French renewable and storage developer Neoen expects to sign more “baseload renewable” contracts as it rolls out more battery projects and kicks off its landmark deal to supply power to one of the world’s biggest mines.

Neoen is already the biggest developer of big battery storage projects in Australia, having built the very first at Hornsdale, and adding the country’s largest, the Victoria Big Battery, and another at Bulgana.

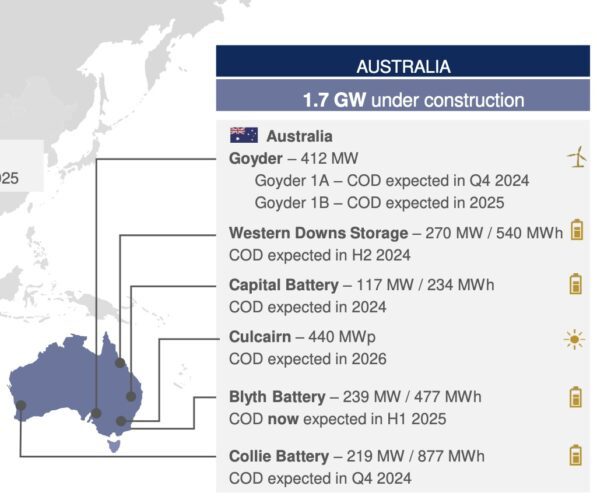

It is currently building five new big batteries – including the Collie stage 1 and the newly announced Collie 2 projects that combined will be the biggest in Australia at 560 MW and 2240 MWh, and more batteries at Western Downs in Queensland, Capital in Canberra and Blyth in South Australia.

The 239 MW, two hour (477 MWh) Blyth battery is one of the most interesting because it will help Neoen deliver a 70 MW “baseload renewables” contract to BHP’s giant Olympic Dam mine, firming up part of the output from the first 412 MW Goyder wind farm that will be the largest in the state when complete in 2025.

Neoen CEO Xavier Barbaro told an investor call after the company’s first quarter revenue results on Thursday that more customers are looking for “base-load” renewables contracts to meet their energy needs.

He said this will give Neoen the opportunity to combine the output of its large Australian wind and solar portfolio with its growing fleet of big batteries, adding that such contracts command a “price premium” from the projects.

He noted that the Blyth battery should be completed on time in the first half of 2025, while the delayed 117 MW, two hour Capital battery should be commissioned by the end of 2024 and the 270 MW, two hour Western Downs battery should also be complete later this year.

Barbaro was also quizzed about the details of the new capacity contract for Collie 2, which will deliver 300 MW and four hours storage to help time shift the output of rooftop solar to the evening peak.

A similar contract for the first stage of the Collie battery last year prompted a significant upgrade of the company’s earnings forecasts for 2025, when the two-year contract starts, but there has been no such forecast accompanying the new contract, suggesting that the second tranche is not quite as lucrative.

Barbaro refused to comment when asked in the earnings call, saying the price agreed with the Australian Energy Market Operator remains confidential. “It’s a very healthy project,” he said. “Battery projects have higher IRRs (internal rates of return) than wind and solar … and we will have recouped an important part of our capex with those contracts.”

He said the company would be happy to extend the contracts with AEMO. “In two years time there will still be the need (for time shifting). We could extend the contract with those batteries, or … maybe some day we can have Collie 3.” He also said the Collie batteries will participate in the frequency and control markets in W.A.

Neoen’s revenue for the first quarter revealed an eight per cent fall to €141 million, which Barbaro said reflected the fact that several newly built projects, such as the 400 MW Western Downs solar farm, had now transitioned to their long term power purchase contracts rather than tapping often higher priced merchant markets.

Around two thirds of the output of Western Downs is contracted to the state-owned CleanCo, which also has a PPA in place for the newly commissioned 157 MW Kaban wind farm in the north of the state.

Neoen rarely releases details of its PPA prices, but it did say that its tender wins for 119 MW of new solar farm capacity in France through government auctions came at an average tender price of €81.9/MWh, which translates to $A146/MWh. This is believed to be more than double the price of solar PPAs in Australia.

Barbaro explained the difference is because of the high cost of connections in France, which he said is greater than the cost of the solar modules themselves.

In the latest quarter, revenues from its fleet of battery storage assets was marginally higher at €16.5 million, with the Victoria Big Battery earning more because of various grid events, including the storms in February that tore down a major transmission line, and earnings falling at Hornsdale due to lower activity in the FCAS market.

Barbaro also confirmed that Neoen will seek to sell minority stakes in some of its Australian projects as it seeks to recycle local capital for investment in new projects. Neoen currently has 9.1 GW of capacity operating or under construction, and aims to reach 10 GW by 2025.