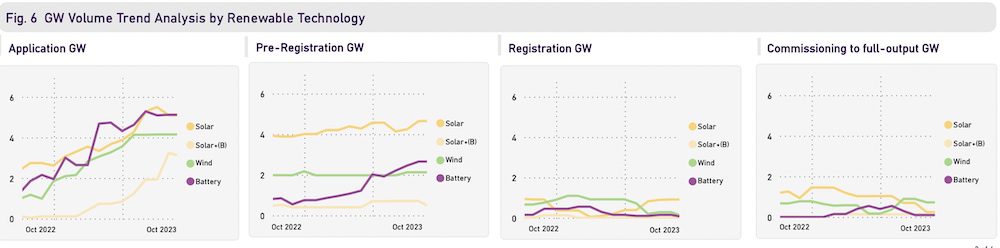

Applications for connections to the grid from new renewable and storage projects have more than doubled in the past year, with more than 31GW of new capacity in the application and pre-registration stages, according to the Australian Energy Market Operator.

The latest and newly expanded Connections Scorecard release by AEMO shows that applications have more than doubled in the past year to over 20GW of new capacity, representing 80 different projects. A further 11GW of new capacity, representing 69 projects, has moved to the pre-registration phase.

AEMO says these figures are significant because that new capacity represents half of all existing capacity in the grid, and it will be needed as two thirds of the country’s remaining coal fired capacity retires over the coming decade.

“The scorecard shows that we’re expecting a major influx of generation and storage capacity, with 90 per cent of all new generation and storage projects currently in the application and pre-registration stages,” AEMO connections manager Margarida Pimentel says.

Of particular interest is the big increase in applications from big battery projects, both in number and size, from 14 projects representing 1,860MW in capacity to 22 projects representing 5,100 MW in capacity. The storage duration was not provided and may vary significantly from project to project.

AEMO has released a new format for the connections scorecard that provides more detail, which it says should be useful to the industry given that connections – and the speed of them – remains a key point of contention for developers of new projects.

The picture painted by AEMO’s scorecard suggests that Australia is still falling short of the pace of investment needed to meet the federal government’s 82 per cent renewable energy target for 2030, but is not nearly as bleak as painted, for instance, by the Clean Energy Council’s survey of new financing.

That survey suggested only two projects had reached financial close in the September quarter, but the nature of FiD and its timing can be a random indicator of what’s being proposed and built.

AEMO’s data suggests that 620 MW of new capacity received application approval in the month of October alone, taking the total since the start of July to 1,560 MW, and 320 MW of new capacity competed registration, for a financial year to data total of 1,200 MW.

A further 630 MW of new capacity reached full output, taking the total for the 2023/24 financial year to date to 1,430MW.

Pimentel says that of the 69 projects (11,000 MW) in pre-registration stage – which means they are now ready to proceed to detailed design and contracts, 39 (representing 6,830 MW) have signed a connection agreement with the local network operator and are ready for construction.

Pimentel says the time taken to get approval for technical standards has also been vastly reduced.

“By engaging early to understand key locational considerations and gaining early feedback on their design, some projects are now getting their important technical standards approval in just one-third of the time that it used to take,” Pimentel said.

“These projects also progress faster by being transparent about project milestones and constraints, and actively working with AEMO and NSPs to address project issues, which allows them to capitalise on pre-negotiated financing and construction arrangements.”

However, AEMO notes that developers still face a range of challenges, including a shortage of experienced resources, the need to refinance projects, long lead times for equipment, and the need to change equipment suppliers.

Federal energy minister Chris Bowen has sought to remove some of the policy uncertainty by announcing the expansion of the Capacity Investment Scheme, lifting the targeted storage number from 6GW to 9GW (average four hours of storage), and using the scheme to secure 23 GW of new wind and solar capacity.

That proposal has been welcomed by the industry, although many say that the devil will be in detail, given concerns about the structure of the proposed floor and collar contracts and their potential impact on the market.

Many had argued for an extension to the renewable energy target, or even a US-styled tax credit which will be used to encourage new green hydrogen projects under the Hydrogen Headstart scheme.

However, the government favoured the proposed CIS mechanism because it switches the added cost burden from consumers to taxpayers (it will be funded by the federal budget).

It allows it a degree of control over what is built and where, which could be crucial as the level of renewables surges towards 80 per cent.