What Is Sustainable Finance?

A Look at 3 Pillars That Can Guide Companies, Investors, and Policymakers — and Benefit Business and the Planet

This article by Dr. Hao Liang is part of “The Basics” series by the Network for Business Sustainability (NBS) that provides essential knowledge about core business sustainability topics.

As someone who has been working on a field called “sustainable finance” for more than 10 years, I keep hearing the question: “What is sustainable finance?” What is this approach that aims to make money and address social and environmental issues at the same time?

Is sustainable finance a new field within finance — a new way of dealing with money management, funding business activities, and creating investment products?

My answer: Yes and no.

Yes, sustainable finance is a new field of finance, with a new industry and new jobs, new regulations and frameworks developed by various governmental and nongovernmental bodies.

At the same time, it is still finance. That means it still involves the fundamental elements of the field: capital allocation, investing, diversification, risk sharing, and value maximization.

Sustainable finance, however, provides a new twist on these fundamentals:

- Capital allocation decides how best to distribute an organization’s money. In sustainable finance, the goal is investing for long-term social and environmental sustainability.

- Diversification is the principle of spreading investments among different types of assets to avoid losses. With sustainable finance, an investor may shift away from diversification for good reasons: for example, choosing not to invest in “sin stocks” like weapons or tobacco.

- Value maximization traditionally emphasizes financial value for shareholders. In sustainable finance, the goal is to also maximize the welfare of stakeholders — including the environment.

How Sustainable Finance Relates to CSR, SRI, and ESG

Here’s a more formal definition of sustainable finance, involving three acronyms you’ll hear a lot about: CSR, SRI, and ESG.

I consider sustainable finance as consisting of these three pillars or frameworks that guide the key actors. To achieve the goals of sustainable finance, all actors — companies, investors, and policymakers — need to commit to these frameworks.

From a company’s perspective, sustainable finance refers to Corporate Social Responsibility (CSR).

CSR refers to the set of corporate activities that improve human or environmental well-being. As a researcher in this field, I try to understand: Why do some companies actively engage in CSR whereas others do not? Do companies that do more CSR also enjoy greater profitability?

From an investor’s perspective, the key lens is Sustainable and Responsible Investing (SRI).

Through SRI, investors put their money into companies with good CSR activities. Institutional investors are leading in this area; these are mutual funds, pension funds, sovereign funds, insurance companies, banks and financial institutions, family offices, and corporate investors. Here, we need to understand: What are the motivations and return implications of SRI for investors?

For everyone — companies, investors, and policymakers — Environmental, Social, and Governance (ESG) data matter.

ESG quantifies and values CSR and SRI activities in order to show the impact of sustainable finance, created by business operation and investment. We are still trying to understand how best to measure ESG.

Here’s how these concepts relate: When companies care about stakeholder welfare, they engage in CSR. When investors put their money in businesses with greater CSR engagement, they make SRI. For both CSR and SRI, we measure them using ESG.

Why Is Sustainable Finance Important?

Sustainable finance is becoming a global trend and a mainstream business activity. We can see this in the action of companies, investors, and policymakers.

Almost all major listed companies, even those in the energy or mining sectors, have established CSR or sustainability departments, appointed chief sustainability officers, or have a CSR committee on their boards. They all issue annual sustainability reports to disclose their carbon footprints, community engagement, employee treatment, and other stakeholder issues.

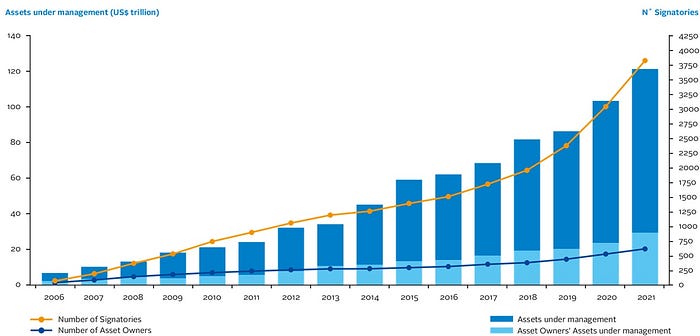

Most asset managers, especially institutional investors such as mutual and pension funds, claim to integrate ESG into their investment strategy. The numbers speak for themselves: According to the Global Sustainable Investment Alliance, over $35.5 trillion was managed for sustainable and responsible investing globally in 2020.

The United Nations Principles of Responsible Investment (PRI) has more than 4,000 signers collectively managing $120 trillion in assets; signers include huge investors such as BlackRock, CalPERS, Calvert, and the Norwegian Government Pension Fund Global.

Policymakers are working toward the Sustainable Development Goals (SDGs), 17 global goals set by the United Nations in 2015, to be achieved by 2030. This also adds fuel to the sustainable finance fire. The goals include 169 detailed targets around social and economic development issues. To achieve the SDGs, we need trillions of dollars to finance different projects; where those projects have a financial return on investment, that money could come from sustainable finance.

