This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

October 19, 2022

Towards Sustainable Global Leadership: How the IRA Catalyzes 21st Century U.S. Global Leadership

In October of 2022, we are in month two of what amounts to a clean energy revolution, increasingly catalyzed by the unprecedentedly ambitious and smartly overfunded Inflation Reduction Act (P.L. 117-169). The wholly partisan “IRA” extends and strengthens two other bi-partisan Acts of the 117th Congress and reflects a changed politics, as both the Democratic and Republican parties are now active supporters of a strategic national industrial policy for the U.S., which was previously (i.e. 1990-2010) championed only by the aging “labor wing” of the Democratic Party. Moreover, the IRA represents a changed approach to the politics of responding to human-caused climate and environmental breakdown, one that secures the funds needed to subsidize and accelerate the transition to a carbon-free economy from the large corporations that are benefiting the most from globalization, which has helped stall wage-earner income in developed economies and has increased global emissions.

This momentum is manifesting on the ground in the U.S. with successive announcements of new, billion dollar plus scale domestic battery, electric vehicle, clean energy manufacturing, and mineral processing facilities. These include Honda and LG Energy’s newly announced $4.4 billion battery plant, Panasonic’s newly announced second $4 billion battery plant for Tesla, Toyota’s $3.8 billion investment in a new EV battery plant, GM’s $1.25 billion investment to expand its Toledo and Indiana-based EV part manufacturing plants, and First Solar’s announcement of a $1.2 billion dollar solar manufacturing facility in the U.S. South East and incremental $185 million dollar investment in its Ohio-based plants (refer to “The Climate Economy Is About To Explode” article and additional footnotes for further examples).1,2,3 Each of these initiatives were reported within two months of the IRA being signed into law on August 16th, and all of which will be subject to the IRA’s requirement for prevailing wages and apprenticeship programs if they are to fully benefit from the policy’s scores of billions in tax credits. Over the last decade, tax credits similar to those provided by the IRA have proven effective in accelerating the growth of utility scale wind, solar and batteries in the U.S beyond virtually all forecasts, even when only being provided for a couple of years at time, which did not facilitate investment nearly as well as the IRA’s ten plus years of federal tax credits. Moreover, the IRA’s tax credits can be “stacked” on top of each other to create credits equivalent to 50% of the cost of a new utility-scale wind, solar or battery project, with credits that are both uncapped and for the first time transferrable in secondary transactions. All in all, the most respected analysts expect the IRA from 2022-2030 to catalyze a greater than tripling of the average annual investment in solar, wind and batteries in the U.S. beyond their already record shattering 2019-2021 levels.4

Four studies on estimated solar and wind capacity increases through 2030. Source: Energy Innovation report “Implementing the Inflation Reduction Act: A Roadmap for State Electricity Policy”

Four studies on estimated solar and wind capacity increases through 2030. Source: Energy Innovation report “Implementing the Inflation Reduction Act: A Roadmap for State Electricity Policy”

As President Biden might have observed, “the IRA is a BFD”; but that understates the case. Biden’s original use of the inartful phrase that the acronym “BFD” stands for became famous when he used the phrase to describe the Affordable Care Act (ACA a.k.a. Obamacare). And, although the ACA was a BFD, there is a sound argument that part of its importance was that it provided the political success necessary to make possible the IRA, an even bigger BFD in terms of needed global leadership and broader, longer lasting impact. Because although Obamacare demonstrated that America could make strides towards the universal healthcare the rest of the world’s developed nations have enjoyed for multiple generations and it reshaped one of America’s largest industries, the accomplishments of the 117th Congress and the IRA in particular reflect tectonic shifts in American politics. The IRA enables American businesses, workers and families to step beyond the success of rival countries in the already scaling technologies of a global revolution towards clean energy. This can, in turn, help provide the political and financial support needed to advance American leadership in responding to human-caused climate and environmental breakdown, which can have a positive effect on human and environmental health for centuries.

The shocking success of the 117th Congress in a bitterly divided America reflects and helps reinforce a changed but largely unrecognized new 21st century American politics as it relates to American economic competitiveness. This new politics is shaped by a united, explicitly multi-racial Democratic Party that has led on defining a new “Clean Energy” based strategic industrial policy for America. This largely urban Democratic coalition has not been large enough to act alone in creating a U.S. industrial policy for the 21st century without finding needed support from a changed and far more rural GOP. Although the GOP this author grew up in has mutated into a radically different, frighteningly nativist and authoritarian party, parts of the Congressional GOP are now finally willing to support the manufacturing-focused industrial policy championed for decades by America’s labor unions and those sympathetic to Unions in the Democratic Party. This new coalition of united Democrats and the minority of GOPers that support a U.S. industrial policy created the bi-partisan Infrastructure, Invest & Jobs Act (i.e. “Infrastructure Act”) and the bi-partisan CHIPS & Science Act, (“Science Act”), two deficit-increasing “industrial policy” bills providing a combined investment of nearly $1.5 trillion in U.S. economic competitiveness.

These two giant bi-partisan laws, however, fail to do three things needed to ensure that what is being invested in is a U.S. industrial policy for the 21st, not the 20th, century. Specifically, what the two bi-partisan bills do not do is: (a) generate the revenue for investment in a U.S. that already has historically high levels of public debt; (b) invest in the clean energy technologies including wind, solar, batteries, geothermal, green hydrogen, heat pumps and modular nuclear that many of the most informed think are already of scaling importance globally; or (c) invest to address historic underinvestment in U.S. communities of color that regularly bear the brunt of human-caused climate and environmental breakdown. Fortunately, these are three things the IRA, supported exclusively by a united Democratic Caucus, was able to deliver at astonishing scale. There is even an argument that Biden, working with what was in the end a wholly united caucus of only 50 Democratic Senators in the 117th Congress, has outdone what LBJ did to meet the challenges of his time with 68 Democratic Senators in the 89th Congress, which included a cohort of racially bigoted Democratic Senators that LBJ overcame to give America Medicare, Medicaid and the Voting Right Act of 1965.

