Using Blended Finance to Navigate the Pandemic: How an Innovative Funding Vehicle is Helping SMEs Survive COVID-19 and Advance the SDGs

To reach the United Nations’ 17 Sustainable Development Goals (SDGs) by 2030, emerging economies require US $3.3 to $4.5 trillion per year in funding, but they face an estimated annual shortfall of US $2.5 trillion. The ongoing COVID-19 pandemic and its disproportionate impact on emerging markets further threatens SDG financing, with COVID-related expenses and reductions in resources adding an estimated US $1.7 trillion to the existing funding shortfall in 2020 alone. Although it’s unclear how long COVID-19’s impact on expenses and available funding will continue, it’s undeniable that the crisis has further set back progress toward the SDGs, which were already behind schedule even before the pandemic began.

Blended finance is one critical tool to mobilize additional sources of capital for the SDGs. The approach uses catalytic capital from public or philanthropic sources to increase private sector investment in emerging markets. Private sector investment barriers in these markets typically include high perceived and real risk, and poor returns for this risk relative to comparable investments. However, when public or philanthropic investors provide funds on below-market terms or as credit enhancement (through guarantees or insurance, for example), they lower the overall cost of capital for businesses while providing an additional layer of protection to private investors. This type of financing structure can expand investable opportunities in emerging markets, leading to more development impact. As of September 2021, aggregate blended finance flows totaled over US $160 billion, with annual flows averaging around US $9 billion since 2015.

In the context of COVID-19, blended finance vehicles to support small- and medium-enterprises (SMEs) in emerging markets have the potential for outsized impact. SMEs have been critical to scaling solutions that promote sustainable development outcomes, such as access to energy, income-generating opportunities and improved nutrition. During the pandemic, these companies have faced lockdowns, fundraising delays, supply chain disruptions and other challenges. Such issues can be catastrophic to nascent businesses, resulting in insolvency, lost jobs, business failure and even the failure of entire sectors, if relief funds are not deployed quickly and effectively.

An innovative blended finance facility for SunCulture, a Kenya-based company providing affordable solar-powered irrigation solutions to smallholder farmers, presents a case for how this financing approach can mitigate risks brought about by COVID-19, attract private investment and bolster development impact. The article below will explore how an innovative facility has helped SunCulture navigate the pandemic, and how blended finance can be leveraged to help SMEs and other businesses recover from the crisis and contribute to the SDGs.

How COVID-19 Has Intensified Risk for SunCulture

Since 2012, SunCulture’s solar-powered irrigation equipment has enabled life-changing improvements for smallholder farmers by saving them time while increasing their yield and income. To increase the access to and affordability of their products, SunCulture offers a “Pay-As-You-Grow” (PAYGrow) model. The model finances the customers’ purchases upfront, giving farmers immediate access to the equipment with the flexibility to pay the company back over time.

However, when the COVID-19 pandemic hit, SunCulture was forced to pause their PAYGrow loans. Since PAYGrow is cash-negative upfront, pausing PAYGrow loans acted as a cash conservation measure for the company. Pausing these loans was also a strategy to protect the credit quality of the PAYGrow portfolio. Due to the economic uncertainty created by the pandemic, this portfolio of customers became increasingly risky for SunCulture. However, managing this risk by increasing prices or excluding potential customers would have been counterproductive to the company’s mission of scaling life-changing technologies that solve the biggest daily challenges of the world’s 570 million smallholder farming households.

As Henry Clarke, CFO of SunCulture, explains, “About 15% of our customers will buy our product with cash, so we’re financing the other 85%. If we modelled our business without the PAYGrow option, that 15% might jump as high as 25%, but that still means 75% lost sales – and lost opportunity for those who wouldn’t have access to our system. That’s pretty unsustainable for where we are now, and where we need to prove we can get to with our business model.”

