Beware the Green Swan

Chris Hall

NOVEMBER 3, 2023

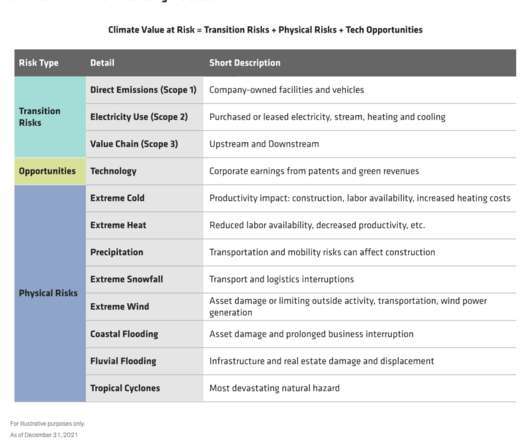

Breaking with tradition Finance Watch’s latest report , released this week, underscores the stark reality of rising climate risks and calls for economic models that do not mislead, scenario analyses that prepare the market, and a new prudential tool to address the build-up of systemic climate risk.

Let's personalize your content