Climate tech investment is booming. Since 2013, there have been more than 6,000 investors (private, public and philanthropic) in climate tech startups, and 2022 alone saw more than 3,000 venture capital investments into climate tech. Over the past decade, there has been an estimated 40x increase in global climate-focused venture capital. We now have climate unicorns and venture funds with hundreds of millions – or multi-billions – of capital committed to climate.

Even the annual “COP” global climate gathering, which has traditionally been for governments and adjacent organizations, is attracting entrepreneurs and tech investors at its events. To wit: COP28 organizers have launched at least three major initiatives in the past month to support climate tech entrepreneurs.

That said, we are still in the early days. Technologies and their ecosystems develop gradually and hit speed bumps – even Silicon Valley took decades to become what it is today, and there are still plenty of challenges. What’s different with climate tech is the urgency: we have to minimize the mistakes and course correct much more quickly. The US Inflation Reduction Act, for example, has been called a “huge, uncharted experiment.” With temperatures steadily rising and a narrowing window to act, we need to align the right pieces now, and fast.

Our recent report, The Climate Tech Opportunity, published by the Oxford Climate Tech Initiative in partnership with the Skoll Centre for Social Entrepreneurship, surveyed more than 140 climate tech practitioners and interviewed more than 60 experts from over 20 countries – what we believe is the largest such study to date.