Beyond how the IRA extends and strengthens both the $1.2 trillion bi-partisan Infrastructure Act and the $280 billion Science Act, it is also important to understand how and why the IRA also extends and strengthens Medicare (which the IRA helps keep solvent through allowing negotiation of drug prices) and the Affordable Care Act (which the overfunded IRA further subsidizes). When how and why the IRA extends and strengthens these two broad-based and popular health laws is understood, and is complimented by an understanding of why the IRA was designed to advance the Infrastructure and Science bills, it becomes possible to see how the IRA positions America to regain global leadership as the world’s most influential multi-racial democracy at a moment of planetary crisis. And at a moment when representative democracy and the rule of law is being challenged by nativist authoritarians around the world, from Russia’s barbarous invasion of the multi-ethnic republic of the Ukraine to the rise of proudly bigoted and increasingly authoritarian leaders from India, to Brazil to Turkey, to Hungary, Poland and the Philippines.

Consequently, it is helpful to ask a sequence of seven specific questions about the IRA:

- How does the IRA extend and strengthen Medicare and the Affordable Care Act?

- How does the IRA extend and strengthen the Bipartisan Infrastructure Act and the CHIPS & Science Act?

- What specifically does the IRA do to accelerate the revolution towards a 100% clean grid by 2035?

- How do the successes of the 117th Congress reflect a changed GOP?

- How does the Inflation Reduction Act reflect a changed Democratic Party?

- How does the IRA reflect changed assumptions about what is needed for the US to lead globally on climate?

- What is the likelihood the IRA will be reversed by later Congresses?

