U.S. sustainable investing assets plunge by more than US$8 trillion

Corporate Knights

DECEMBER 14, 2022

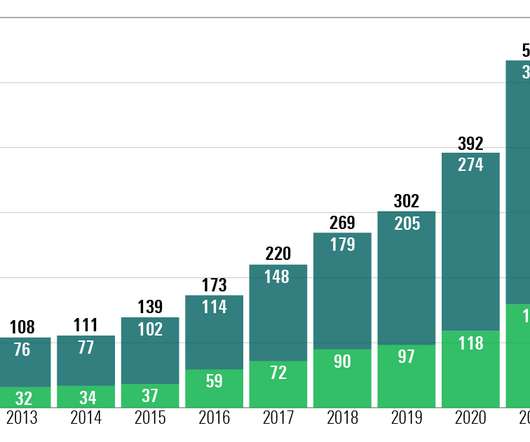

Sustainable investing assets in the United States have plunged by more than half to US$8.4 trillion at the end of 2019, according to a new report from the US Forum for Sustainable and Responsible Investment (US SIF). The reports show that assets rose steadily but incrementally between 1995 and 2012 to US$3.7

Let's personalize your content