The planned closure date of the Vales Point coal fired power station on the central coast of NSW has been pushed back four years, in the latest blow to the hopes of a swift transition to renewables in the country’s most coal dependent state.

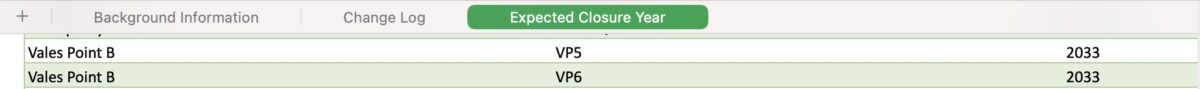

The new scheduled closure date for the 1.32GW Vales Point coal plant – now 2033 instead of 2029 – was revealed in one of the regular but obscure spreadsheet updates issued by the Australian Energy Market Operator.

One document, called the Generator Expected Closure Year, notes that the technical life of Vales Point B “has been reassessed” to be 2033. The change was effective on Thursday, July 13.

The document says the final closure date will be subject to “market conditions and commercial considerations”.

But an accompanying document, the monthly Generation Information update, now puts the expected closure date of Vales Point at 2033 instead of the 2029 cited previously, by which time its two units will be well over 50 years old.

The news comes amid growing fears that Australia could miss its renewable and emission targets, and also comes as tumbling temperature records across the world, soaring ocean temperatures and record low sea ice levels in the Antarctic underline the need to accelerate action on climate change.

The new owners of Vales Point – a Czech-based company called Sev.en Global Investments that also has an interest in the Callide coal generator in Queensland – has made no secret of its desire to keep Vales Point open beyond 2029 and keep the profits flowing into its coffers.

Sev.en completed the purchase of Vales Point owner Delta Energy earlier this year from high profile investors Trevor St Baker and coal baron Brian Flannery, who together bought the coal fired power station from the NSW government in 2015 for a mere $1 million.

Sev.en initially said the purchase would have no impact on decommissioning plans, but its country manager in Australia, Mark Sykes, told the ABC in March this year that locking in to 2029 “so far out” was not wise.

“We don’t know what capacity there is in the market and to be able to put a date on it, I don’t think that is wise,” Mark Sykes, country manager of Sev.en Global Investments in Australia said at the time.

“Right now, we are seeing demands for power being at risk, certainly from a capacity generation side, and what we are really wanting to do is provide energy reliability.”

The new closing date for Vales Point follows speculation that the closure of the country’s biggest coal generator, the 2.8GW Eraring facility also located on the NSW central coast, may also be at least partially delayed.

The new NSW Labor government has made no secret of its annoyance that Eraring is schedule to close so early – seven years ahead of its previous closure date – and has even canvassed buying the generator from Origin or its likely new owners, Brookfield, although that now seems unlikely.

Still, there is speculation that one or two units could be kept open beyond the scheduled August, 2025, the closure date still cited in the AEMO documents, at least for another summer.

The state Labor government has commissioned an independent “health check” of the NSW electricity system and expects to receive that report in August.

Federal Climate and Energy minister Chris Bowen told RenewEconomy’s Energy Insiders podcast earlier this week that “nobody wants to see a coal fired power station remained open longer than it needs to.”

“I don’t think anybody’s talking about any delay of years. I think it’s appropriate for New South Wales to say to Origin at this point, and potentially Brookfield down the road, let’s talk, let’s make sure that everything is in order for that date, and if not, let’s just keep a little bit of flexibility.”

The roll-out of wind and solar across Australia has been significantly delayed, running at around half the pace needed to meet the federal government’s 82 per cent target. This has been caused by delays in building new transmission, connection problems, rising costs, labour shortages and policy uncertainty.

NSW has a detailed infrastructure roadmap but it recently revealed that its own transmission plans, particularly relating to several key renewable energy zones, is also running behind schedule.

It has, however, fast tracked and expanded an auction of “firming capacity” along with the federal government in the first example of the new Capacity Investment Scheme, and is currently holding its second auction for 1GW of wind and solar and up to 600MW of long duration storage.

RenewEconomy has reached out to AEMO, the NSW government and Sev.en for comment.

Update: In a statement, Delta Electricity, the Vales Point plant owner acquired by Sev.en, said it had noted the delays being experienced by new generation and transmission projects, along with earlier closure dates being announced by owners of other coal fired generators.

“Given the uncertainties surrounding the capacity of electricity resources over the next 10 years and the urgent need to maintain system security throughout this period, Delta considers it a responsible step to advise AEMO of the availability of Vales Point Power Station’s capacity,” it said.

Interim CEO David Morris said Vales Point has benefited from a “detailed and rigorous maintenance” regime throughout its life, which would allow it to continue beyond it normal 50-year lifespan.