Analyzing Menstrual Health and Hygiene Through a Market-Based Lens: A New Report Assesses the Landscape in the Global South

Around the world, roughly 1.8 billion people menstruate — a group that comprises over 20% of the global population. Over 300 million people are menstruating on any given day. (Since some of these individuals don’t identify as female, we’ll refer to them as menstruators in this article.)

Yet despite the vast number of people who experience menstruation, and menstrual health and hygiene (MHH)’s link to multiple Sustainable Development Goals (SDGs), MHH has long been — and still is — an overlooked topic among researchers and across the global development sector. Very few studies have looked systematically at MHH behaviors and solutions, and while some have examined market solutions for low-income menstruators, none have done so at a systemic level. This has contributed to a lack of knowledge about the global market for all types of menstrual products — both reusable and disposable.

To address this knowledge gap, Hystra recently published a new research report using a market-based lens to analyze the MHH landscape in the Global South, supported by the Bill & Melinda Gates Foundation. Below are some key takeaways from this research.

Positive and Negative Trends in Access to Disposable Menstrual Products

In the eight countries covered by this report (Bangladesh, Ethiopia, India, Kenya, Nigeria, Senegal, South Africa and Pakistan), the penetration of disposable pads is increasing, with an expected 14.8% compound annual growth rate between 2022 and 2026. This growth is driven by younger generations that have grown up with access to this product. Based on our analysis of available data, we calculate that over half of the menstruators in these eight markets use disposable pads at least some of the time. In India, penetration of menstrual hygiene products (primarily disposable pads) among menstruators is 58%, but it rises to 78% among 18-24 year-olds. The growth of this market shows that low-income menstruators are both ready to pay for MHH products, and willing to prioritise them over other essential products like shampoo, toothpaste and food — a trend that’s supported by qualitative consumer research.

Falling prices have also contributed to this growth. According to market research conducted for this report, retail prices of quality disposable pads have decreased in recent years to as low as US $0.07-0.08 per pad in India and Kenya, thanks to increased competition. Multinational corporations that benefit from large economies of scale — Procter & Gamble in particular — dominate most of the markets we researched. But local companies increasingly challenge these bigger players by leveraging their own existing assets (e.g., distribution channels) to launch new affordable brands, thereby putting pressure on prices. For example, SMC Enterprise Ltd sells Joya pads in Bangladesh that are 10-20% cheaper than the market-leading brand Senora, helping them earn a 30% market share in Bangladesh in under 10 years, according to data shared by the company.

Further, a few pioneering businesses have developed improved, affordable disposable pads with additional benefits for low-income menstruators. These brands address consumers’ key requests in the design of their products. For instance, Joya offers quality, affordable “belt” products (which don’t require underwear); NIA, the disposable pad brand of the NGO ZanaAfrica in Kenya, has created longer-lasting pads; and Aakar Innovations, an Indian disposable pad company, offers compostable pads at equivalent prices to local market-leading products.