1. How does the IRA extend and strengthen the Afford Care Act and Medicare?

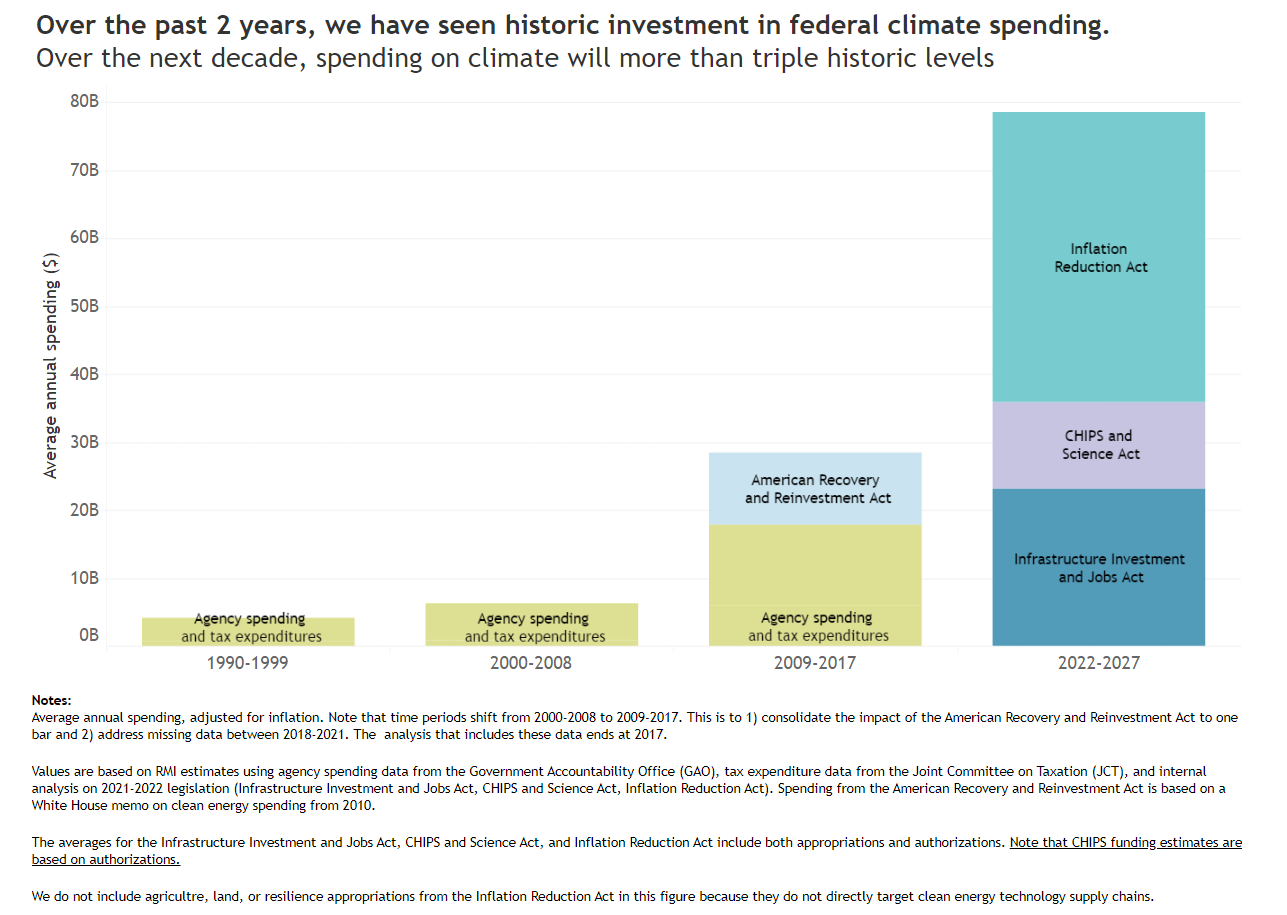

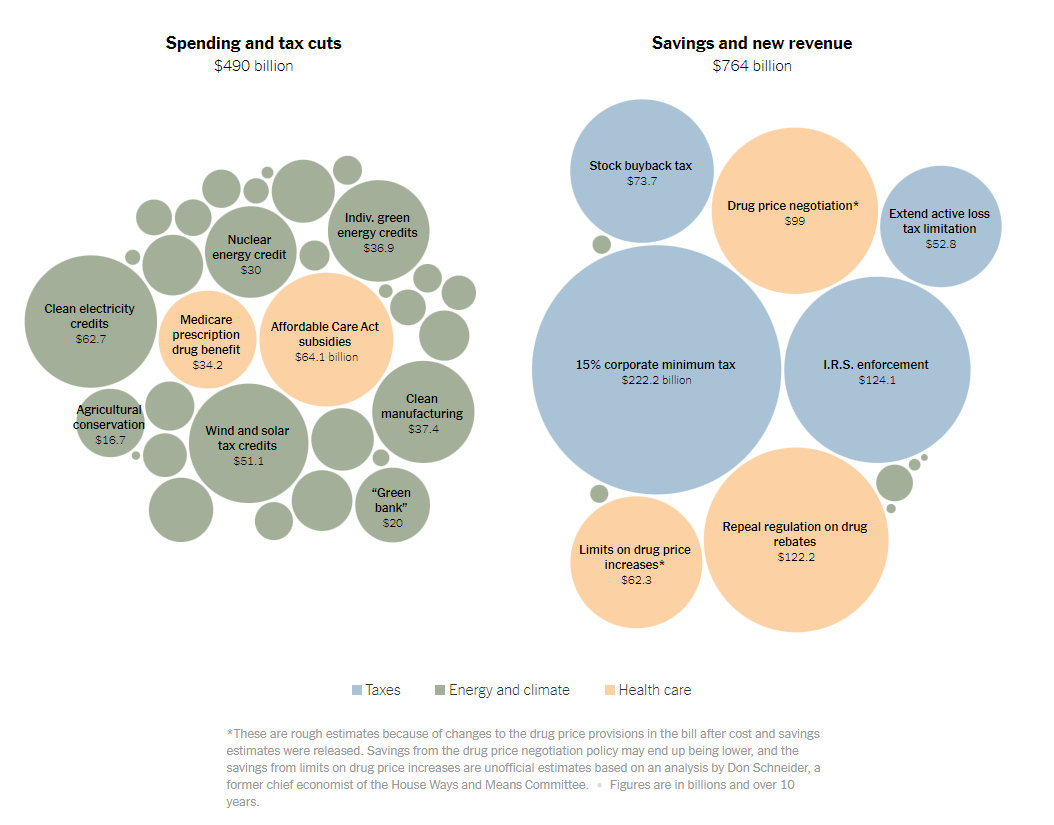

The Inflation Reduction Act represents the largest U.S. federal investment in clean energy and climate related efforts by many multiples. Respected independent experts expect it to help America – the world’s largest economy – to reduce its Greenhouse Gas Emissions (GHG) by 40% from 2005 levels by 2030, even before scoring the impact on GHG emissions caused by the outcomes financed by the IRA’s $27 billion “green bank” and more than $365 billion dollars in authorized loans, credits and grants for clean technologies. But what may be most impressive about the IRA is how it expresses the multi-racial coalition of Democratic Congressmen and Senators’ willingness to embrace the “big structural changes” which Senator Elizabeth Warren and others have long called for, and steps towards tax fairness with the world’s wealthiest corporations. For decades, Democratic Congressmen and women in swing suburban districts and Democratic Senators in all but the bluest states were not willing to endorse taxing even the wealthiest corporations or their largely unproductive stock buybacks. Trump’s rise to the presidency and successful gutting of corporate taxes, alongside enthusiasm for the “Green New Deal” among activists who shape Democratic primaries, ultimately led 100% of the Democratic Caucus in the House and Senate to support the IRA. The IRA taxes the wealthiest corporate interests and saves on drug benefit-related waste to be able to fund needed Medicare and ACA health benefits, as well as Paris Agreement-aligned climate action, while still enabling it to reduce the deficit by more than $270 billion.

Specifically, the IRA generates more than $222 billion in revenue through: a new minimum tax of 15% for corporates with booked revenues over a billion, more than $124 billion in revenue through investment in IRS enforcement of corporate taxes and those making over $400,000 annually, and $74 billion in revenue from a 1% tax on corporate stock buybacks. In all, the IRA drives a remarkable $764 billion in savings and revenue that allows it to contribute more than $270 billion to deficit reduction over and above the $369 billion the Congressional Budget Office (CBO) estimates it will invest in clean energy and climate related efforts and the nearly $100 billion it will invest in health benefits.

The fact that the IRA provides a historically huge $100 billion investment in health benefits is not incidental. It is a fact that helped build a bill with both deep and broad support. The IRA provides for the health of the elderly and disadvantaged through strengthening and extending Medicare and the ACA. First, the IRA repeals ACA drug rebates to companies to create $122 billion in savings. Second, the IRA finally empowers Medicare to negotiate drug prices to win another $99 billion in expected savings. And third, the IRA limits subsidized drug prices to save another $62 billion. All of this allows the IRA to provide $64 billion in subsidies to the ACA and a $34 billion dollar Medicare prescription drug benefit and fund America’s leadership in the global clean energy revolution – while simultaneously providing $270 billion in deficit reduction.

2. How Does the IRA extend the Bipartisan Infrastructure Act and the CHIPS & Science Act?

Taxing the wealthiest global interests in our unprecedentedly wealthy and unequal American economy creates abundant resources, including for much needed deficit reduction. Since the IRA finally succeeded in stepping towards tax fairness with the world’s wealthiest corporations, it is able to provide broadly popular support to Medicare and the ACA, and just as meaningfully, extends the 117th Congress’ other two major legislative accomplishments that preceded the IRA in supporting America’s economic leadership in our globalized 21st century– namely, the bi-partisan Infrastructure Act and the bi-partisan CHIPS & Science Act. These two new laws reflect a new bi-partisan willingness to invest in American economic competitiveness, but they each lack critically important items which the IRA provides.

The $1.2 trillion dollar Bi-partisan Infrastructure Act provides a historic, generations delayed investment in U.S. infrastructure that includes a painfully needed $65 billion investment in the transmission grid, $7.5 billion for 500,000 EV charging stations, and $5 billion for decarbonizing school buses across the country. It does not, however, invest in the development and manufacturing of the technologies of the future or compensate for the historic underinvestment in traditionally marginalized communities. Spurred in part by competition from China, the $280 billion Bi-partisan CHIPS & Science Act does invest scores of billions in the American development and manufacturing of the technologies expected to shape the future. Specifically, it invests in Basic Research and American development and manufacture of Microchips, Robotics, AI, Quantum Computing, Wireless & more that will shape the future, including the Biden Administration’s goal of a 100% clean grid by 2035. It does not, however, invest directly in the leading technologies of the clean energy revolution, nor does it compensate in any way for generations of underinvestment in marginalized American communities, which, in a time of ever-increasing inequality, has begun to risk the ability of people to act as a single American community in any instance. The IRA does specifically invest in American manufacturing and development of solar, wind, stand alone batteries, green hydrogen, geothermal, next generation modular nuclear, heat pumps and much more, as well as provide focused investment in marginalized communities long ravaged by environmental exploitation and its consequences, as well as in the communities that must transition from a reliance on fossil fuel jobs.

