After talking about portfolios, renewable energy zone capacity factors and other stuff which is of little concern to punters, it seems high time to catch up on what’s been happening in the “real” world of spot electricity prices.

It’s also an opportunity to make a few comments about the role of gas in particular, and firming in general. The basic message is very, very obvious – namely gas has market power in states like Queensland right now because there is not enough alternative supply.

Put another way, gas does not always set prices and in the future it will set them less and less. People who think gas will run the market in the future are either talking their book or are still stuck on “old” style models.

The purpose of writing this piece is to draw out and reemphasise two things that I think are very relevant to electricity consumers (and producers) in Australia.

- The price of electricity depends on the quantity of firming energy required at any point of time.

- The price that firming providers can charge depends, like any other good or service on the quantity of firming capacity relative to demand. Competition in firming supply drives price.

In Europe, firming energy is often not that big a deal because there is plenty of hydro supply. In China for many years no gas was required because coal plants just ramped up and down with capacity utilization rates of 50-60%.

In future, wind energy in the NEM will reduce the quantity of firming energy required (over night) and solar will reduce it in the day. To the extent there is storage demand, the gap between midday and peaking prices will narrow.

In theory, the gap between the storage buy and sell price should be just enough to provide a return to the incremental supplier. Batteries and pumped hydro will increase the supply of subsitutes for gas, utilization of the gas generation fleet will fall.

As a result of the reduced need and the greater competition firming, prices will fall and overall electricity prices will fall in real terms.

This will happen (eventually) as surely as night follows day provided the right signals are sent to producers and consumers.

Prices convey information: They provide everyone, consumers, producers and Governments with information. Information is valuable.

I am not going to harp on about the “invisible hand” because I am quite sure that the prevailing mood out there is “drain the swamp, big business is evil and goverments know far better than the population what’s good for them”.

Nevertheless, when you control price, as well as distorting the overall market you blindfold everybody. Better to ensure that markets are competitive, lots of buyers, lots of sellers, lots of room for innovation and new ideas.

Even in that context it helps to have an idea of what the right scale is for a supplier. To the extent that an industry has economies of scale then there will be fewer suppliers and consumers benefit from access to those economies.

It’s not just a naive, ideal world and theoretical discussion that is irrelevant to unions and producers looking to protect today’s jobs and investments. It really isn’t. By looking at the prices by time of day and by region big consumers can work out where its cheap to buy and producers can see where to invest to make a return.

Of course, those decisions are made on a forward basis, but it’s the price expectation that drives decisions. For instance, if I ran an energy intensive global business I’d be very tempted to invest in the US. And guess what, lots of producers of cars etc are shifting their factories around.

Nem wide spot prices

A NEM wide spot price is not particularly useful because producers don’t receive it and consumers don’t pay it. Prices are set regional reference nodes or more or less at the State boundary. Yet it provides an overall picture.

The figure below shows the time weighted (the price for each half hour added up and divided by the number of half hours) weekly average price weighted for each Stated divided by each State’s share of NEM wide volumes. And actually it’s only the mainland states. For this first run and because I was initially interested in solar prices I left Tasmania out.

Higher gas prices benefit every other producer

The time weighted price, NOT shown in the figures immediately below has gone up for for a variety of reasons, but in my opinion the main reason is that gas and coal prices have increased and that gas has got to set the price for a bigger amount of time in QLD and NSW because coal generation volumes were down.

Coal generation volumes were down because generators aren’t working (Callide in QLD and in Winter 2022 a number of NSW generators) and coal volumes were restricted due to flooding.

Different commentators emphasize different parts of the coal and gas story and as a general statement the fact that coal generation volumes are just not there when they are needed basically providing “a leg over” for gas producers is an important driver that many commentators have underestimated.

So gas generation gained market power because there has been less alternative firming power available. Not just coal, but not enough pumped hydro, not enough batteries and indeed not enough wind.

A slightly more subtle point is that when time weighted prices go up, the gap between one fuel and the next in the merit order also increases.

That is utility solar looks more profitable relative to rooftop, wind looks more profitable relative to utility solar and of course gas looks more profitable relative to wind.

The extent of the relative increase reflects the potential for the fuel to generate into peak prices. Utility solar can operate for an hour or so when rooftop can’t and can also avoid (at the expense of volume) negative prices. Wind will sometimes operate right through peak prices

You can see this in a couple of the State charts.

First, Queensland

The rise in gas fuelled electricity prices which started in June was shortly followed by increasing gaps between lower merit order fuels as they were able to capture a part of the higher prices. At the moment in QLD wind looks far, far more profitable than utility solar.

Malcolm Turnbull once infamously said when he was Prime Minister that South Australia is a giant experiment in decarbonising an electricity grid, and if “giant” is perhaps an overstatement of South Australia’s place in the order of things it is nevertheless an interesting case study.

For instance you could argue that the high prices wind producers achieve in QLD are due to the low penetration of wind but that’s certainly not the case in South Australia. Nor in the first instance do coal prices or coal volumes have much impact in South Australia. For South Australians its about solar, wind, gas and net imports.

Its interesting to note that in South Australia where wind makes up about 46% of production and solar (utility + rooftop) 23% that wind’s premium over utility solar has increased and stayed high.

Gas may often set price right now, but so what?

Gas’s ability to charge a high price is no different to that of any other fuel in that the price it charges will depend on not just the cost of gas nor even the total quantity of gas generation required but the capacity utilization of the gas generation fleet and the extent of competition.

