The cost of wind, solar and battery storage projects has jumped by between 20 and 60 per cent over the last two years, and show little prospect of any immediate reduction.

That is the assessment of Neoen, the French renewable and storage developer that has been the most successful developer in the Australian market, both by size and innovation.

Neoen is probably best known for building the original Tesla Big Battery (aka the Hornsdale Power Reserve), and the Victoria Big Battery, now the biggest battery in Australia.

It is also building the country’s biggest solar farm (Western Downs), has begun construction of the biggest wind, solar and battery hybrid (Goyder South), has been the first to deliver synthetic inertia at grid scale (Hornsdale) and has landed a unique 24/7 renewable power supply deal with mining giant BHP (Goyder and Blyth).

Neoen has around 3GW of wind, solar and storage in Australia in operation or under construction, part of its plans to reach a global installation target of 10GW by 2025, and 20GW by 2030. So when it comes to cost, it knows what it is talking about.

Neoen has around 3GW of wind, solar and storage in Australia in operation or under construction, part of its plans to reach a global installation target of 10GW by 2025, and 20GW by 2030. So when it comes to cost, it knows what it is talking about.

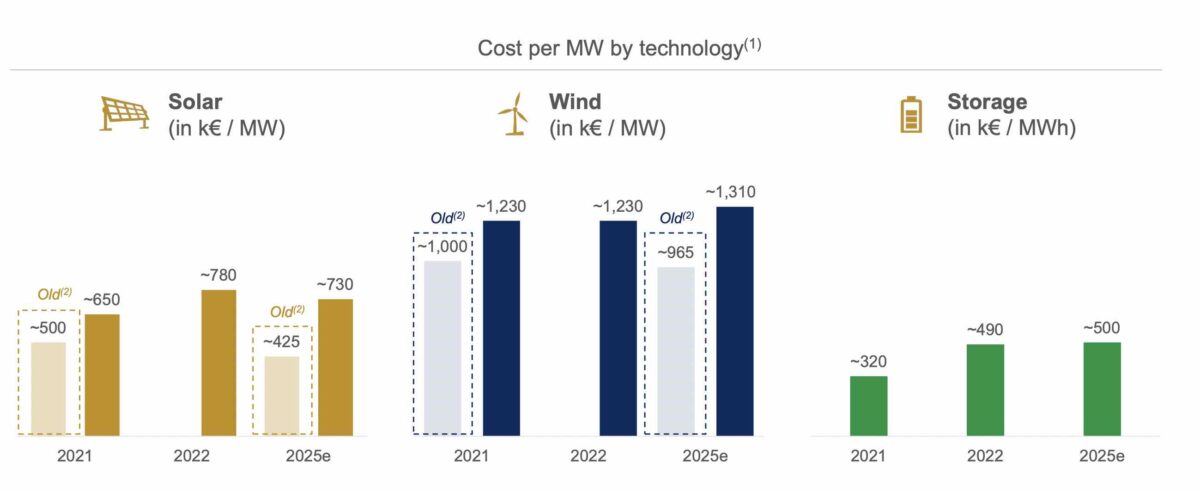

“If we start with solar first, we have seen over the past two years, cost of projects go up roughly 50 per cent,” chief operating officer Norbert Thouvenot said during the company’s interim results presentation and strategic update this week.

He pointed to significant increases in the cost of polysilicon, one of the main components of solar modules, as a result of industrial accidents in the supply chain in China, and then due to Covid lockdowns.

“Logistic costs have gone to the roof. PV modules themselves have increased in the range of 80 to 100 per cent over the period.”

Thouvenot said that looking towards 2025, prices of PV modules will come down slightly, and project costs will stabilise, “but we don’t see those costs coming back anytime soon to pre-Covid years.” He said labour costs would follow inflation growth over the coming year or two.

“On the wind side, we saw an increase of product cost in the range of 20-25% over the past two years,” he said, mostly due to raw materials, particularly steel, and as a result of concentrated ownership of wind turbine industry, and big losses in the industry.

So looking forward towards 2025. We see this market stabilizing, but unfortunately, due to steel a bounce back on steel cost and the fact that those OEMs are going to factor their losses in the future price we don’t expect a reduction of the price of a product costs when it comes to wind farms.

“Last but not the least the storage which is a key component of our growth, again, we have seen over the past two years the cost of project storage cost going up roughly 60%.

“The main component of that increase was the cost of lithium. Lithium is the driving factor for the cost of battery cells and as a result as a huge part of the cost of storage project cost.

“This the cost of lithium has changed a lot during the past years as a result of a strong imbalance between the demand of electrical vehicles and the offer on the market.

“Looking forward into 2025 we see the industry catching up a bit, with additional capacity of lithium mining opening around the world.

“But at the same time we still think that this is part of our business is going to remain quite volatile, due again to the fact that we are only a part of the market size, which is the electrical vehicle who has experienced, again, very large volatility in the recent months.”

CEO Xavier Barbaro says the impact of these costs is a €750 million increase in the anticipated €5.3 billion cost of reaching its 10GW target for 2025.

But Neoen expects to get more debt financing, mostly because the revenues from the projects will be higher, and won’t draw on its equity resources.

It is also investing an extra €150 million to double the anticipated length of storage in its battery projects, from one hour to two hours, which will require twice the number of battery cells.