Nora’s Digitalization Challenges: What the MSE Sector Can Learn From the Digital Journey of a Woman Entrepreneur in Peru

Nora is the owner of a bodega – i.e., a small grocery store – in San Juan de Lurigancho, the most populous district in Peru, and one of the most populated areas in Latin America. The store provides opportunities for both Nora and her family: Her husband works with her on her business, building product displays, while her son helps by manning the cash register. It is a typical family business similar to countless others across Latin America and other emerging markets, but with one important difference: Nora’s bodega is digitalized.

The story of Nora’s family business highlights, among other things, the importance of women’s role as a driving force for digitalization. According to an internal study by Fundación Capital, conducted in Mexico and Peru in 2020, women entrepreneurs have less resistance to digitalization than their male counterparts, exhibiting a lower aversion to risk and a higher level of trust toward digital tools for business. We found that women in the study also attributed greater importance to digitalization’s possible benefits, and showed less inhibition in the face of the challenges and barriers (self-perceived or real) of the “digital journey” – i.e., the series of processes and interactions that a startup goes through when digitalizing, from learning about a digital solution to adopting and using it. It is for this reason that entrepreneurs like Nora could lead a disruptive change that better prepares the Mexican and Peruvian micro and small enterprise (MSE) segment for the challenges and opportunities presented by the growing digitalization of economies globally.

In Peru, enterprises with five or fewer employees constitute around 95% of all businesses, and by employing around 47.7% of active workers, they are key drivers of the economy. However, productive enterprises such as Nora’s are still struggling to consolidate themselves as engines of growth and job creation, as their informality causes or increases a wide range of needs (like financing and skills development, among others) that present difficulties for their full development. Furthermore, although COVID-19 has made it difficult for any business (small or large) to operate the way it did before, the pandemic has not automatically paved an easy path to digitalization. Entrepreneurs still face multiple challenges in their digital journeys, including obstacles related to their awareness and understanding of new digital tools, as well as their decision-making and usage capabilities, which can prevent them from making a successful transition to digitalization.

As part of our DigitAll program research agenda, financed by MasterCard’s Center for Inclusive Growth, Fundación Capital and the social research company Decodis are undertaking a qualitative study in Colombia, Mexico and Peru, to better understand the digitalization processes of micro and small entrepreneurs. Through the use of interactive natural language recognition and processing methodologies, we are conducting interviews throughout 2022, with sample groups of between 40 and 50 entrepreneurs in each country. The project will help inform our efforts to promote the adoption and use of a wide range of digital tools by businesses such as Nora’s, to boost their productivity and financial health and facilitate their integration into the digital economy. We will release several technical notes related to this study throughout the remainder of this year – and in the article below, we’ll highlight some key initial findings from the first wave of interviews, and discuss their relevance to Nora and other microentrepreneurs like her.

Nora’s Digital Journey: Selecting the Right Digital Tool

Though she was eager to use digitalization to differentiate her bodega from the growing competition from other stores in her neighborhood, Nora herself did not know which digital tool to use. She was faced with a wide and dispersed product offering, including: solutions for accepting digital payments; business sales and inventory management tools; digital marketing tools, such as Facebook, Instagram and WhatsApp Business; and apps that enable purchases from suppliers and access to financial services, among others.

The great variety of solutions available in the digital ecosystem highlights the need for accessible information that’s clear, simple and concise, clarifying these digital offers for first-time users who may feel overwhelmed by the many products and services at their fingertips. By learning about these products’ functionalities, costs and navigation aspects (i.e., the characteristics of the devices that are essential to ensuring proper use), entrepreneurs at the base of the income pyramid can better determine which digital solution is right for their businesses’ unique needs.

In light of the amount and variety of products available, decision-making is a key challenge of digitalization. The decision-making process frequently involves several of the individuals behind a family business, who jointly weigh all the implicit elements in a decision of this type. This process is not easy, since it involves both tangible factors (such as the costs of commissions for the use of digital payments solutions), and intangible factors (such as an individual’s self-perception of their ability to operate a point-of-sale device, or their resistance to changing business operating procedures that are considered to work well). These intangible factors can contribute to inertia and other behavioral tendencies that affect the decisions of entrepreneurs throughout their digital journey. The ongoing qualitative study conducted by Decodis and Fundación Capital highlights the impact of these factors: The study found that only 3% of the entrepreneurs we interviewed in Peru wanted to change their approach to inventory management. Furthermore, most of these interviewees (80%) reported that their current management system is adequate, even though a large number of them handle this through notebooks or by simple observation.