The Rocky Mountain Institute (“RMI”) said it well and early in an August 22nd blog post entitled: “Congress’s Climate Triple Whammy; Innovation, Investment and Industrial Policy.” Therein, authors Lachlan Cary and Jun Shepard described the 117th Congress’ Chips Act as the “brains”, the Infrastructure Act as the “backbone”, and the Inflation Reduction Act as the “engine” of a new industrial policy for the U.S.5

Source: Rocky Mountain Institute article “Congress’s Climate Triple Whammy; Innovation, Investment and Industrial Policy.”

3. What specifically does the IRA do to accelerate the revolution towards a 100% clean grid by 2035?

The RMI article’s authors’ description of the IRA as the “engine” of a new strategic industrial policy for the U.S. is understandable but inelegant, since they began by suggesting the IRA was part of a living animal, as we have the “brain” of the Science Act and the “backbone” of the Infrastructure Act. Consequently, Carla Frisch of the U.S. Department of Energy may have perfected RMI’s metaphor when she described the Science Act as the “brains”, the Infrastructure Act as the “backbone”, and the IRA as the “lungs” of a new strategic U.S. industrial policy.6

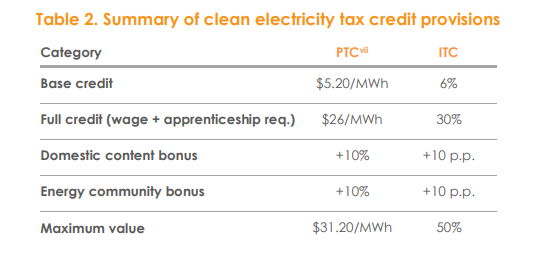

The air that fills those ‘lungs’ are tax credits, fully restored to the 30% of project costs provided in 2009 by Obama’s American Recovery Act for three years and then repeatedly extended, but which would have declined to zero without the IRA. These credits have proved to be a remarkably efficient, non-bureaucratic way to accelerate the adoption of utility scale wind and solar. Even though they were provided over the last decade on a halting, every couple of years renewing basis, they still helped ignite a stampede to build large-scale wind and solar in the U.S. that exceeded all forecasts, even GreenPeace’s “green revolution” forecast.7 The IRA now allocates funding to allow for fully restored credits up to 30%, 5 times the base credit rate of 6%, when projects meet prevailing wage and apprenticeship provisions. The IRA also makes the formerly solar-only Investment Tax Credit also applicable to wind, makes the formerly wind-only Production Tax Credit also applicable to solar, and provides both for a market changing ten plus years. Specifically, the credits will be available for projects that start over the next ten years or before a 75% reduction of U.S. GHG emissions is achieved, whichever is later. In fact, the details around the clean energy tax credits designed to fill the lungs of the new U.S. strategic industrial policy for a sprint to transformative global leadership warrant being listed out. Because several of them may individually – and certainly all of them together – promise to reshape the transition away from fossil fuels in the U.S. and beyond. Specifically, the IRA tax credits are:

- Uncapped (and many believe the final allocation will exceed the estimates of the Congressional Budget Office)8

- Transferrable (enabling scores of billions more dollars to be invited into clean energy)

- Extended out to the later of a. ten years or b. when a 75% U.S. GHG reduction is achieved

- Reflect an ITC and PTC that is now interchangeable for Solar & Wind projects

- Are extended to stand-alone utility scale batteries (previously had to be integrated with Solar)

- Are extended to Green Hydrogen, Geothermal, Modular Nuclear & much more

- Are available as “Direct Pay” (i.e. immediate cash rebate) to tax-exempt entities

- Provide an additional 10% for U.S. project using U.S. manufactured products

- Provide an additional 10% for U.S. based sourcing of relevant minerals/content

- Provide an additional 10% if located in an Environmental Justice or Energy Transition community

- On a sliding scale, starting at 6%, moving up to 30% in tax credits as projects meet requirements of providing prevailing wages and apprenticeship programs

- Different credits can be used on a single project to cumulatively to create a 50% credit

Source: Energy Innovation report “Implementing the Inflation Reduction Act: A Roadmap for State Electricity Policy”

The IRA additionally establishes a new manufacturing PTC under section 45x, which can be applied to production of a whole range of clean energy technology components.9

Because the IRA was negotiated through one-on-one negotiations that few knew of outside of Energy Committee Chair Joe Manchin and Senate Majority Leader Chuck Schumer’s offices, and it was passed by the Senate, House and signed by the President within weeks, few are fully aware of all it provides. The fact that the amount of credits available are uncapped, and the fact that the credits are for the first time made transferable to any U.S. tax paying entity that may want to acquire the credit, are the two facts about the IRA that seem least understood. Moreover, how those two facts work together is likely to be important in how great a transformation the IRA is able to beget in power generation and storage. Because the $369 billion the IRA is consistently described as investing in clean energy is a Congressional Budget Office estimate, it is possible it could be lower or considerably, even exponentially, higher. Especially because the IRA for the first time makes the credits “transferable,” this vastly opens up who can benefit from the credits by enabling them to be resold, therefore extending the utilization of the credits far beyond the handful of large banks who currently finance utility scale renewable projects, and presumably enabling all U.S. taxpayers who want to acquire the credits to do so through a secondary transaction. Consequently, some market participants and leading commentators, including the author of this writing, have asserted that it is more likely than not that the IRA’s investment in clean energy will be far greater than $370 billion.10

