Genex Power, the solar and storage developer now subject of a takeover bid led by Atlassian billionaire Scott Farquhar and his wife Kim Jackson, has underlined the promise of a new 200MW wind project and its first battery storage project to cash in on Queensland’s fossil fuelled price shock in electricity markets.

Genex revealed on Monday, just as news of the $320 million bid by Skip Capital and US investor Stonepeak emerged, that its operating assets – two 50MW solar farms in Queensland and NSW – recorded average revenue of nearly $200/MWh in the quarter.

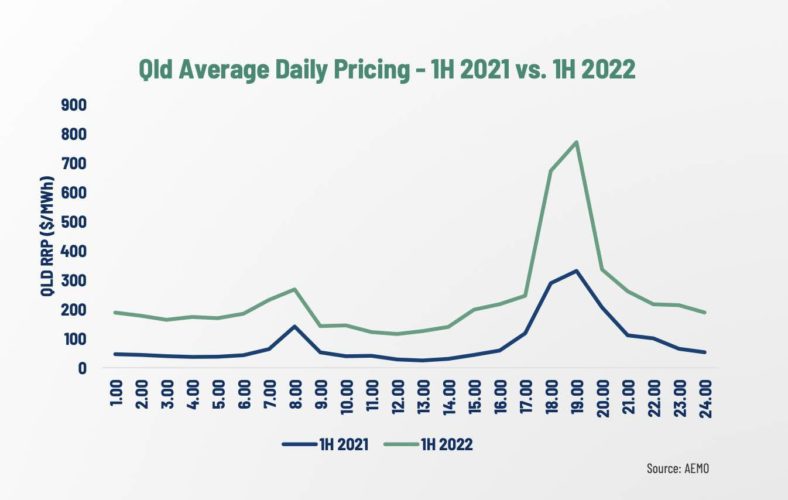

That is around double the same period last year, and around three times more than what solar farms would normally need to make a return to investors.

And it highlights the point that the bidders may have a battle on their hands if they hope to gain control at the current offer of 23c a share, particularly as Queensland electricity prices – dependent on high coal and gas costs, and regular fossil fuel breakdowns, is predicted to remain high for some time.

Genex had planned to a bit of an investment roadshow this week, but the plans have been muddied by the timing of the bid. However, on Tuesday it revealed further details of progress on a proposed 200MW wind farm near the Kidston renewables hub, as well as the ground-breaking Bouldercombe battery in Queensland.

It hopes to make a final decision on the wind farm with its 50 per cent partner J-Power early next year, and have it completed by early 2026 if it does go ahead.

The production profile of the wind farm would fit nicely into its portfolio, producing more at night than during the day when prices are subdued because of the solar duck curve.

The current profile of the electricity market is also looking good for its storage projects, the 50MW/100MWh Bouldercombe battery is hopes to have on line in the first half of next year, and the 250MW/2000MWh Kidston pumped hydro project due in mid 2025.

“High coal and gas prices are resulting in higher marginal pricing in morning and evening peaks when the sun is not shining,” the company said in its presentation, which was released to the market but not “delivered” as such to an analysts briefing.

It also notes that the market is being affected by “availability issues of older fleet of coal fired power plants impacting reliability of peak generators”, and the increased reliance on wind, and on the increased volatility springing from the shift to 5 minute settlement.

“(The) price shape has been exacerbated over the last 12 months, highlighting the urgent need for energy storage,” it says.

Genex says the first Tesla Megapacks are due in the first quarter of calendar 2023, with energisation expected to take place the following quarter. Genex has struck an interesting deal with Tesla that guarantees a floor on the revenue for the battery, and allows Genex to pocket the upside.

That’s a similar arrangement that the company has with the Queensland government for its 50MW Kidston solar farm, and which allowed it to cash in on the recent price surge.

The Kidston pumped hydro project has a different arrangement, with a 30 year contract with EnergyAustralia which will operate the facility, and a type of lease arrangement with the owner which has become a regular feature of the market.

Genex said its two solar farms and the Bouldercombe battery were well placed to take advantage of the rapid rise in wholesale electricity prices in both NSW and Queensland, the volatility in Queensland, to deliver “considerable” earnings growth over the medium term.

Its shares were trading at 21c on Tuesday, a rise of 1.2c on the day earlier, and from 13c before the conditional offer was announced, but still below the proposed price of 23c a share.