The wind industry has reacted with shock to new NSW draft guidelines that effectively say no to new wind projects in the state, including in the renewable energy zones that were supposedly created to accommodate the technology and smooth the transition away from coal.

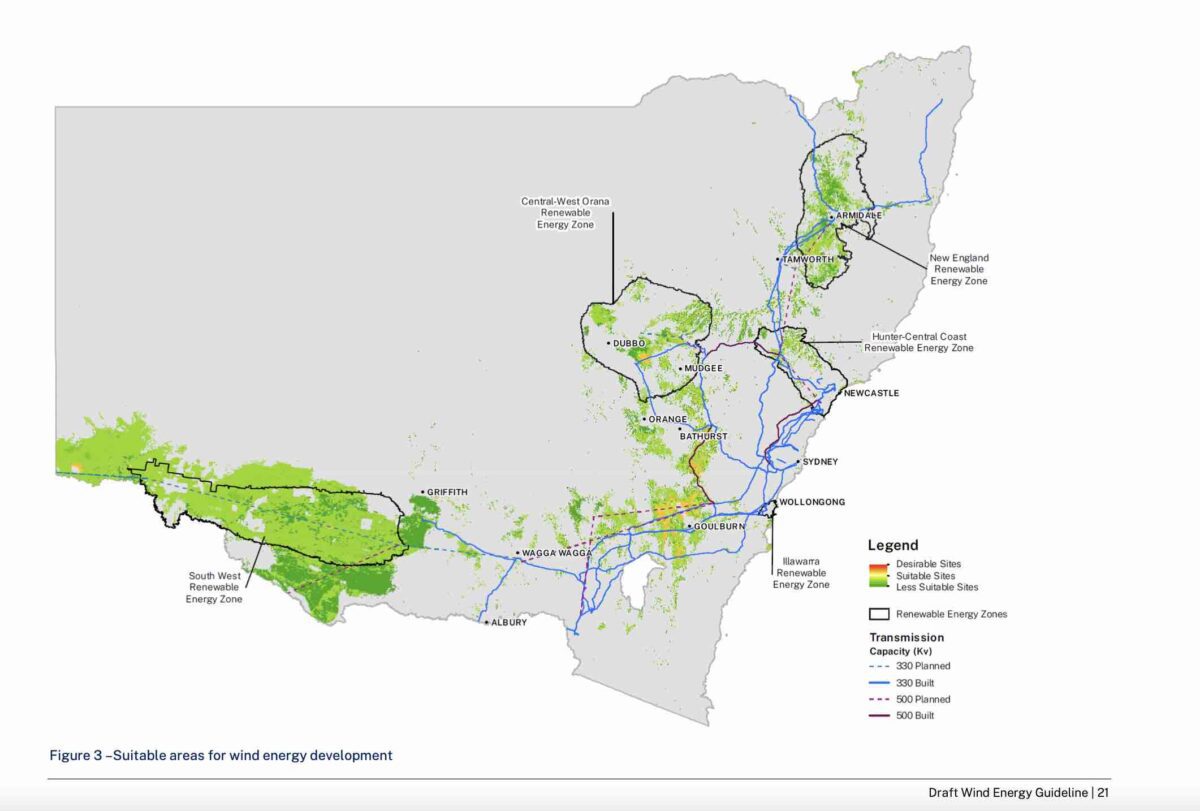

The draft guidelines, and particularly a map that effectively shut the gate on new wind farms across the state, has stunned the industry, which says NSW has become “the hardest place to do business in the world” and warns that investors will move either interstate or overseas.

At the heart of the draft guidelines is a new ruling that requires a 2km setback from any building on any adjoining property. This could even be a simple “plan” for a building, and developers warn that it provides an easy right to veto for activists opposing large wind projects.

The NSW department of planning, which has only approved one new wind project in the last three years, overlaid this new guideline on a map of NSW, resulting in vast tracks of the state being deemed “less suitable”, and only a few isolated spots deemed “desirable” for new wind projects.

“Yesterday was a very bad day for the direction of renewables in NSW,” said Simon Currie, a director with Energy Estate which is involved in a host of projects in NSW, and other states.

“This is not a little thing. NSW has always been difficult to operate in, but we choose to be here. After this, why would we stay?

“We are living in an existential climate crisis. Clearly there are people who want Narrabri [the controversial Santos gas fracking project] to happen, who do not believe renewables are up to the task.”