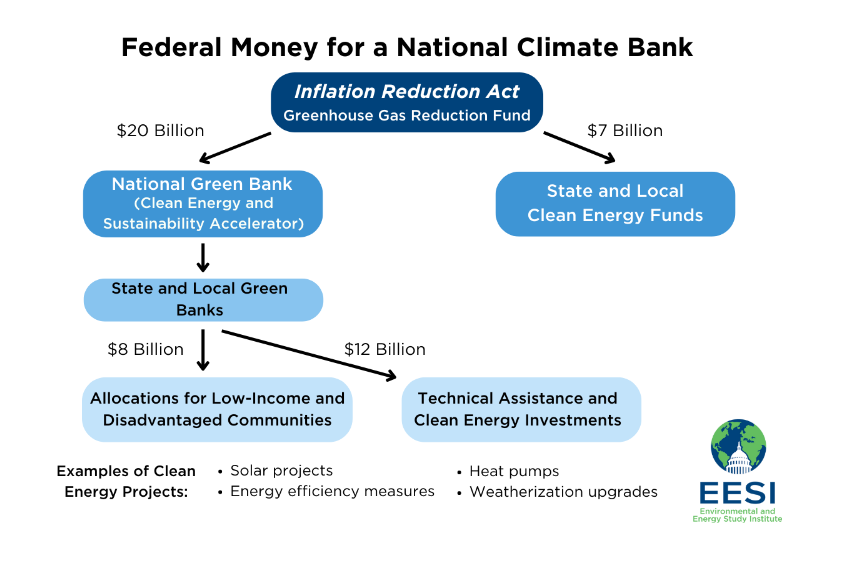

Beyond the potential for the IRA to provide a far more than the CBO-estimated $370 billion dollar direct investment in U.S. clean energy technology that has been widely reported, there are three other major components of the IRA which are not scored in the calculation of the IRA’s expected and widely reported 40% reduction from 2005 levels of U.S. GHG emissions by 2030. The first is a painfully needed new U.S. Department of Energy (DOE) Section 1706 loan program to help revamp energy infrastructure. The IRA expands the DOE’s relevant loan authority to $250 billion for the new Section 1706 program focused on revamping the energy infrastructure, which could enable and accelerate additional GHG reductions. The second component of the IRA not scored into its expected 40% reduction in U.S. emissions is the IRA’s creation of a new national “Green Bank” administered by the Environmental Protection Agency (EPA). This will have a direct impact on the third component of the IRA not yet scored into its expected impact on U.S. emission reductions, and that is how the IRA helps and enables U.S. states to be more ambitious in their climate strategy. Which is exemplified by California’s remarkably ambitious $54 billion state plan signed into law one month after the IRA.11

Source: New York Times article “A Detailed Picture of What’s in the Democrats’ Climate and Health Bill”

The IRA’s Title VI, Section 60101 directs the EPA to create a $27 billion Greenhouse Gas Reduction Fund (GGRF). This enables the EPA to create what amounts to America’s first national “Green Bank.” Green banks are mission driven organizations that provide low-cost financing to help businesses, non-profits, and families benefit from zero and low carbon solutions, including solar energy, battery storage, weatherization, EV charging stations, heat pumps and much more. The IRA does specify that, of the GGRF total allotment of $27 billion, the EPA shall use $20 billion to create a national “Clean Energy and Sustainability Accelerator” that the EPA will manage to leverage public and private capital to finance clean energy projects of all types through-out the U.S., with 40% of that $20 billion (i.e. $8 billion) dedicated to projects in low-income and disadvantaged communities. This Accelerator grows directly out of the leadership of Senator Ed Markey, who authored legislation of the same name in early 2021, and has long championed progress on the Green New Deal (according to the Senator, “The Green New Deal isn’t just a resolution, it is a revolution”).

The IRA also directs that these disadvantaged communities will also be the focus of the remaining $7 billion of the GGRF that the IRA directs the EPA to grant directly to state, municipal and tribal governments who will then administer loans to low income communities. The IRA will enable these state, municipal and tribal authorities to themselves “retain, monetize, manage, and recycle all payments from loans.” Consequently, the state, municipal and tribal authorities will be able to create or capitalize Revolving Loan Funds (RLFs) that are focused on supporting clean energy. Significantly, the IRA directs the EPA to disburse this $7 billion to state, municipal and tribal authorities within 180 days of the enactment of the IRA on August 16, 2022.

Since Green Banks have proliferated in the U.S. over the last decade with some notable success, it is reasonable to assume the IRA’s Section 60101 is likely to have an incremental, positive impact on U.S. emission reduction that has not yet been scored into the IRA’s contribution to the expected post IRA 40% emission reduction in the U.S. This is a reasonable expectation, in-part, due to the success of the 23 Green Banks in 17 states that regularly leverage relatively small public grants to mobilize exponentially more private capital to finance clean energy projects in the U.S. One Canary Media report asserts an expectation that the IRA’s $27 billion in “Green Bank” grants could spur 10X value in private lending. And with the most established state green banks like that of New York and Connecticut already having had success with the standardization and securitization of a portion of their “green loan” portfolio, it is reasonable to expect the EPA’s national “Sustainability and Clean Energy Accelerator” to scale what is proven successful at a state and municipal level.12

Source: EESI Article “New Climate Law Jumpstarts Clean Energy Financing”

4. How do the Bi-partisan successes of the 117th Congress reflect a changed GOP Party?

The 117th Congress could not have passed the Science Act “brains” or the more than trillion dollar Infrastructure Act “backbone” of a new U.S. industrial policy for the 21st century if the GOP had not changed. Following WWII, the GOP in the U.S. broadly and deeply embraced business and America’s leadership in efforts towards global free trade. GOP enthusiasm for “free trade” especially since the ‘Reagan Revolution” in 1980 made it, as a party, opposed to efforts to develop strategic industrial policies similar to those of Germany and Japan that sought to develop and maintain domestic manufacturing through strategies designed to support an export driven economy.

With the unexpected election of Donald Trump to the Presidency in 2016, the GOP began a drastic change. That change was not completed until after the GOP loss of the House, Senate and White House under Donald Trump – and after the January 6th attack on the capitol by Trump supporters. The change was completed when, after those failures and shocking violence, ranking House member Kevin McCarthy of California pledged public support to Donald Trump. That act meant that the GOP the author of this writing had grown-up was now unlikely to ever again be a conservative party premised on the prioritization of personal morality, small government, and a strong defense, but rather had become a frighteningly nativist and authoritarian party that, according to the approved party platform, had no platform other than the support of Donald Trump. The only apparent positive of this very dangerous development for America and the world is that GOP thinkers and legislators are now willing to support the type of strategic industrial policy U.S. rivals, including China, have had for generations.