Using a Second Loss Guarantee Facility to Mitigate Risk and Mobilize Investment

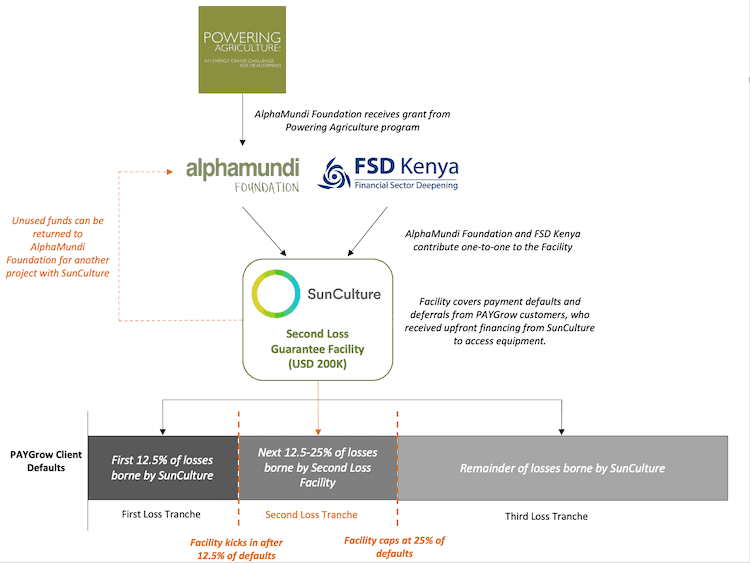

To mitigate risk and help SunCulture restart its PAYGrow portfolio, AlphaMundi Foundation and Financial Sector Deepening (FSD) Kenya structured an innovative blended finance facility with support from the Powering Agriculture: An Energy Grand Challenge for Development program. The program, a multi-government partnership between the United States Agency for International Development (USAID), the Swedish International Development Cooperation Agency and the Deutsche Gesellschaft für Internationale Zusammenarbeit, was designed to accelerate the development and deployment of clean energy solutions for increasing agricultural productivity and/or value in developing countries.

The US $200,000 facility, which includes $100,000 from AlphaMundi Foundation and $100,000 from FSD Kenya, is structured as a Second Loss Guarantee Facility that provides a financial cushion for the expected increase in customers who default on their PAYGrow payments. Operationally, the Facility covers cash flow shortfalls from the total SunCulture PAYGrow portfolio of existing loans and new loans. For SunCulture, this means less risk in the portfolio and enough confidence to restart their PAYGrow loans. For clients, this means access to payment deferrals and other options in the short term, along with improved food security and sustainable incomes during the ongoing COVID-19 crisis.

Lisa Willems, Managing Director at AlphaMundi, explains how this mechanism is better than a direct cash infusion or a traditional grant: “A check would just go to the company’s cash flow. But this company isn’t yet profitable, so that check would just evaporate. But by linking capital to the Second Loss Facility, we are able to remove the risk of increased defaults and cash flow shortages – which then increases investor comfort. As risk increases, Sun Culture’s debt investors would naturally look for compensation from this risk in the form of higher interest rates. However, by offering a cushion at a critical time, we were able to give investors some additional comfort about the risk profile of the investment while saving the company money in interest payments.”

The Second Loss Guarantee Facility also gives AlphaMundi and FSD Kenya the possibility to get their money back, meaning they could repurpose the same money for use in another project and amplify their impact. “We structured it in a way that [SunCulture is] incentivized to make loan collections. If they do, the money comes back to us and we can do another project with them. But if it doesn’t, it still served a valuable purpose,” Willems explains.

Despite the uncertain territory that this new type of financing represents, initial results of the Facility show its promise. By reducing the potential for default in SunCulture’s PAYGrow portfolio, the Second Loss Facility increased investor comfort enough to catalyze significant private investment in the company. In February 2021, SunCulture closed a PAYGrow and Inventory Working Capital Facility with a US $11 million commitment. The money will support the growth of the PAYGrow portfolio and the company’s strategic plan well into 2022. Clarke praised this achievement, stating, “The Second Loss Guarantee was an important facilitator.”

This kind of partnership, which involves a relatively small amount of blended finance, is rare in the SME space. Transactions in the hundred-thousand-dollar range are viewed as a hard sell, according to Willems, because the types of financial institutions willing to engage in concessionary capital projects aren’t interested in amounts that small. “We appreciate that USAID was willing to be flexible with us on doing this. They could have said no,” she says. “We hope the Facility sets an example to other development financial institutions that might be able to donate more funds specifically for larger blended finance facilities for SMEs.”

A Catalytic Opportunity to Scale

Seeing the catalytic impact, the partners involved in this deal urge more donors and investors to get involved. As Michael Mbaka, Senior Innovations Specialist at FSD Kenya says, “Development partners and public institutions can play a big role in working with the private sector to increase access to development capital through blended finance.”

Clarke adds, “It is a trickier concept than just getting a grant for something tangible. Here we’re being financed for people not paying us and it requires a lot of modelling for potential scenarios. It isn’t something that a lot of institutions are used to doing, but this type of financing is just as powerful – and it’s one we need more of.”

When asked what advice she would give to donors looking to explore blended finance, Willems offers some key insights: “Think about it: What is the overarching impact goal? Are you using the right tools to achieve that goal? If you’re traditionally only using grants, be open-minded about other ways to use those dollars and make that money go further.”

Learn more about SunCulture’s impact on smallholder farmers by visiting their website or watching the videos on their YouTube channel.

Learn more about the results of the Powering Agriculture: A Grand Challenge for Development project on the USAID website.

Margi Goelz is a Masters student in the Global Human Development Program at Georgetown University’s School of Foreign Service, and Bridget Bradley is a Communication Specialist at Tetra Tech.

Photo courtesy of Maximilian Weisbecker.

Sorry. This form is no longer available.

- Categories

- Coronavirus, Energy, Investing