all three brown coal generators closed by 2030.

Other generators are sequenced within each state based on technical life, with newer generators closing later. But the last coal plant in NSW is closed in 2033, and the last one in Queensland in 2034.

“The 1.5°C Investor Credible scenario sees a rapid decline in NEM emissions in the late 2020s and early 2030s,” the report says.

However, it says that once coal is closed, the remaining emissions remain low, but stable, as gas turbines produce dispatchable capacity, although it says that this could be replaced by green hydrogen or other new storage technologies.

“The 1.5°C Investor Credible scenario considers the need for reliability and security across each NEM region,” the report says.

“It minimises excessively peaky workforce and supply chain requirements, with a coordinated coal closure schedule smoothing the buildout of replacement capacity. It also ensures that average wholesale spot prices are neither too low for investors nor too high for consumers.”

The report identifies six priority actions:

- The Electricity sector needs a carbon budget – This will help governments and market bodies accelerate transition in line with targets.

- Transition requires national coordination – Governments, industry and communities must work together to accelerate coal closures and renewables roll out.

- Investment in long duration storage – This strengthens reliability and security during infrequent renewable energy droughts.

- Support for offshore wind development – Offshore wind offers significant volumes but is unlikely to be cost-competitive in Australia until the 2040s without policy support.

- Accelerating network infrastructure build – Transmission buildout must be accelerated.

- Skills, supply chains and communities – Delivery of infrastructure projects will be challenging with international competition for resources. Communities must be supported and empowered through the transition.