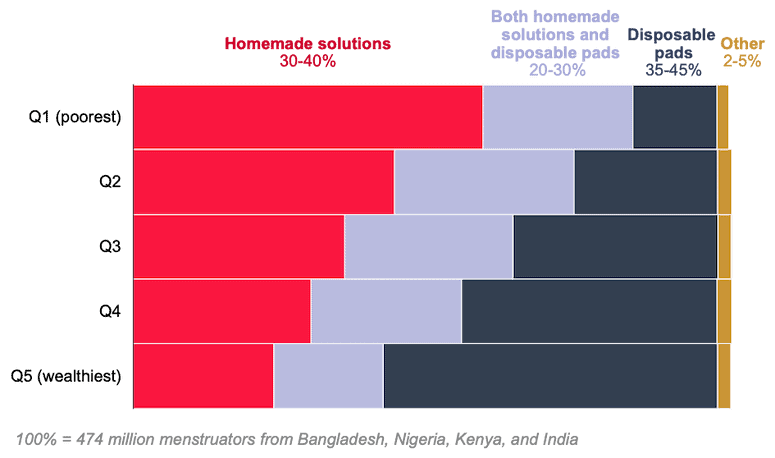

Despite this positive trend, disposable pads are still an unsatisfying solution for most menstruators in the Global South due to cost, quality and disposal challenges. Today, over 27% of menstruators in the world still lack access to products and adequate facilities for MHH management. And even menstruators with access to disposable pads do not see these products as a perfect solution: According to Hystra’s analysis of data from several sources, menstruators using commercial solutions use, on average, only 4.3 sanitary pads per menstruation, which is well below the commonly cited estimate of 12-15 pads required. Beyond affordability issues, existing research and consumer insights point to low quality as a key reason that disposable pads are used only part of the time. In Kenya, for example, ZanaAfrica’s internal research found that 95% of menstruators report burning and rashes, either due to poor quality pads or extended use. In addition, given cultural taboos that prevent menstruators from disclosing their menstruation to others, disposal challenges (e.g., shared toilets without bins and a lack of waste management in rural areas) often deter more frequent usage. As a result, an estimated 20-30% of menstruators use a mix of disposable pads and homemade solutions, as shown in the figure below.

Menstruators in four countries of the Global South, segmented by products used, based on Hystra’s analysis of data from Bangladesh, India, Kenya and Nigeria

Reusable Menstrual Products Have Potential, But Haven’t Scaled

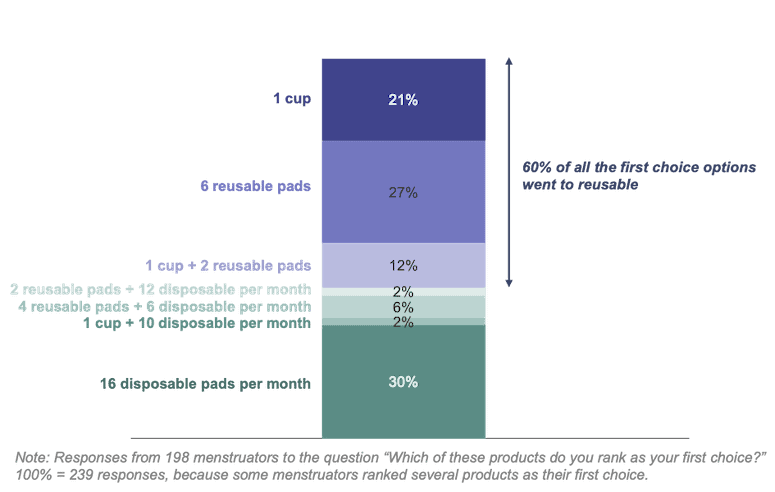

Hystra’s report found that over half of menstruators rank a reusable option like menstrual cups or reusable pads as their preferred theoretical solution, believing these products would solve the pain points of disposable pads. Cups and reusable pads are three to 15 times cheaper per use than disposable pads, and although they require washing, they address the disposal challenge. Qualitative consumer research conducted for this report shows that these products generate significant theoretical interest when menstruators know their benefits and prices. As shown in the figure below, when menstruators ranked their first choice of menstrual product (after being informed of their respective prices), 30% preferred disposable pads, while 60% selected reusable options (27% for six reusable pads, 21% for a menstrual cup, and 12% for a cup combined with two reusable pads).

Preferred product(s) to manage menstruation among 198 urban and semi-urban menstruators: 51 in Bangladesh, 45 in Kenya, 52 in Pakistan and 50 in Senegal

Looking at actual sales, we see early proof of consumers’ interest in menstrual cups and reusable pads, though these products are yet to be scaled up. Leading disposable pad companies in the Global North have started branding their own cups, reflecting growing interest from consumers in those countries, and the product has begun to demonstrate its appeal in the Indian market as well. According to sales data shared by the company, Sirona, an Indian feminine hygiene brand, has sold 1 million menstrual cups to middle- to high-income consumers since 2015 (400,000 in 2022 alone), thanks to a set of digital marketing tactics like online tutorials. As far as reusable pads are concerned, one company — AFRIpads in Uganda — has demonstrated consumers’ willingness to pay and has achieved some repeat purchases at a modest scale, but it has not yet built a business model that will enable it to sustain those sales numbers. At its peak, as one of the only reusable pad producers selling this product in retail in the Global South, the company managed to sell 230,000 two-pad packs annually, reaching 2% of Ugandan menstruators per year.