The scope and rhetoric of this change reflects a fundamental shift in GOP perceptions of the role of government and is shocking to those decades familiar with the traditional GOP commitment to “free trade.” An August 3rd New York Times article on the bi-partisan Science Act, what used to be called “the paper of record,” reported the thinking of the key GOP leader on the Science Act. As the article relayed:

Senator Todd Young, a Republican from Indiana and one of the bill’s key architects in the Senate, called it “an important sea change in our public policies. It’s really important not only to our national security but to our economic security and our very way of life that we have effective and at times energetic government,” he added.13

5. How does the success of the Inflation Reduction Act reflect a changed Democratic Party?

When LBJ signed the Civil Rights Act of 1964, he reportedly observed to an aide that “we have lost the South for a generation.” LBJ was referring to the Democratic Party and proudly bigoted Democratic Senators like South Carolina’s Strom Thurmond and North Carolina’s Jesse Helms, had already begun leaving the party, as first JFK and then LBJ supported the civil rights movement. The trend of Southern Senators leaving the Democratic Party to join the GOP continued up until Alabama’s Richard Shelby switched to become a Republican in 1994. So LBJ’s statement in 1964 was an understatement. Now, with the surprise election of pastor Ralph Warnock, who occupied the same pulpit as MLK in Atlanta, to become the all-important 50th Democratic Senator in the first days of 2021, the political evolution of the American South continues.

The result of Senator Warnock’s election, only days after a murderous attack on the U.S. Capitol Building on January 6th by Donald Trump supporters carrying confederate flags and wearing antisemitic insignia, created a razor thin but unprecedentedly united bi-cameral Democratic majority led by Speaker Pelosi in the House. One that, in the wake of former President Trump’s success in gutting both corporate taxes and U.S. global leadership on climate issues, was willing to use the Budget Reconciliation process that requires only a simple majority vote in the Senate to circumvent GOP determination to stymie Democratic priorities through the Senate’s filibuster. Which is a remarkably anti-democratic legislative rule not based in the Constitution and contrary to James Madison and Alexander Hamilton’s related writing promoting majority rule in the Senate. The filibuster was developed in the wake of the Civil War to enable and then preserve the influence of a minority of Senators opposed to civil rights legislation. Over the last two decades in particular, it has increasingly required a 60 vote supermajority in the Senate (an institution structurally designed to empower smaller states through its two Senators for each state composition) to pass meaningful legislation through the U.S.’s two chamber legislative process.14 Consequently, the U.S. Senate’s filibuster rule and its requirement for a 60 vote supermajority has largely shaped the conventional understanding of what is possible in U.S. policy-making. But for bills that are deemed to be exclusively financial in nature (i.e. concerning tax revenue and spending), an exception is available for the “Budget Reconciliation” process that only requires a simple majority in both houses.

This is what the Democrats in the Senate led by Majority Leader Chuck Schumer from New York (who is a decades long champion of socially progressive and financially conservative Wall Street interests) was willing to use to get the IRA passed. The fact that only all Democrats and Independents Bernie Sanders of Vermont and Angus King of Maine were needed to vote for it, is why it boldly sought a new 15% minimum tax on corporations with more than $1 billion in booked revenue, in order to generate the hundreds of billions in revenue needed for clean energy investments and deficit reduction, as well as to compensate for corporate taxes Republicans had led in slashing in Trump’s first year. The undeniable enthusiasm among young Democratic activists, who are critically important in Democratic Primaries, for the big structural changes called for by the “Green New Deal” which catapulted the young Alexandria Ocasio Cortez “AOC” to Congress in Senator Schumer’s own New York, had to influence Senator Schumer’s willingness to be uncharacteristically bold. Moreover, an alliance of new and long-term Democratic leaders concerned about the possible loss of our system of elections and even the rule of law, proved willing to demonstrate that the government could matter and committed to meeting activists’ intersectional demands for a broad array of programs that advance greater racial, social and environmental justice. Consequently, activists sought and party leaders delivered an explicitly broader solution in the new administration’s Build Back Better proposal that survived to a surprisingly meaningfully degree in the IRA, which includes more than $100 billion in health benefits and an unprecedented $60 billion investment into historically marginalized communities which regularly bear the brunt of pollution and the always building challenges of water stress, extreme weather, and wildfires.

6. How does the IRA reflect changed assumptions about what is needed for the US to lead globally on climate?

The success of the 117th Congress in creating a strategic industrial policy for U.S. leadership in a world challenged by human caused climate breakdown stands in stark contrast to more than thirty years of failed U.S. leadership on needed climate policy. And in particular to the failure of the Markey/Waxman cap and trade bill that passed the House in 2009, but was not brought up for a vote in a Senate with 59 Democrat Senators in it. What was different? In a word: everything.

More specifically, the IRA was different in three fundamental ways. First, unlike Markey/Waxman, the IRA began, was developed, and was passed as a broad-based bill meeting what was framed as the demands for dignity of an explicitly multi-racial, multi-generational coalition that sought social and economic justice as much as climate justice. Unlike previous climate initiatives, what became the IRA was not driven by older, extensively educated, environmentally conscious voters who wanted the government to be more responsible in regard to climate change to help protect future generations. The IRA began in student activists’ demands for the remarkably broad “Green New Deal” and evolved into a politically astute, fairly astonishing success. In the memorable framing of Varshini Prakash, Co-Founder & Executive Director of the “Sunrise Movement,” which was and is the primary proponent of the “Green New Deal” and its broad, urgent call for a mutually dependent social and environmental justice, “the Green New Deal is about saying that no person should be disposable so a few CEOs can make a buck.”15 Consequently, it is not surprising that many provisions of the IRA work to build the capacity for continued change in a democratic capitalist society through “green banks” and financially incented manufacturers and developers in red and purple states, and especially through their workers being paid to prevailing wage standards and provided apprenticeship programs so that clean energy workers might finally become as unionized – or more so – than fossil fuel workers.16

The groundswell of support in the activist community important to Democratic Party primaries for the Green New Deal was translated into practical legislative politics once the Biden/Harris Administration took office through the $3+ trillion Build Back Better Plan, which is what ultimately evolved into the 117th Congress’s two bi-partisan industrial policy related Acts and the IRA. What was passed into law by the 117th Congress left out most of the Build Back Better plan’s social spending, but as aforementioned, does include $100 billion in new and needed health benefits that help strengthen Medicare and ACA, as well as an unprecedented $60 billion in new clean technology investments in low-income and traditionally marginalized communities. Consequently, what helped the IRA become law was an explicitly multi-racial, multi-generational coalition of supporters making demands based on what their dignity as citizens required, which included but went well beyond climate responsibility to include health and economic needs as well. Which is to say that the IRA was enacted to serve the immediate needs of all Americans, especially those in “frontline communities,” which are regularly communities of color that bear the brunt of human-caused climate and environmental breakdown through disproportionate exposure to extreme weather, water stress, wildfires, political disinvestment and generations of pollution. Consequently, the IRA was different in its supporting coalition, objectives, rhetoric and program than twenty plus years of failed climate legislation promoted by suburban environmentalists.