Nora is a client of ADRA Peru – a microfinance provider which the DigitAll project supported in digitalizing the operations of its MSE borrowers. In the process, we made consistent efforts to help ADRA integrate its scattered information about the digital product options available to its clients, and to guide these MSEs in implementing best practices when digitalizing their operations. We organized training sessions to teach ADRA’s clients about the functionalities of a variety of digital tools available for their use, as well as these tools’ terms of use, in order to reinforce their decision-making process in selecting appropriate products. That is how Nora identified Scanntech – a multifunctional intelligent point-of-sale (i-POS) tool that digitally records sales, handles inventory management and provides business performance data to facilitate decision-making, among other functions – as the tool she needed to digitalize her business.

Common Challenges of Digitalization: Starting to Use Digital Tools

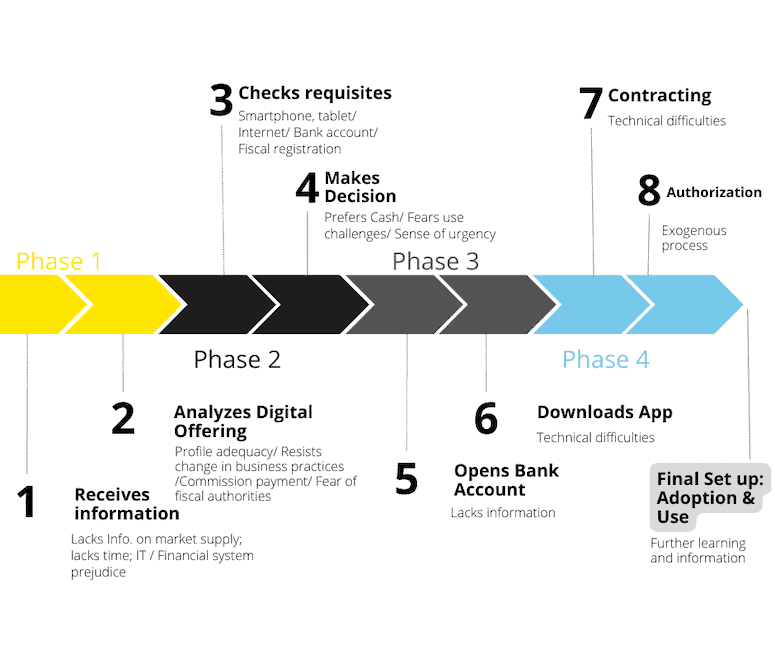

However, the decision to use a digital tool is just the gateway to a process full of additional challenges, where the risk of abandoning the digitalization effort is high. That’s why it is not enough to inform and facilitate MSEs’ decision-making process – instead it is necessary to accompany these enterprises through the various challenges they will face when starting to use a digital tool. We saw the importance of this ongoing support when DigitAll mapped the behavior of enterprises in the digitalization process.

We found that out of 100 microentrepreneurs who decide to adopt a digital tool, 75 drop out before reaching step 4 (see Illustration 1 below). Of the 25 that remain, 40% of those who would have decided to adopt a digital payment solution abandon the digitalization process before it has been completed (between steps 4 and 6), leaving only 15. Several more drop out between step 6 and the end of the process, resulting in a total drop-out rate of over 90% of the people who started the digitalization experience.

Furthermore, in DigitAll’s aforementioned qualitative study, the entrepreneurs we spoke to referred to different factors that highlight the efforts that go on behind the scenes during digital adoption. For instance, in addition to the time that entrepreneurs must invest to learn how to handle the different functionalities of a solution (especially digital business management solutions, such as Nora’s), there is often a need for specialized support to address technical issues that make a tool difficult to use. For example, some users report complexities in the use of the payment key of some digital payment solutions, and some tools require devices with specific features that are not always available (e.g., a certain amount of available memory, which is not always present in low-end smartphones).

