New renewable energy investment tax credits unveiled in Canada’s 2023 federal budget are expected to boost the value of some projects by more than 50%, a new analysis has found.

The study by independent research and business intelligence company Rystad Energy finds that Canada’s new renewable energy investment tax credit (ITC) will help make the country a beacon for investment in green energy projects.

According to Rystad Energy’s renewable economic modelling, the new tax breaks unveiled in the 2023 federal budget will raise the value of some renewable energy projects by more than 50% over their lifetime.

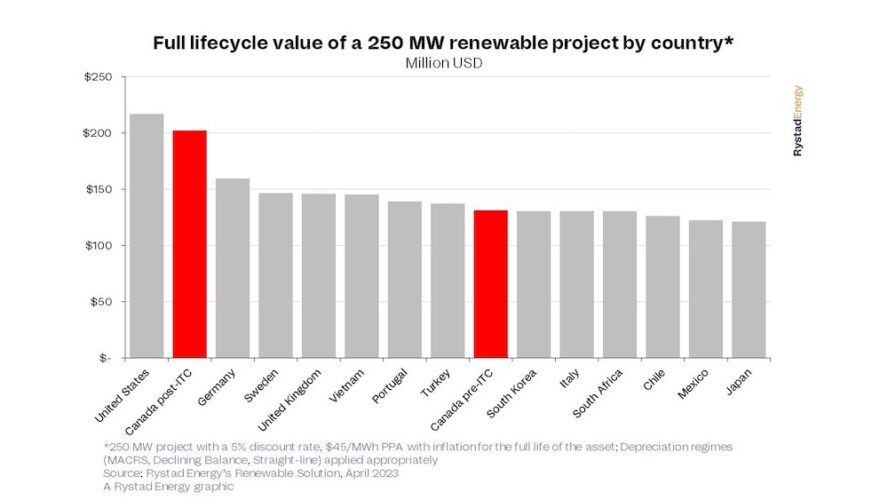

In turn, according to Rystad, Canada will emerge as the second most attractive place for renewable developers, behind only the United States – a telling outcome for other countries looking to ramp up renewable energy development and secure increased domestic labour security.

Following hot on the heels of the passage of the United States’ politically expediently named Inflation Reduction Act, the so-called ‘made in Canada’ strategy is aiming to grow its own production and labour market.

The renewable energy investment tax credit will act as a refundable incentive that offers up a percentage of the cost of capital investment, providing a 30% tax write-off for renewable energy technologies deployed through 2034.

As a result, for example, a 250MW project built in Canada will now boast a full lifecycle net present value of $CA202 million after tax, up from $CA131 million – a demonstrably significant increase in value over the life of the project.

“Canada looked at its southern neighbor’s renewable tax breaks and the influx of investment it’s set to trigger and thought: ‘I want some of that’,” said Geoff Hebertson, senior renewables and power analyst at Rystad Energy.

“And its answer to the Inflation Reduction Act could have wide-ranging implications. In the short term, it will shake loose projects that hit snags due to recent economic conditions.

“However, in the long term, it could unleash a wave of new investments.”

Canada’s new renewable ITC will apply to geothermal, solar, wind, and energy storage projects and will run through to December 2033 before falling to 15% for its final year in 2034.

Separate to the renewable ITC, green hydrogen projects will also benefit from a government-backed credit scheme for new projects, with up to 40% tax credits for green hydrogen projects emitting less than 0.75 kg CO2e per kg of clean hydrogen.

“While an investment tax credit is not a silver bullet, countries trying to compete for a share of global renewable investments and reach net zero should consider its benefits,” added Hebertson.

“Thoughtful policy moves, like an ITC, can support the uptake of renewables and ensure competitiveness with economic rivals.”