The proposals add to a series of setbacks to the NSW renewable energy roadmap in the past 12 months, including the recent delay in the tender for “access rights” to new renewable energy zones, particularly the first one off the ranks at Central West Orana.

Developers and investors warn that the delays in planning, access rights, transmission, connections and investments could leave NSW with no choice but to pay big money to delay the planned closure of the 2.88GW Eraring coal fired power generator, the biggest in the country which is now scheduled to close in August, 2025.

Simon Corbell, the former ACT energy and climate minister who now heads the Clean Energy Investor Group, which represents many big investors, says his members have raised serious concerns about the impact of the draft guidelines on clean energy development in NSW.

“At a time when we need to accelerate regulatory timeframes these new proposals send the wrong messages to industry and will make new project development more difficult,” Corbell told RenewEconomy.

“CEIG will be raising these concerns with the NSW government and is making planning reform in NSW a priority focus on behalf of our members.”

Some developers suggest that delay may be the intention of the NSW Labor government, or at least sections of it. They say that major energy consumers are being frustrated because they cannot secure new projects to write long term contracts for lower cost and cleaner energy as they seek to decarbonise their products.

“It’s a shemozzle. I think it’s deliberate,” said one of many developers who chose to speak off the record because of the sensitivity of the issue.

“It’s just farcical and laughable that this is going on,” said another. “It has created a planning monster. It is just awful … it’s almost worse than anything previously … it could have been Barnaby [Nationals MP Barnaby Joyce] writing these rules.”

Even Adam Marshall, the state Nationals MP for the Northern Tablelands, which overlaps Joyce’s New England electorate, called for clarity from the state government.

“It’s very clear the left hand of government does not know what the right hand is doing,” Marshall said.

“We now effectively have two government departments saying two completely contradictory things about the future of our region – it’s not only embarrassingly amateurish, but also very concerning for our community.”

The draft setback rules are particularly problematic. They allow objectors on neighbouring properties to seek “building certificates” for a proposed “dwelling” – something that could be obtained in a matter of weeks at a cost of just $5,000, and not actually be built – and which could cause a 2km setback.

RenewEconomy understands that several wind projects that are currently going through the planning process in NSW have been referred to panels because of such actions, made after the wind farm application, that threaten to make the projects impossible to build, or uneconomic.

The fear is that new draft guidelines will legitimise this process, and make it relatively easy for wind farm opponents to stop projects in their tracks.

NSW actually needs around 8GW of new wind farm capacity over the coming decade to make up for the anticipated closures of the Eraring, Bayswater and Vales Point power station, and the potential early closure of the Mt Piper coal fired generator.

Delays in transmission projects and the roll out of renewable energy zones, the lack of new wind farm approvals, and the increasingly shrill opposition led by the federal Coalition and conservative media, along with the push for nuclear energy in some quarters, is now raising doubts about whether this can be achieved.

A slow down in wind projects in NSW would also make it more difficult for the federal Labor government to reach its stated target of 82 per cent renewables for the country by 2030. That target requires an acceleration of new wind and solar investment, not a slow down.

Steve Jackson, the managing director of BEA Renewables, described it as the “banana rule” in a post on LinkedIn – Banana being an acronym for “Build Absolutely Nothing Anywhere Near Anyone/thing.”

“Fingers crossed we don’t end up in a situation where our existing generators fail and we haven’t been able to replace them prior due to the search for Banana rainbow unicorns,” he wrote.

Others agreed: “This is nothing to do with planning for the best locations, and everything to do with politics and vested interests in the fossil industries,” wrote retired wind energy and grid connection engineer Peter Thomas.

Another senior project developer described the new visual guidelines as “non-sensical.”

There was also concern about the proposed new payments to communities, which would amount to $850 per megawatt per annum for solar farms (or about $85,000 a year for a 100MW project), and $1,050 per megawatt per annum for wind farms (or about $105,000 a year for a 100MW project).

These payments will be over and above any arrangements between a project developer and host landowner.

“Buying ‘social license’ never works and mandating the need to do so makes it harder to achieve not easier,” said one developer.

Others pointed to the new need for “templates” on agreements between land owners and neighbours. “Why does DPE want to add yet another document to the process,” said one.

See also: NSW blots out nearly entire state for wind projects – few areas deemed “desirable” for turbines

And: Wind and solar projects face hefty new fees as NSW seeks to accelerate planning process

Note: This story has been updated to make clear the new guidelines are draft, and to include comment from Adam Marshall.