The above challenges are particularly relevant to entrepreneurs entering the digital journey for the first time. They require satisfactory user experiences as a precondition to build trust in the digital ecosystem and trigger behavioral changes that can increase their willingness to digitalize. A study carried out on a sample of Mexican entrepreneurs reveals that technical problems are some of the main causes of desertion from the digital transformation process. Furthermore, the study found that in contexts with low levels of trust toward formal institutions, entrepreneurs tend to magnify the frustrations caused by poor user experiences (reflected, for example, in the time it takes to contact a call center for technical assistance or to update software, or in Bluetooth connection failures). Thus, the study tested a series of incentives (including technical assistance to entrepreneurs), which generated promising results in digital adoption rates: For instance, startups that received these incentives nearly doubled their monthly card transactions – and processed almost 60% more money via cards.

Some digital providers are making efforts to support entrepreneurs in navigating these usage challenges. In the case of Nora, the supplier Scanntech has helped her adopt the tool’s functionalities gradually, beginning with the registration of sales and the placement of products’ prices in the i-POS, before using the (more complex) module that’s focused on inventory management. In this process, it is noteworthy that face-to-face assistance, when combined with remote support, helps to reinforce the confidence of new users. In Nora’s case, the support of her son (a digital native) has also helped: During the hardest months of the pandemic, he helped train his mom on the usage of these tools at home, as he was the one who continuously used Scanntech’s i-POS functionality.

Optimizing digital adoption processes

The digitalization of micro and small entrepreneurs is a complex and gradual process that does not happen automatically. It requires comprehensive support strategies which are essential for successful digital inclusion. These strategies – characterized by a broad package of interventions, where information, training and technical support are key – invite the participation of all actors in digital ecosystems. Naturally, this includes solution providers, but it also includes companies that integrate MSEs into their business models, as well as public programs that promote digital inclusion/training.

It is noteworthy that entrepreneurs like Nora have demonstrated their potential as agents of change: In the case of Peru, none of the participants in Fundación Capital and Decodis’ study expressed rejection of digital solutions. On the contrary, even among startups that would have been late adopters of a digital tool, we found evidence showing unprecedented enthusiasm for digitalization. According to the feedback from the bodegas we studied, digitalization can achieve several diverse impacts: In addition to being a vehicle to significantly increase sales, digital tools provide greater security (e.g., via digital payments), greater convenience, and greater money control and time savings (e.g., by using mobile wallets to make transfers, which also promotes financial savings by enabling users to receive deposits directly into their home-business bank accounts). Additionally, these tools can allow entrepreneurs to tap into the growing digitalization of demand: For Nora, it is common to receive customers who only use digital payment channels, especially since the pandemic.

As the DigitAll program continues through its third and final year of implementation, it will address the challenges of digitalization by focusing on the promotion of three tools aligned with the digital journey, to support the development of an ecosystem that promotes the participation of all relevant actors – both public and private, in addition to MSEs. These tools will include a virtual assistant (chatbot) and two online informational platforms: one to inform entrepreneurs about existing digital products and services on the market, and another to train them in greater depth on certain topics (like basic digital skills), and to support them as they incorporate these new tools into their businesses. In this way, the project will seek to maximize the acquisition rates of digital users and trigger more productive and financially healthy enterprises that increase the well-being of their communities.

As more and more entrepreneurs, especially women, realize that digitalization can make their MSEs more productive, efforts such as the DigitAll program will become increasingly necessary, to provide them with the information and skills they need to select appropriate digital tools and utilize them effectively to grow their businesses. Now is the right time to join these efforts, and to strengthen the huge ecosystem of MSEs in Latin America and other emerging markets.

Visit Fundación Capital’s website to learn more about the DigitAll program and our other efforts to support MSEs.

Gianmarco Cheng is the Project Manager in Fundación Capital Peru and Juan Navarrete is Fundación Capital’s Vice President of Partnership and Business Development.

Photo courtesy of Fundación Capital.

- Categories

- Technology