Many other pressures are also driving sustainable finance. These include events such as international climate conferences (Paris Agreement, COP 26) and campaigns on board gender diversity by large asset managers (BlackRock, State Street, and Vanguard). These events and movements are raising awareness of the importance of sustainable finance among corporations, investors, and the general public.

What Criteria Are Included in Sustainable Finance?

Today, almost every company and investor is trying to claim that what they do somewhat relates to sustainability. That’s because sustainability claims can often bring them significant financial benefits: lower cost of capital (because more people are willing to put their money into sustainable companies and funds), lower interest rates from banks (because banks perceive sustainable companies as having low risks), and greater capital availability.

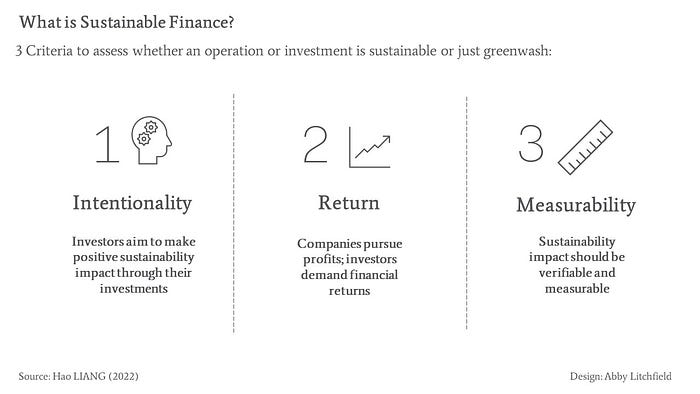

Given the many claims, one may wonder how truthful they are. Indeed, one of the greatest challenges in sustainable finance is how to be sure whether an operation or investment is actually sustainable or simply greenwashing.

To me, three main criteria must be applied to determine what’s really sustainable finance. These are intentionality, return, and measurability.

Intentionality means that investors intend to make a positive environmental or social impact through their investments. This is especially the case for impact investing (usually done through private equity). Investors can be passively holding shares in sustainable companies or actively involved in the investee companies’ decision-making.

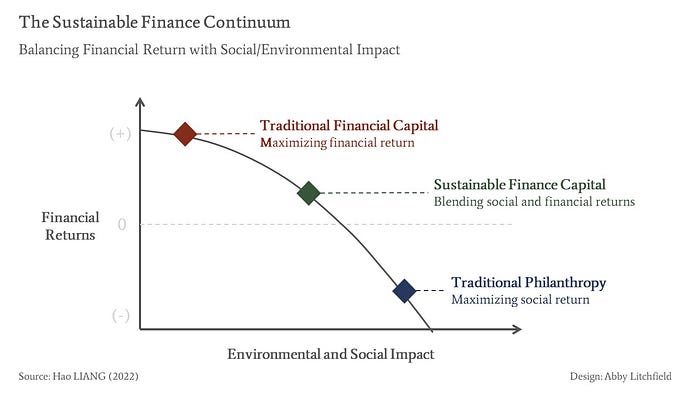

Return means that sustainable finance is still finance — companies still need to pursue profits and investors still expect financial returns. It’s not philanthropy, but it does differ from traditional finance. Investors might accept a lower rate of return, for example, in exchange for sustainability impacts. The figure shows where sustainable finance fits between financial return vs. environmental/social impact.

Measurability means that the sustainability impact from a company’s operation, or an investor’s action, should be verifiable and measurable. Verified usually means that claims are independently assessed, e.g. by an auditor. Sustainability metrics should also be clear, meaningful, transparent, and capable of being compared to others.

Measurability Is a Challenge in Sustainable Finance

If you’ve explored the field of sustainable finance, you may have been confused by the many ratings systems and terms. Here’s a tour of the landscape and the issues.

Many third-party rating agencies — private and public — have developed ESG ratings, based on metrics, for managers and investors to gauge how sustainable a business or an investment is. But experts in academia and practice have raised concerns about these ESG ratings. The different ratings systems may not “agree” with each other or be transparent; they can be biased and inconsistent. Ratings systems have also focused on public companies, whereas the bulk of sustainable finance happens in other areas: private equity, projects, fixed incomes, etc.

In response, new standards and policy frameworks are being developed by international organizations, governments, NGOs, and commercial investors. These variously focus on carbon/ESG disclosure, corporate reporting, impact measurement, and portfolio evaluation. But, perhaps because there are too many frameworks, managers and investors very often get confused about which one to follow.

Another puzzle is how to integrate different kinds of social, environmental, and financial impacts — so that the stakeholders can gauge what’s the “net impact” of an operation or investment.

There’s no easy answer to these puzzles, but there are many people working on them. The hope is that solutions — or better approaches — will continue to emerge over time.

A version of this article was published by the Network for Business Sustainability. B The Change gathers and shares the voices from within the movement of people using business as a force for good and the community of Certified B Corporations. The opinions expressed do not necessarily reflect those of the nonprofit B Lab.