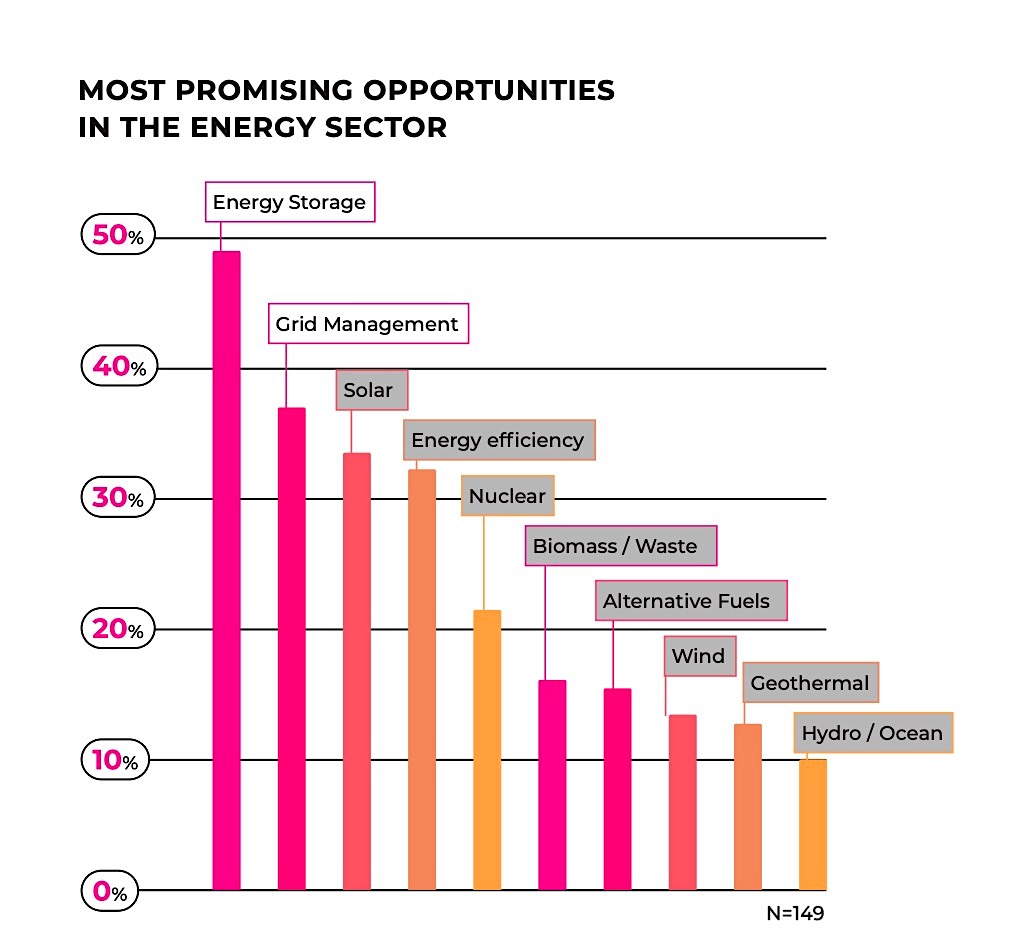

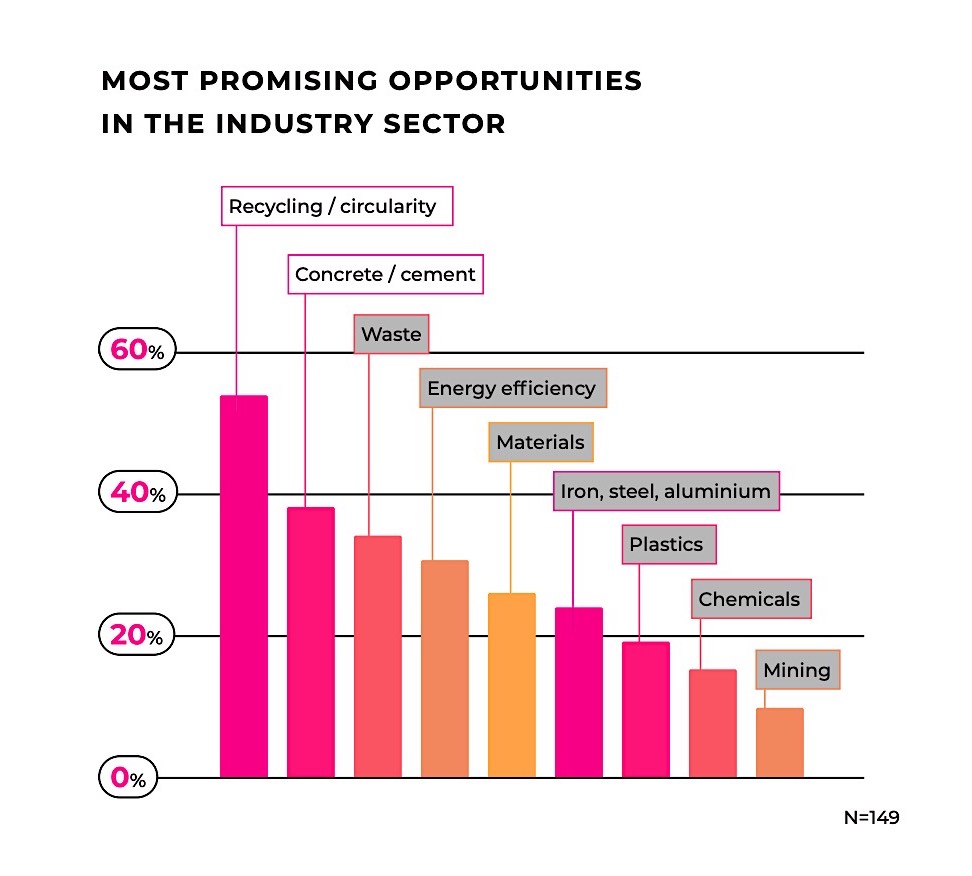

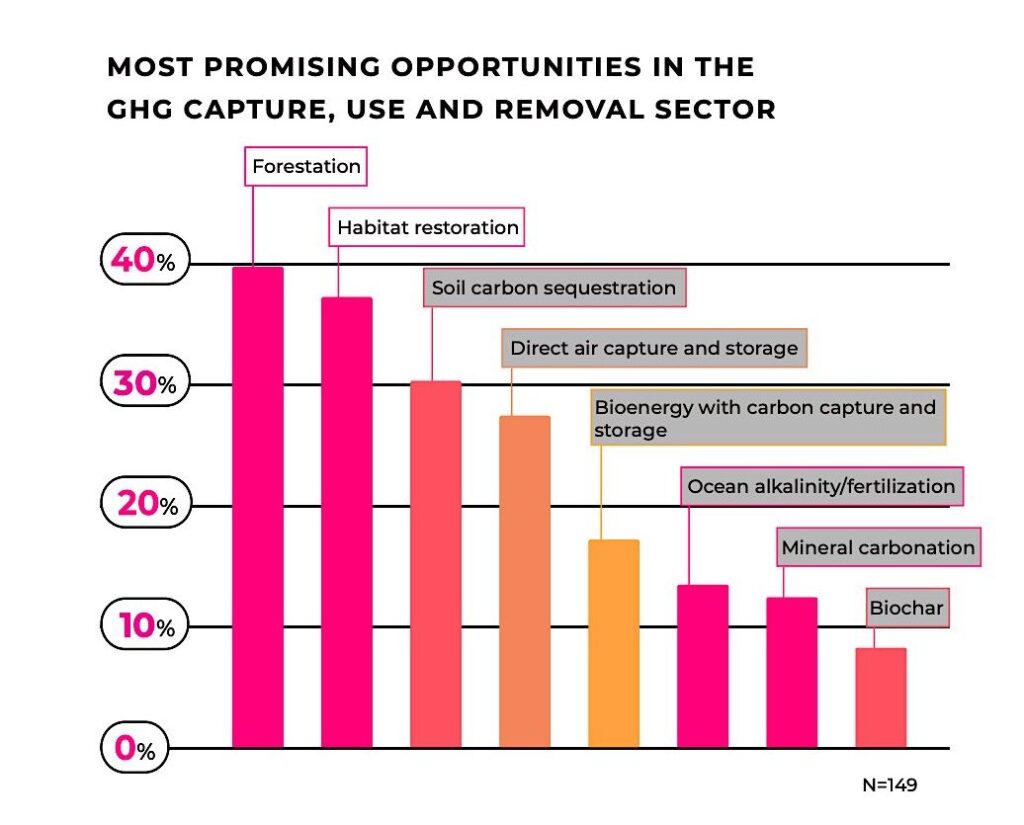

These experts pointed to the biggest opportunities they see now, including storage and grid management in the energy sector; recycling and low-carbon concrete and cement in industrials, and forestation and habitat restoration in carbon removal.