Understanding the Lack of Investment in Reusable Menstruation Products

Despite growing consumer interest, only 2-5% of menstruators in the Global South use reusable products in 2023, according to our analysis of the existing data. They mostly include menstruators who benefit from donated products (e.g., pads from AFRIpads or Real Relief, cups from Ruby Cup) in emergency or school settings, and, to a lesser extent, menstruators who purchased products in countries where they are available (e.g., AFRIpads So Sure pads in Uganda, Real Relief Safepads pads in India, Bangladesh and South Africa, and Sirona cups in India).

Low private sector investment in reusable options is a key driver of the discrepancy between theoretical demand and actual consumer purchases. Reusable products represent significantly lower overall costs for menstruators, and thus they offer a significantly smaller commercial market for private players when compared to disposable pads. As a result, it is no surprise that reusable products have received less than 1% of marketing and research and development investment in the MHH market, according to Hystra analysis based on market data and interviews. This is clearly insufficient, since these products require some behavior change, with first trial remaining a key barrier to uptake among menstruators accustomed to homemade solutions or disposable pads.

Additionally, despite the number of menstruators in the Global South, MHH has long been — and remains — an overlooked topic for donors, one that struggles to find a home between related SDGs. MHH has causal links with good health (SDG 3), quality education (SDG 4), gender equality (SDG 5), and clean water and sanitation (SDG 6). Yet it is not explicitly articulated in any of the SDGs. As a result, MHH is a secondary topic for many donors, touched on as part of WASH, sexual and reproductive health and rights, and/or gender equality initiatives, but a main priority for none.

This general underinvestment is at least partly due to the complexity of the menstrual health issue, which cannot be solved by product-centric approaches alone, but rather requires a range of products, coupled with education to reduce the taboo and stigma around menstruation. Private and philanthropic approaches around menstrual products have tended to sell or give away one type of product at a time — with few exceptions — rather than offering a full choice of solutions to menstruators. What’s more, they have not always provided the required instructions to use these products. This results in lower uptake, since menstruators typically prefer a mix of solutions which evolves between their menstruations and throughout their life stages, and new products require support to encourage adoption. Pioneers such as Her Ground in Pakistan or Sirona in India have addressed this challenge by taking a menstruator-centric rather than product-centric approach: They now offer a full suite of product options to menstruators, together with educational videos. Yet for now, this is a new — and still too marginal — trend.

Further compounding the complexity of the issue, a final reason for underinvestment in reusable MHH products is the lack of large-scale data available on the topic. This lack of data makes it difficult to quantify menstruators’ preferences and interest in reusable products, the market potential of these products for private players, and the potential social and economic returns on government or philanthropic investments in these solutions. Beyond hampering investment, this lack of data can also lead stakeholders to make decisions about these products based on personal experience, anecdotal evidence or their own opinions.

Public, private and philanthropic players each have an important role to play in enabling the development of the market for reusable MHH solutions. Combined with efforts to improve the quality of all MHH products and increase access to adequate education to debunk remaining myths and stigmas around menstruation, this market development would help ensure that low-income menstruators have a real choice of MHH solutions — along with the freedom to act on it.

To find more details on our research and recommendations, access the full report here.

Note: This article is based on research funded by the Bill & Melinda Gates Foundation. The findings and conclusions contained within are those of the authors and do not necessarily reflect positions or policies of the Bill & Melinda Gates Foundation.

Note: This article was in NextBillion’s Most Influential Articles of 2023 contest.

Lucie Klarsfeld McGrath is a partner at Hystra and co-founder of the Global Distributors Collective; Louise Berthault is a consultant at Hystra; Jeanne Charbit is a project manager at Hystra.

Photo courtesy of Hystra.

- Categories

- WASH