Second, the IRA smartly ignored economists, who for decades have counseled prioritizing a broad-based costing of carbon in an increasingly unequal society without regard to its prohibitive political costs. Fortunately, the IRA instead derives most of its funding from a new tax exclusively on the wealthiest global companies, which are historically under taxed and benefit more financially than any other parties from globalization, which has increased global emissions. Of vital importance is the fact that the IRA is able to be “all carrots and no sticks” for the general voting public. Because it obtains more than enough funds from corporations with more than $1 billion in annual booked revenue to pay for the public benefit of incentivizing an acceleration of society’s move from fossil fuels, the IRA can even provide $270 billion in deficit reduction. This is both the right thing to do, and helpful when spiking inflation in August of 2022 prompted a new interest in the IRA’s impressively responsible financial impact in the critically important weeks it was voted on and signed into law.

Third, the IRA deliberately complimented and extended massive new investments in U.S. basic research and the manufacturing and deployment of new technologies and infrastructure that is needed to enable substantial emission reductions, which were accomplished through bi-partisan Acts. This enabled the IRA to focus on the technologies scaling all over the world including Wind, Solar, and Batteries, which already constitute most of the new generation capacity of electricity (which incumbent fossil fuel interests will not permit GOP elected leaders whom they fund to support). Interestingly, getting those other bi-partisan bills completed was enabled by the fact that the IRA appeared dead – that is, unlikely to ever become law – for several critically important weeks. Since it generally takes a fairly or completely united party to pass legislation in contemporary U.S. politics and, in this divided time, neither party likes to provide the other with unprecedented large bill successes. Which is exactly what the 117th Congress achieved when, after the two huge bi-partisan bills were passed, the IRA was surprisingly “resurrected” through a secretly negotiated deal between Senate Majority Leader Schumer and Senate Energy Chairman Manchin, and then quickly passed by both chambers with only Democratic support.

The success of the 117th Congress in creating a responsible climate policy for the world’s largest economy and largest historic contributor of GHG into our atmosphere changes global climate politics and enables the U.S. to again offer needed leadership. With the IRA, the US now has a model of multi-racial and multi-generational success based on a broad coalition making demands based – not on a preference for “environmentalism” but on the universal and inalienable dignity of voters as citizens. Which is a model a diverse and challenged world can follow.17 On a practical level this model is grounded in obtaining the necessary financial resources to accelerate the transition from fossil fuels from the wealthiest corporations that are benefiting the most from globalization, which few any longer deny is a force that has disadvantaged many who are least supportive of responsible climate action in developed economies, but who may be among the most economically benefited by the emerging clean energy revolution.

7. What is the likelihood the IRA will be reversed by later Congresses?

The obvious question raised by the remarkable success of the 117th Congress is: will it be reversed? The considered answer is: no. Four reasons support this conclusion. First, because a substantial portion of the success was achieved through the bi-partisan Science Act and the bi-partisan Infrastructure Act. Second, because the IRA, which was unfortunately passed on wholly partisan lines, obtains its funding from a new flat minimum tax on corporations with more than billion in booked revenues, and a changed GOP is no longer a relentless public champion on corporate (as opposed to business owner or investor) interests. Third, the principal financial benefit the IRA confers is through non-bureaucratic tax credits that have proved politically durable over the last tumultuous political decade, when similar credits have been repeatedly extended on a bi-partisan basis, in part because they are regularly and disproportionately used to support clean energy projects in red states. And a changed, more populist, GOP is even less likely to oppose what amounts to “tax cuts” for manufacturing plants in red states, the announcements of which are already proliferating.

The fourth reason it is decidedly unlikely that the most important substance of the IRA will be reversed is likely the most important, and it is based on the fact that it is extraordinarily easy to frustrate important legislation in contemporary U.S. politics and, therefore, very difficult to reverse major legislation when it is passed and signed into law. For the foreseeable future, U.S. politics is likely to remain highly partisan. Consequently, the GOP would most likely have to win control of the House, Senate and White House to pass and sign into law a reversal of the IRA. Particularly because many view the Supreme Court as biased towards the GOP, it seems highly unlikely the American electorate would, in this divided time, choose to give the GOP control over all the aspects of the American government that they would need to reverse the IRA. Consequently, the IRA has joined Medicare and the ACA as a central part of what progressive and independent American voters’ require from their government. Therefore, absent the all too real possibility of America losing its system of elections and the rule of law pending the outcome of upcoming elections, America is empowered by the IRA and now positioned to lead in the research and development, manufacturing and deployment of the global clean energy revolution. And as a result, if the U.S. can protect and preserve our system or elections and rule of law, America is now prepared to provide broad-based business and job creating leadership the world needs in its largest economy to succeed in the greatest emergency humanity has ever confronted – human-caused climate and environmental breakdown. As America offers a new approach, exemplified by the IRA, that an urgently and deeply challenged world needs to understand.

Footnotes

- Maracci, Silvio, “$28 Billion In New Clean Energy Manufacturing Investments Announced Since Inflation Reduction Act Passed,” Oct 12, 2022, Forbes, https://www.forbes.com/sites/energyinnovation/2022/10/12/roughly-28-billion-in-new-clean-energy-manufacturing-investments-announced-since-inflation-reduction-act-passed/?sh=66fef2566159

- Volcovici, Valerie, “Factbox: U.S. climate package jump-starts EV, clean energy projects,” Sept 12, 2022, Reuters, https://www.reuters.com/world/us/us-climate-package-jump-starts-ev-clean-energy-projects-2022-09-12/

- Meyer, Robinson, “The Climate Economy is About to Explode,” Oct 5, 2022, The Atlantic, https://www.theatlantic.com/science/archive/2022/10/inflation-reduction-act-climate-economy/671659/

- O’Boyle, Mike; Esposito, Dan; and Solomon, Michelle, ““Implementing the Inflation Reduction Act: A Roadmap for State Electricity Policy,” Oct 2022, Energy Innovation, https://energyinnovation.org/wp-content/uploads/2022/10/Implementing-the-Inflation-Reduction-Act-A-Roadmap-For-State-Policy.pdf

- Carey, Lachlan; Shepard, Jun, “Congress’s Climate Triple Whammy: Innovation, Investment, and Industrial Policy,” Aug 22, 2022, Rocky Mountain Institute, https://rmi.org/climate-innovation-investment-and-industrial-policy/

- Climate One, “ The Inflation Reduction Act Passed. Now What?” Sept 23, 2022, Climate One https://www.climateone.org/audio/inflation-reduction-act-passed-now-what

- O’Boyle et al., Oct 2022

- Meyer, October 2022.