They also identified a range of areas where the climate tech ecosystem is still maturing and needs further support, and provided insights into building better programs, strategies, platforms and policies to support climate innovation.

More funding and more funding instruments

The Climate Policy Initiative suggests that climate finance (including venture capital and other types of funding) must increase from $640 billion in 2020 to $4.35 trillion annually by 2030 – and then to almost $6 trillion annually by 2040 – in order to maintain the 1.5 °Celsius target. To put this number in perspective, climate tech VC alone clocked in at around $70 billion in 2022. While it represents just a tiny slice of overall climate funding (development finance institutions, banks and corporations, for example, make up the bulk) climate tech venture funding would need to grow up to 60-fold to fill the gap.

On one hand, this suggests that we need more venture investors, which is true, but we also need different types of funding. Grants, project finance and varying debt instruments, among others, are in high demand, yet low supply when it comes to climate tech. Climate startups that begin as R&D projects are not ready to absorb dilutive funding, just as a profitable business might opt for debt funding. The point being, the climate capital stack is diverse and we need to increase the supply of instruments across the board.

Corporate and government support

Corporations and governments are unique in the climate tech ecosystem in that they have a rare ability to make and shape markets, but can also play an important role in de-risking technologies that are not yet ready to go to market. However, we need governments and corporations to play a bigger role. Over 60% of respondents said that corporations need to play a larger role in supporting climate tech companies, through R&D funding, product testing support, market access and contracts.

Similarly, more than half of respondents said that governments need to play a larger role in enabling market access for climate tech solutions and incentivizing the adoption of new technologies. We can launch as many climate startups as we want, but without support from governments and large companies, the chances of these companies scaling is minimized.

Larger talent pool and workforce

We tend to focus on the technology and investments needed to mitigate and adapt to the realities of climate change, but it is humans that will ultimately be tasked with building these companies. Nearly 40% of respondents identified talent as a key constraint to the growth of climate tech. A wide spectrum of competencies is needed to get the equation right: engineers and designers to create products, commercialization experts to bring them to market, markets and sales people to help them reach the end-user, contractors to install and maintain new technologies, and legal experts to advise on navigating regulatory hurdles, to name just a few.

Interviewees also flagged talent gaps in emerging economies as particularly concerning, noting historical patterns of brain drain and inadequate educational infrastructure. We need to rapidly upskill people across the board to work on climate, particularly in the most vulnerable settings where there may be pre-existing labor shortages.

Reaching developing countries and vulnerable populations

Some 90% of respondents do not believe that climate tech solutions are reaching the people who need them most. The majority of climate tech funding originates from, and flows to, wealthier countries. And wealthier countries have consistently fallen short of meeting their climate finance pledges to developing nations.

Equity and inclusion is arguably more important in climate tech than in other sectors: If we do not build solutions for the entire globe, including the most vulnerable, we will likely create new problems, incur new costs and suffer more setbacks. Historically, inclusion has been positioned as a humanitarian imperative, but given the vast economic damage that climate change has caused, and will continue to cause, inclusion needs to be baked into the climate tech ecosystem.

Funding the adaptation solution set

Currently, just 7% of global climate funding (climate tech and other) is being allocated to adaptation projects, and roughly 2% was used for projects that tackle both mitigation and adaptation. Moreover, adaptation finance for developing countries is 5-10 times below estimated needs of $160 to $340 billion annually by 2030, and $315 billion to $565 billion annually by 2050. We do not know precisely how much climate tech activity is focused on adaptation, but the shortfall is clear. The majority of climate VC funding has gone to transportation, followed by energy and the built environment, all of which are predominantly mitigation-focused.

Adaptation solutions such as weather forecasting, water technology, food and agriculture resilience, and even healthcare solutions have yet to find a home in the climate VC world.

Moving forward

Building ecosystems to support technological development is a challenging, circuitous process laden with pitfalls. It becomes even more challenging when the technologies are supposed to protect livelihoods and maintain planetary stability. There is no silver bullet here – no single company, investor, technology, policy or entrepreneur who will save us. We have to take a holistic, ecosystem-wide approach, bringing in new funding, talent and partnerships at a historic pace, while ensuring that these resources are accessible to all.

We hope that these current hurdles become future opportunities, and demonstrate how the climate technology ecosystem is equal parts dynamic, inclusive and pragmatic.

_________________________________________________________________________________

Jamil Wyne is an advisor, investor and educator working on climate technology and investment around the world. He is the co-founder of Riffle Ventures, the founder of the Climate Tech Bootcamp, and a co-lead of the Oxford Climate Tech Initiative.

Minahil Amin is an executive in the Climate Change team at British International Investment, the UK’s development finance institution and impact investor. A Saïd Business School graduate, she previously worked at ENGIE Impact, helping companies and investors develop and implement their decarbonization strategies.

Dr. Abrar Chaudhury is a senior research fellow at the Saïd Business School, University of Oxford. Abrar’s research interests span challenges at the intersection of environmental management, climate leadership, sustainable development, climate finance and corporate purpose.