The European Commission, on behalf of the EU, has today (Jan 24) successfully executed its first green bond auction, by raising 2.5 billion in NextGenerationEU green bonds for Europe's sustainable recovery.

The 2.5 billion were issued via a tap of the 12-billion 15-year first NextGenerationEU green bond, that the Commission placed on the market on 12 October 2021. The auction supports the secondary market liquidity of the first NextGenerationEU green Bond and confirms the Commission's commitment to the market for sustainable finance. The bond, has been issued under the NextGenerationEU green bond framework published in September last year.

The bond is part of the 50 billion in long-term funding the Commission intends to issue under its NextGenerationEU recovery programme in the first half of 2022, as announced in its funding plan for the period January-June 2022.

With today's transaction, the Commission has so far issued a total of 73.5 billion bonds under its up to around 800 billion NextGenerationEU recovery programme. In an expression of its commitment to sustainability, the Commission intends to issue 30% of the amount, or up to 250 billion, in NextGenerationEU green bonds.

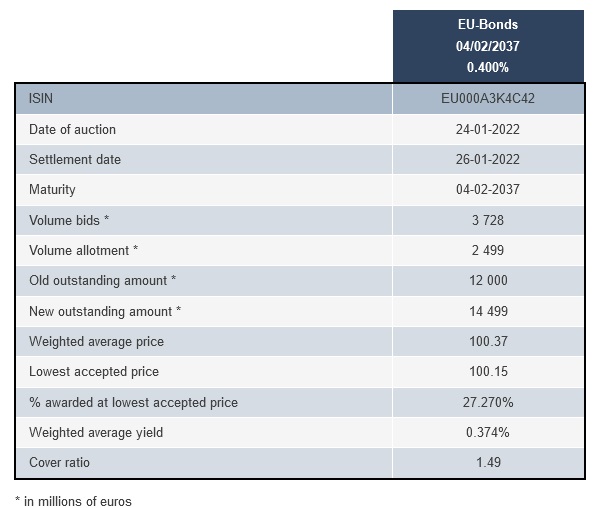

Technical details about the transaction are available below: