This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

December 19, 2022

Green Banks and the Greenhouse Gas Reduction Fund: A Preview of Sustainability Roundtable Inc.’s Full Member Advisory

The Inflation Reduction Act (IRA), a landmark piece of legislation signed into law on August 16, 2022, includes a number of provisions intended to mitigate climate change. Many have identified the uncapped wind and solar tax credits as perhaps the most significant inclusion in the bill, as well as the extensive support for tribal communities, but the IRA also establishes a well funded Greenhouse Gas Reduction Fund, focused specifically on financing clean energy innovation and more rapid adoption of green technology nationwide. This fund may pose a strategic opportunity for corporate executives, as the funding is allocated towards establishing a national green bank.

What is the Greenhouse Gas Reduction Fund?

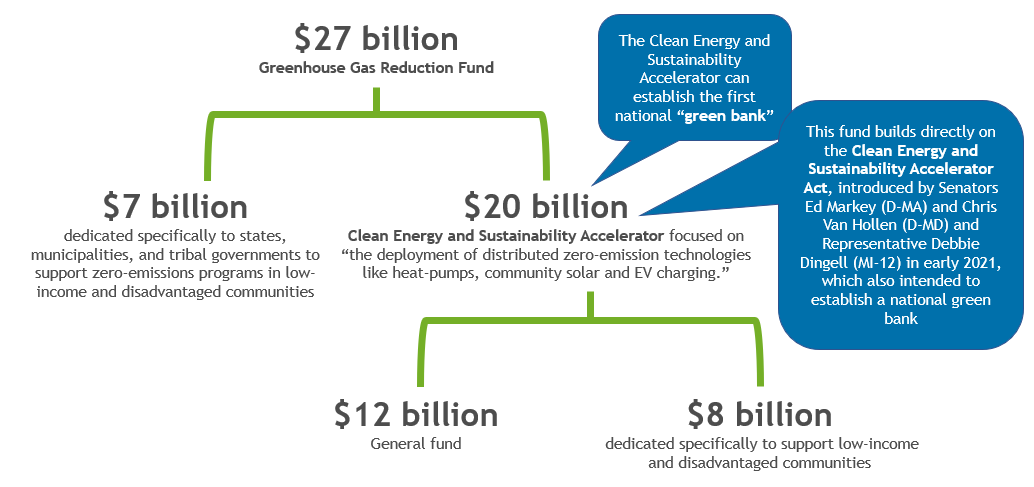

Section 134 of the Inflation Reduction Act establishes a Greenhouse Gas Reduction Fund (GGRF), accompanied by $27 billion in total funding appropriation. This fund is broken down into two major segments; $7 billion is dedicated specifically to states, municipalities, and tribal governments to support zero-emissions programs in low-income and disadvantaged communities, and the remaining $20 billion will establish a Clean Energy and Sustainability Accelerator, administered by the EPA and focused on “the deployment of distributed zero-emission technologies like heat-pumps, community solar and EV charging.” This accelerator is further split into a $12 billion general fund, and $8 billion dedicated specifically to support low-income and disadvantaged communities. Through the Clean Energy and Sustainability Accelerator, the EPA will be able to establish a national green bank.

What is a Green Bank?

Green banks are mission-driven public, quasi-public, or non-profit organizations which provide financing support for the development and implementation of innovative climate and clean energy technology. This support can take a number of forms, including direct co-investment alongside private funders, credit enhancement, or aggregated loans to support a smaller-scale set of projects. In all of these cases, the capital provided by the green bank is to be repaid, and will be redirected back into future projects (i.e. capital recycling).

Green banks establish riskier– entailing perhaps credit that is less than publicly-rated investment grade, unestablished technology, or being particularly small in scale– investments in climate and clean energy as viable, and thereby leverage private sector funding that would otherwise be hesitant. Bloomberg reports that “with taxpayer dollars and creative deals, [green banks] can help recruit private-sector capital off the sidelines and into underserved markets, leveraging as much as $8 in private funding for every $1 that comes from the government.” The US regional green banks in existence have indeed had significant success, causing $7 billion– $1.9 billion from green banks and $5.1 billion from the private sector– in clean energy investment since 2011 (as of 2020).

What Does This Mean for the Corporate Executive?

It is important to note that non-profit organizations and renewable energy developers comprise the vast majority of existing green bank awardees. Green banks’ main aim is to support organizations that cannot regularly access sufficient capital to engage in the green economy transition. There are, however, multiple past green bank-supported projects and programs that directly serve corporations, and furthermore, partnering alongside green banks can be a strategic philanthropic opportunity. A company committed to leading in high performance on environmental, social, and governance items (particularly those material to financial investors) will work to align their philanthropic giving with their broader ESG strategy. And ultimately, the establishment of this national green bank will progress the green energy transition in the United States and make clean energy more accessible and affordable for all entities.

For a comprehensive assessment of key considerations surrounding the fund, as well as guidance on how corporate executives can integrate green banking into their philanthropic portfolios, Member-Clients can refer to the Member Advisory available in the SR Inc Digital Library. The growing SR Inc team looks forward to continuing to deepen our direct assistance to Member-Client companies in regard to public private partnerships. SR Inc is especially interested in assisting Member-Clients in exploring ways to leverage green banks and similar authorities in order to best take advantage of new incentives from the Inflation Reduction Act.

As an Analyst at SR Inc, Casey supports Member-Clients with outsourced program assistance and creates original research to help clients drive industry best practice in areas ranging from ESG governance structures, ESG reporting, and innovative renewable energy procurements. Prior to working at SR Inc, Casey served as an AmeriCorps VISTA with Hawai‘i Green Growth Local2030 Hub, convening and collaborating with over 70 diverse partners across the Ala Wai watershed on sustainability and resiliency initiatives. This work involved cultivating individual relationships with community, government, and business partners, and driving forward the creation of a comprehensive project assessment tool rooted in indigenous knowledge systems and design economics. She graduated with a Bachelor of Arts in Environmental Studies from Boston College, during which time she also interned with Brookline-based organization Boyer Sudduth Environmental Consultants, providing small business clients with sustainability best practice research, as well as exposure through a number of published blog articles. Casey has also held certification as a LEED Green Associate through the US Green Building Council since 2019.

As an Analyst at SR Inc, Casey supports Member-Clients with outsourced program assistance and creates original research to help clients drive industry best practice in areas ranging from ESG governance structures, ESG reporting, and innovative renewable energy procurements. Prior to working at SR Inc, Casey served as an AmeriCorps VISTA with Hawai‘i Green Growth Local2030 Hub, convening and collaborating with over 70 diverse partners across the Ala Wai watershed on sustainability and resiliency initiatives. This work involved cultivating individual relationships with community, government, and business partners, and driving forward the creation of a comprehensive project assessment tool rooted in indigenous knowledge systems and design economics. She graduated with a Bachelor of Arts in Environmental Studies from Boston College, during which time she also interned with Brookline-based organization Boyer Sudduth Environmental Consultants, providing small business clients with sustainability best practice research, as well as exposure through a number of published blog articles. Casey has also held certification as a LEED Green Associate through the US Green Building Council since 2019.