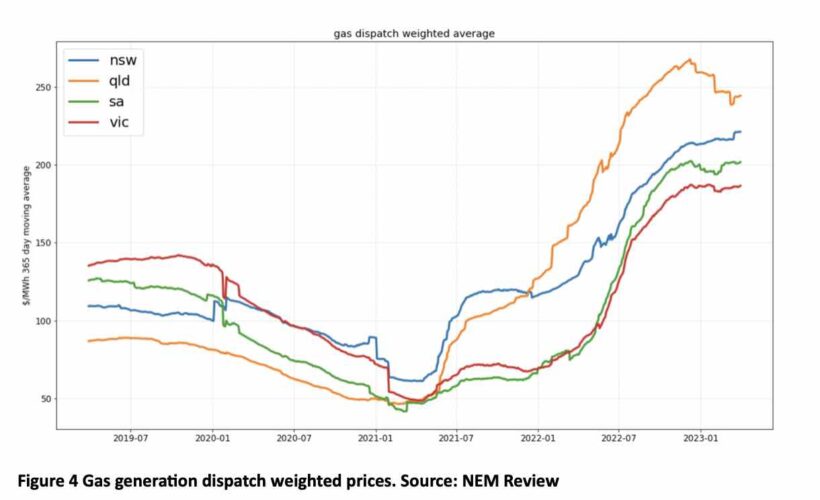

The following chart shows:

- The prices received for gas generation are all over the place just like for other fuels;

- Qld gas generation went from having the lowest price on the mainland in 2018 to easily the highest price achiever in 2022. This reflects basically the shortage of coal fired generation in QLD last year, and this year, the lack of having much wind to operate at peak times and gas generation capacity being squeezed. Let’s not forget that Swanbank had unit out of service for some time. NSW gas generation prices have been dragged up QLD, recall that NSW is exporting to QLD at 6:00pm.

How about firming cost?

Excluding coal there four main future sources of firming supply that can be built over the next decade.

They are new gas plants, pumped hydro, utility batteries and behind the meter storage. If you think about the demand for firming, it falls in three main groups – very short term, morning and evening peaks and seasonal.

This would be a long note to write about the whole thing but my point really is:

Gas can’t compete easily in the very short term firming market. If we think of frequency control as the demand for instantaneous firming gas can’t play, neither can pumped hydro, that belongs to the battery market.

If we think about the “diurnal”, and let/s call it the daily peaking market,then all four sources are technically capable of running for a couple of hours ever day. It’s quite likely that behind the meter storage can make a difference there.

Not only that, if retailers set time of use tariffs exactly right most of the time automated home battery systems such as Evergen or Solar Analytics provide will make sure the battery is discharging when it suits the system and charging when it suits the system. For the most part you don’t need an expensive VPP.

In the seasonal market that’s when the longer duration storage is needed and when gas does, presently, have a role. Even in that market the need can be reduced by having enough wind and solar and by enabling power from the North of Australia to flow South. The South of Australia is much more seasonal than the North.

For batteries and short duration pumped hydro the following chart assumes 1 cycle per day. Pumped hydro guys will laugh at a 4 hour plant and talk about 8 hours minimum, but I use four hours because the profit opportunity for each additional hour of storage falls sharply.

The reason people build 2 hour batteries and not 4 hour batteries is that even though the cost per hour of a 2 hour battery is higher than that of 4 hours, you can still make more money because the gross profit (spread or revenue less cost) per hour of a 2 hour battery is much more than the spread you can earn from the third and fourth hour.

When you have 8 hours of storage you can’t buy it all easily in one day and nor sell it all. You also require much more forecasting skill to understand when to charge and when to discharge. Anyhow, that is all in front of us and no doubt the facts will change. Then, of course, we don’t really have much data on pumped hydro costs and therefore required spreads.

Note that for batteries in particular revenue can be earned from frequency control, so that if you have a “generalist” battery that is as well suited to diurnal trading as it is to providing frequency control then it’s the total margin you earn that matters.

Put another way once batteries and pumped hydro are built they have a variable cost basically equal to the charging price and they will easily be able to undercut gas based on variable cost.

How much firming energy?

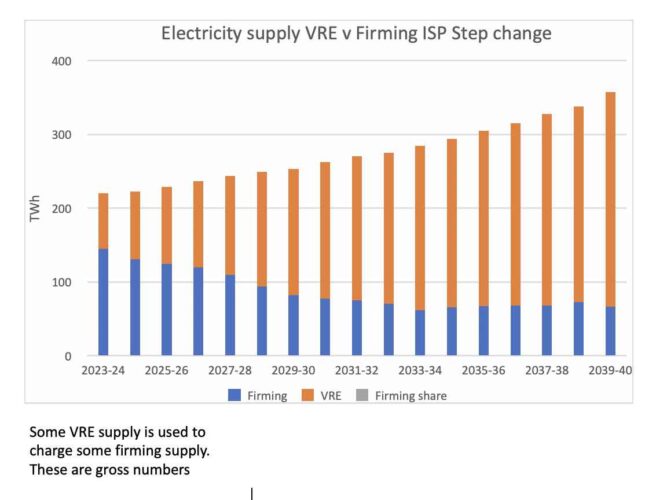

The chart below uses data provided in the ISP to measure the firming energy provided.

Rooftop is included in solar, gas is included in thermal. You can see that the storage requiement as a share of supply is not that big,

To make it even more explicit let’s add thermal and storage and hydro together to get a firming compared to VRE chart.

The point about this is, as far as I’m concerned is that as coal supply declines it is mostly replaced by VRE and that firming supply is only needed about 20% of the time.

Let’s break up the firming supply of energy (not the amount of MW needed at 6pm but the annual energy by fuel).

Figure 8: Dispatchable power by fuel. Source: AEMO ISP

Historically, mainland hydro (read Snowy) hasn’t tended to compete with gas, even though it could. Snowy has tended to price above gas. New pumped hydro and batteries though will be keen to make a turn.