- For more detail on eligible components and their respective allocated credits amount, refer to; O’Neill, Rob; Rohner; Kaden, Matt; Blitman, Jon; and McClure, Keegan, “An Overview of Clean Energy Tax Legislation in the Inflation Reduction Act,” Aug 26, 2022, Moss Adams, https://www.mossadams.com/articles/2022/08/inflation-reduction-act-clean-energy-credits#section-45x

- Meyer, Robinson, “‘The Biggest Thing to Happen in International Climate Diplomacy in Decades’,” Aug 31, 2022, The Atlantic, https://www.theatlantic.com/science/archive/2022/08/inflation-reduction-act-america-world-diplomacy/671293/

- To learn more about California’s $54 billion investment in climate action, refer to the Office of the Governor’s press release at https://www.gov.ca.gov/2022/09/16/governor-newsom-signs-sweeping-climate-measures-ushering-in-new-era-of-world-leading-climate-action/

- St. John, Jeff, “How a new national green bank could steer $27 billion to clean energy projects,” Aug 24, 2022, Canary Media, https://www.canarymedia.com/articles/climatetech-finance/how-a-new-national-green-bank-could-steer-27b-to-clean-energy-projects

- Swanson, Ana, “Congress is Giving Billions to the Chip Industry. Strings Are Attached,” Aug 3, 2022, New York Times, https://www.nytimes.com/2022/08/03/business/economy/chip-industry-congress.html

- Jentleson, Adam, “Kill Switch: The Rise of the Modern Senate and the Crippling of American Democracy,” Jan 12, 2021, published by Liveright Publishing Corporation.

- Prakash, Varshini, “We can’t tackle the migrant crisis without fighting climate change,” July 25, 2019, The Hill, https://thehill.com/opinion/energy-environment/454781-we-cant-tackle-the-migrant-crisis-without-fighting-climate-change/

- “A new analysis commissioned by the BlueGreen Alliance from the Political Economy Research Institute (PERI) at the University of Massachusetts Amherst finds that the more than 100 climate, energy, and environmental investments in the Inflation Reduction Act will create more than 9 million good jobs over the next decade—an average of nearly 1 million jobs each year.” BlueGreen Alliance, “9 Million Good Jobs from Climate Action: The Inflation Reduction Act of 2022,” BlueGreen Alliance, https://www.bluegreenalliance.org/wp-content/uploads/2022/08/BGA-IRA-Jobs-Factsheet-8422_Final.pdf

- To explore the potential paradigm change and impact of moving from a framework of perception that seeks efficiency to one that offers dignity to all stakeholders see; Boyle, Jim “Leading with Dignity in 2021,” Jan 18, 2021, Sustainability Roundtable Inc., https://sustainround.com/leading-with-dignity-in-2021/

Jim Boyle is the CEO & Founder of Sustainability Roundtable, Inc. For more than a dozen years, Jim has led full-time teams of diverse experts to assist nearly 100 Fortune 500 and growth companies in their move to more sustainable high-performance. Specifically, SR Inc has helped world-leading corporations, real estate owners, and federal agencies to set goals, drive progress, and report results in their move to greater Corporate Sustainability. Mr. Boyle led in the creation of SR Inc’s Renewable Energy Procurement Services (REPS), which advises and represents Fortune 500 and fast growth companies across the U.S. and internationally in the development of renewable energy strategies and the procurement of both on and off-site advanced energy solutions. Before founding SR Inc, Mr. Boyle co-led Trammell Crow Company Corporate Advisory Services in San Francisco and returned to his native Boston and Trammell Crow Company’s market leading team in Greater Boston where he received the Commercial Brokers Association’s Platinum Award for the highest level of commercial real estate transactions. Earlier, he advised companies on real estate and environmental matters as an attorney at a large law firm based in Boston. Jim is a graduate of Middlebury College, where he co-captained the football team, and Boston College Law School. Early in his career, he served as a federal law clerk, an aide to John F. Kerry in the U. S. Senate, and on Vice President Al Gore’s campaign for President. Jim lives in Concord, MA with his wife and kids a half mile across the street from Emerson’s house and museum on the route to Walden Pond.

Jim Boyle is the CEO & Founder of Sustainability Roundtable, Inc. For more than a dozen years, Jim has led full-time teams of diverse experts to assist nearly 100 Fortune 500 and growth companies in their move to more sustainable high-performance. Specifically, SR Inc has helped world-leading corporations, real estate owners, and federal agencies to set goals, drive progress, and report results in their move to greater Corporate Sustainability. Mr. Boyle led in the creation of SR Inc’s Renewable Energy Procurement Services (REPS), which advises and represents Fortune 500 and fast growth companies across the U.S. and internationally in the development of renewable energy strategies and the procurement of both on and off-site advanced energy solutions. Before founding SR Inc, Mr. Boyle co-led Trammell Crow Company Corporate Advisory Services in San Francisco and returned to his native Boston and Trammell Crow Company’s market leading team in Greater Boston where he received the Commercial Brokers Association’s Platinum Award for the highest level of commercial real estate transactions. Earlier, he advised companies on real estate and environmental matters as an attorney at a large law firm based in Boston. Jim is a graduate of Middlebury College, where he co-captained the football team, and Boston College Law School. Early in his career, he served as a federal law clerk, an aide to John F. Kerry in the U. S. Senate, and on Vice President Al Gore’s campaign for President. Jim lives in Concord, MA with his wife and kids a half mile across the street from Emerson’s house and museum on the route to Walden Pond.